SAND’s reversal odds – Identifying if an upside is likely for its price

- SAND broke out of its falling wedge, signaling potential bullish momentum

- On-chain data highlighted rising activity and confidence in SAND’s price action

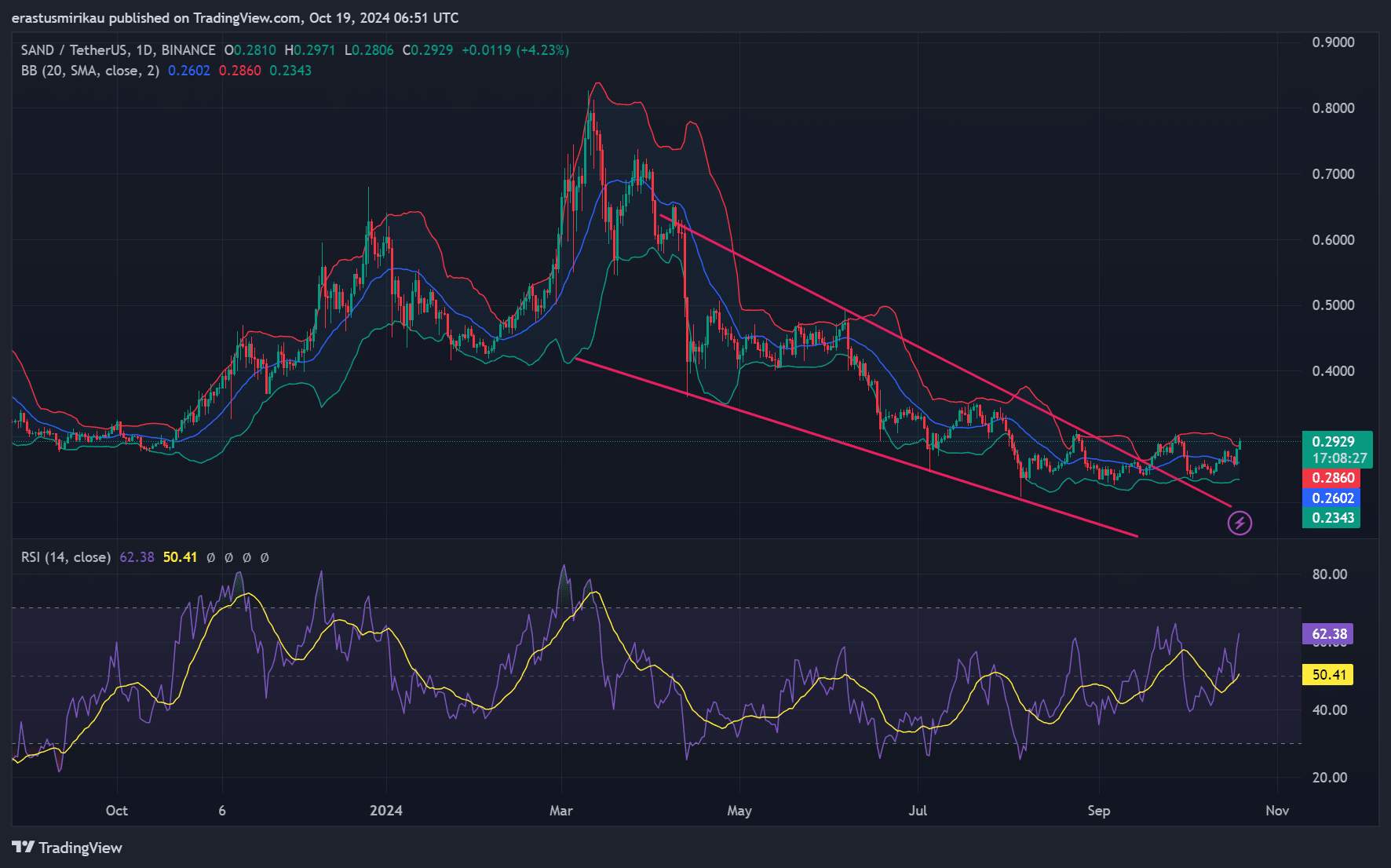

The Sandbox [SAND] recently broke out of its prolonged falling wedge pattern, signaling what could be the beginning of a major bullish trend. Trading at $0.2931 after climbing by 12.06% at press time, SAND has seen a surge in both market interest and trading volume lately.

In fact, its 24-hour trading volume also soared by 126.45% – A sign of renewed excitement from traders and investors alike. Will this breakout be strong enough to maintain the altcoin’s momentum?

SAND chart analysis – What does this breakout mean?

SAND’s price chart confirmed a strong breakout above its falling wedge pattern, which had been holding the token in a downtrend for months. Additionally, the Relative Strength Index (RSI) rose to 62.38 – A sign of bullish strength. The Bollinger Bands were widening around the price candles too.

These indicators, together, implied higher volatility, which often follows after such breakouts. Consequently, SAND’s price appeared to be entering a new upward phase. However, the token will need sustained buying pressure to confirm its longer-term direction.

Hike in active addresses and transaction count – Bullish support?

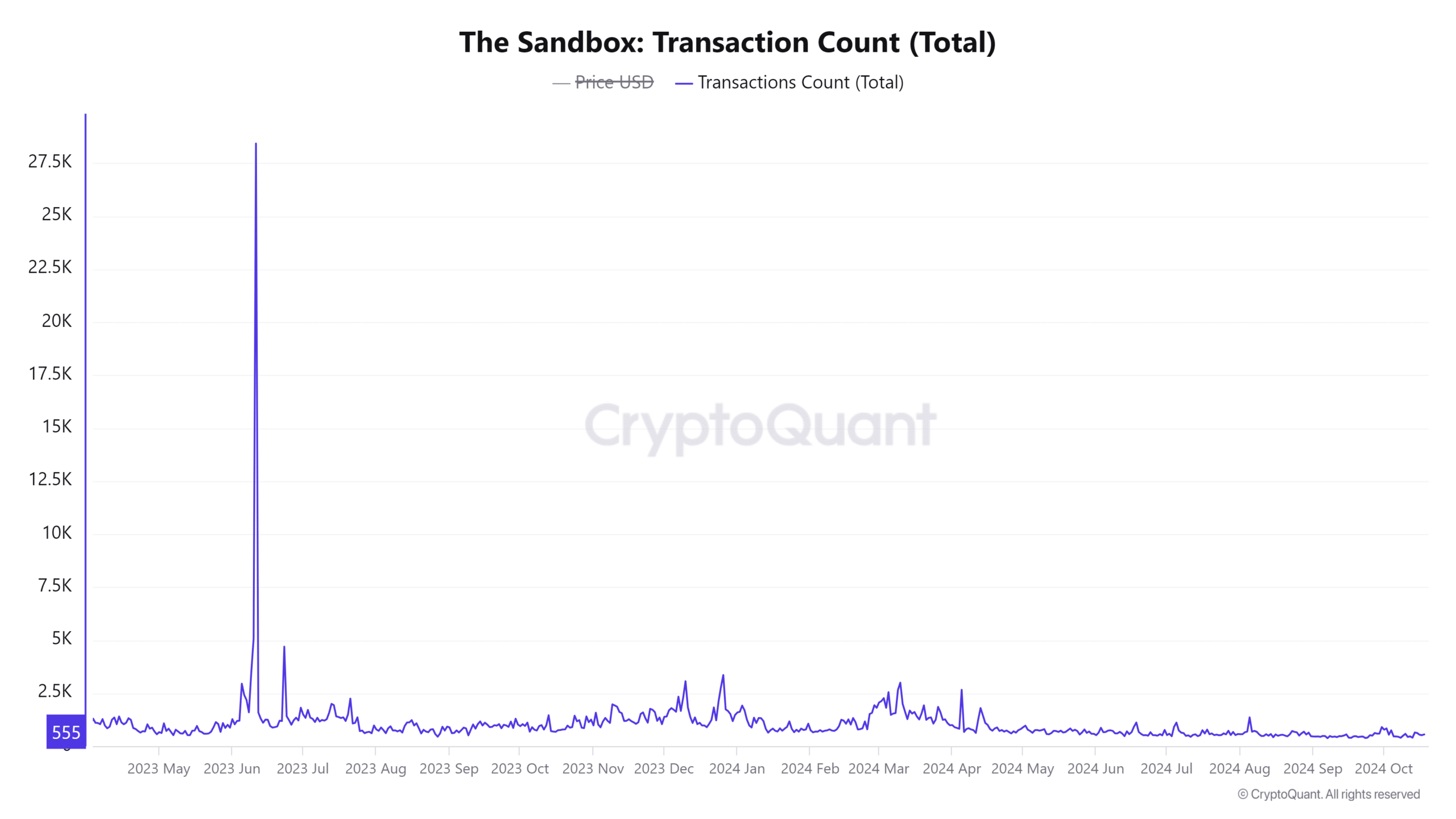

Additionally, on-chain data from CryptoQuant supported SAND’s recent price surge. The number of active addresses increased by 1.54% over the last 24 hours at press time, bringing the total to 40.66k. This uptick in network activity is crucial as it can be interpreted to mean rising interest in the token.

Also, the total transaction count rose by 2.1%, further reinforcing this trend. Simply put, the hike in user engagement suggested that SAND’s rally might not be purely speculative, but one backed by strong fundamentals.

SAND exchange reserve analysis – Lower selling pressure?

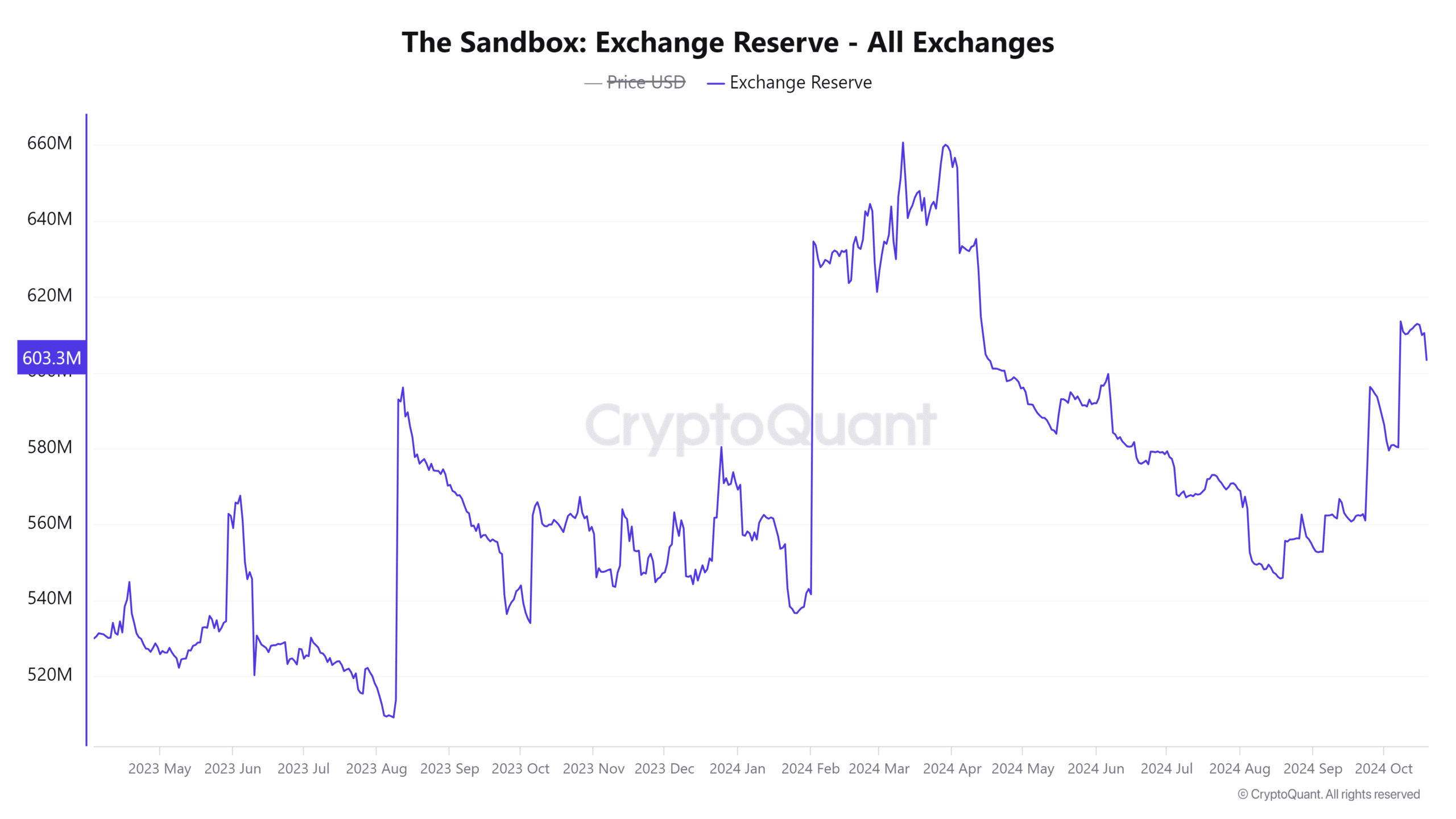

Exchange reserves for SAND dropped by 1.06% over the last 24 hours, indicating that fewer tokens are now available for sale on exchanges.

Consequently, this fall in available supply implied that sellers have been moving their tokens off exchanges, likely opting to hold. This behavior often precedes further price hikes, especially as it reduces immediate selling pressure in the market.

Open interest spike – Are traders confident?

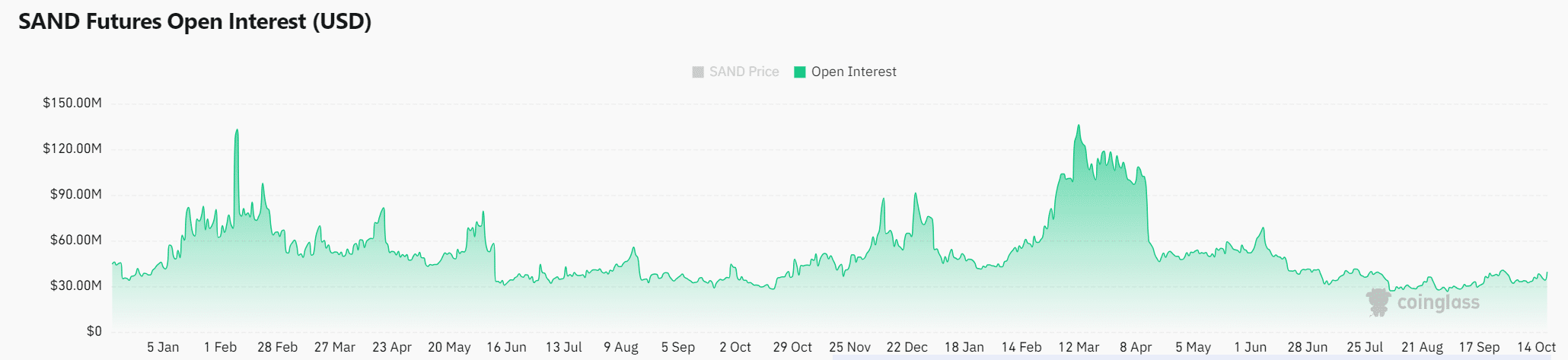

Open interest for Sandbox climbed by 28.26%, hitting $44.51 million. Such a major hike suggested that more traders are opening new positions – A sign of confidence in SAND.

Taken together, the uptick in Open Interest, combined with SAND’s price action, implied growing optimism for sustained gains.

Realistic or not, here’s SAND market cap in BTC’s terms

Can SAND maintain its rally?

The altcoin’s breakout, supported by strong technicals and positive on-chain metrics, pointed to a potential bullish reversal.

However, sustained buying pressure will be critical to keeping this momentum alive. Therefore, while SAND is showing promise, traders should proceed with caution amidst market volatility.