‘Rough day to be a Bitcoin ETF:’ What’s going on with BlackRock?

- Fidelity eclipsed Grayscale in BTC ETF outflows on the 1st of May.

- BlackRock’s IBIT saw its first outflow as BTC struggled to reclaim $60K.

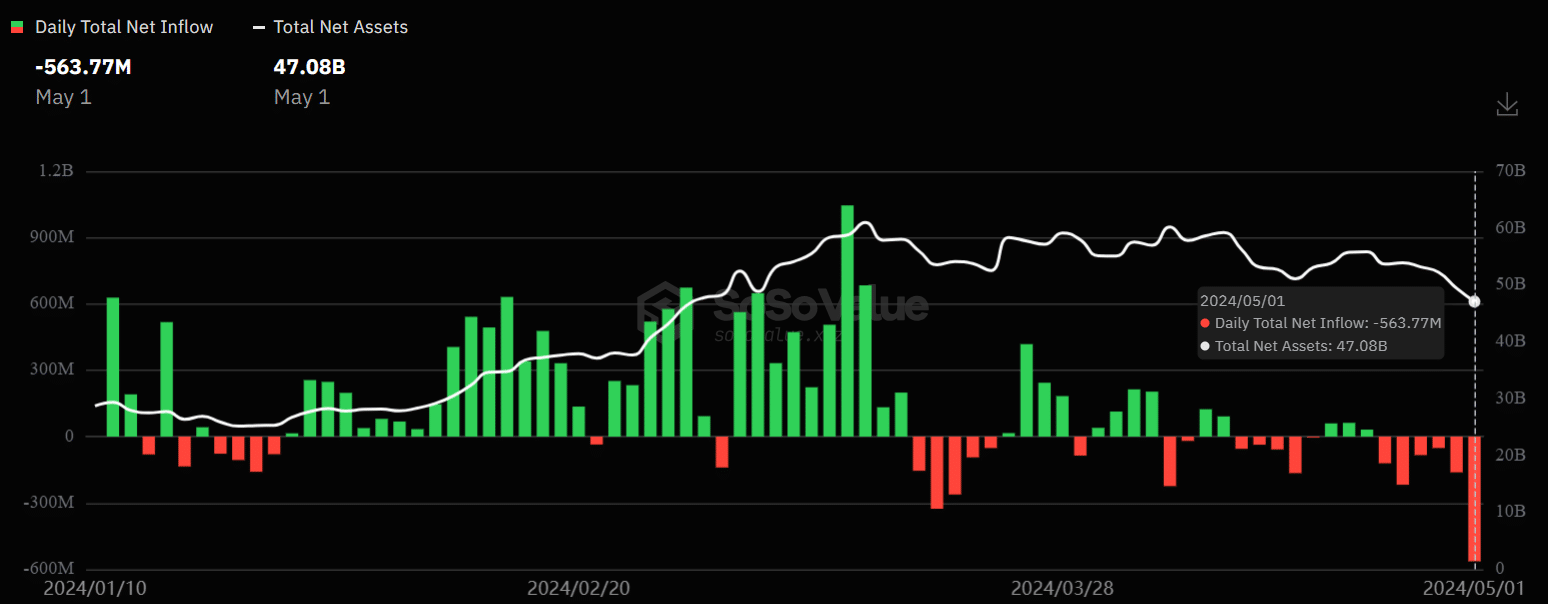

Bitcoin’s [BTC] rough Q2 seems far from over. According to Soso Value data, US BTC ETFs recorded more outflows on the 1st of May, worth $563.7 million.

Surprisingly, Grayscale’s GBTC dominated outflows previously, but didn’t lead the outflows as Fidelity’s FBTC took center stage.

BlackRock’s first outflow as Fidelity loses 2% of its BTC ETF assets

Out of the total outflows of $563.7 million, Fidelity’s FBTC led the outflows with $191.1 million, Farside data showed.

Grayscale’s GBTC recorded the second-largest daily outflow on 1 May, worth $167.4 million.

Bloomberg ETF analysts noted that Fidelity’s massive daily outflows were “huge” and almost worth 2% of its ETF assets,

“Damn.. while it is like 2% of the ETF’s assets, but a) it’s big for Fidelity and b) all of them getting hit today looks like.”

Additionally, BlackRock’s IBIT, after hitting pause and going zero inflows for five days, saw its first outflow worth $36.9 million yesterday.

Reacting to IBIT’s first outflow, Bloomberg analyst James Seyffart noted,

“Ruff day to be a #bitcoin ETF.”

The Fed rate decision didn’t help much with the sentiment either. BTC remained firmly below $60K after the Fed kept the interest rate unchanged.

According to financial commentator Peter Schiff, BTC could drop to $54K after losing the $60K support. Schiff said,

“Notice on this shorter-term #Bitcoin chart that $60K, which was support, has become resistance.”