SAND’s short-term price targets – Is a breach of $0.375 next?

- SAND seemed to be consolidating below its $0.375 resistance, with the RSI at 71.87

- Bullish on-chain metrics included a 13.10% hike in large transaction growth

The Sandbox [SAND] has seen heightened activity recently, with 9.04M SAND ($3.28M) deposited into Binance in the last 13 hours, adding to a 26-day total of 19.05M SAND ($5.9M). At press time, SAND was trading at $0.3465, reflecting a 2.20% decline over the last 24 hours.

However, bullish on-chain signals and key technical levels seemed to suggest that a significant move could be on the horizon.

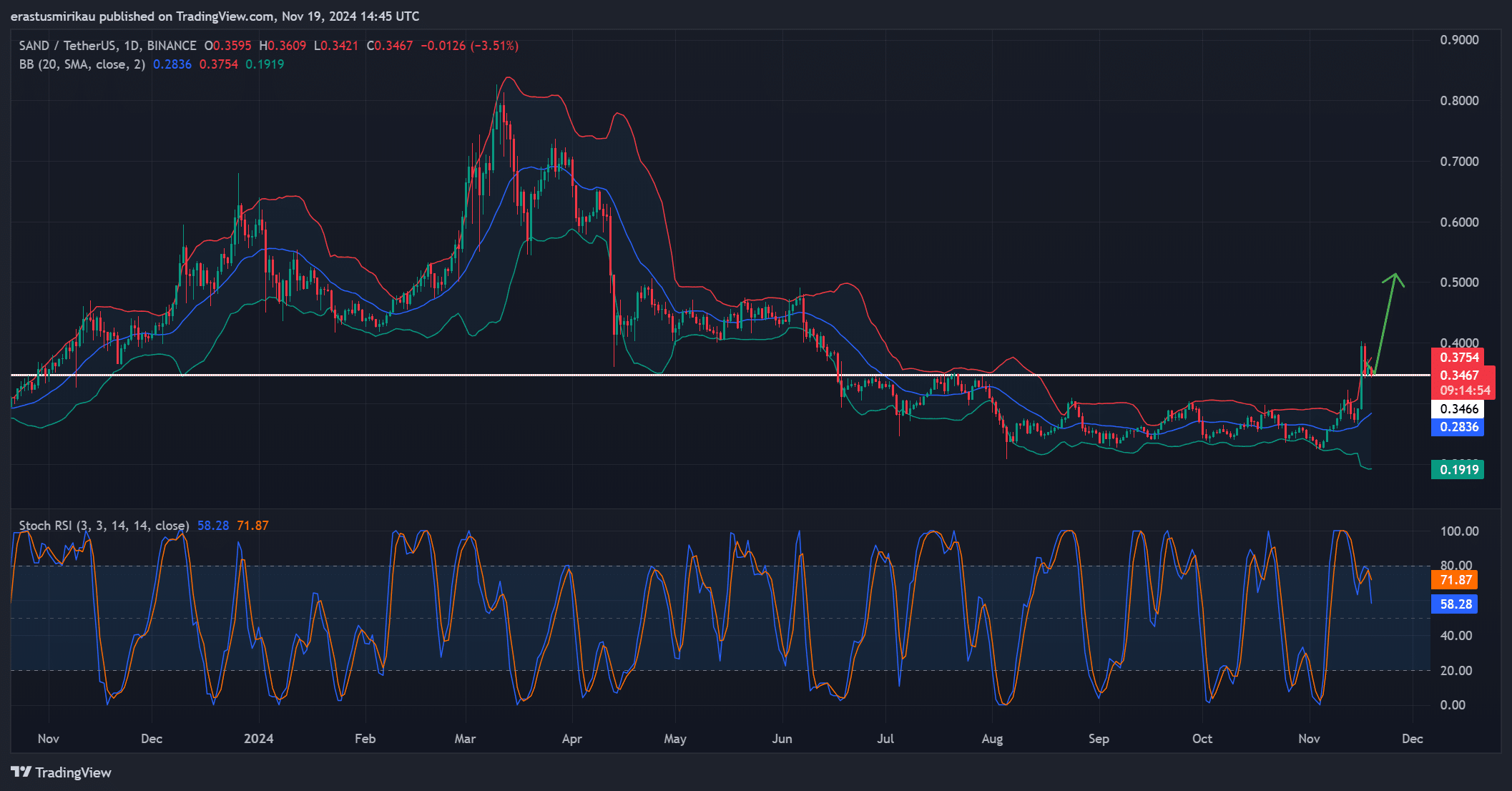

SAND testing critical resistance levels

SAND’s price has been consolidating near a key resistance level at $0.375, which has historically served as a pivotal zone. The Bollinger Bands were narrowing, reflecting reduced volatility and signaling that a breakout may be imminent. A successful close above $0.375 could pave the way for a rally towards $0.50, but a failure to hold could push the price back to support at $0.34.

At press time, the Stochastic RSI sat at 71.87, indicating that SAND was approaching overbought levels. A potential downward crossover could lead to short-term price retracement, providing traders an opportunity to re-enter before another attempt at the resistance level. Therefore, the next few trading sessions will be critical in determining SAND’s trajectory.

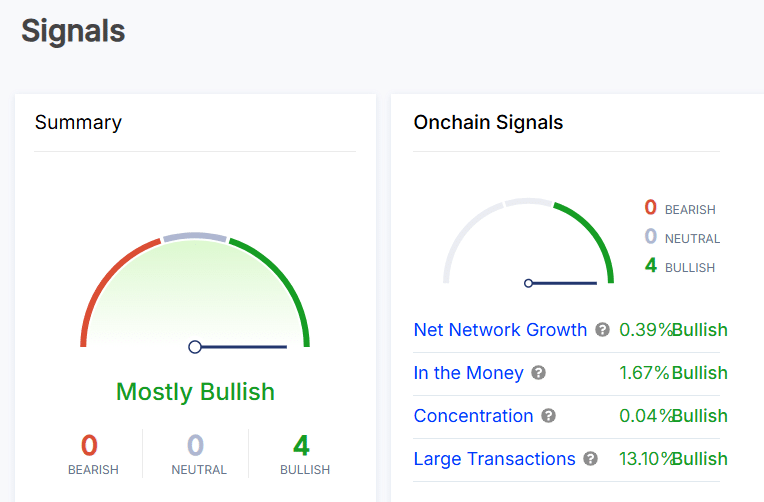

SAND’s bullish on-chain signals inspire confidence

On-chain metrics remain a source of optimism for SAND though. Net network growth increased by 0.39%, suggesting that user adoption has been steadily rising. Additionally, 1.67% of SAND holders were “in the money” at press time, signaling profitable positions despite the recent dip in price.

The concentration metric revealed a 0.04% hike, highlighting a stable balance of token distribution among large holders and smaller investors.

Meanwhile, large transactions surged by 13.10%, pointing to growing interest from institutional investors and high-net-worth individuals. These figures could bolster confidence in the altcoin’s long-term potential and may precede stronger upward momentum.

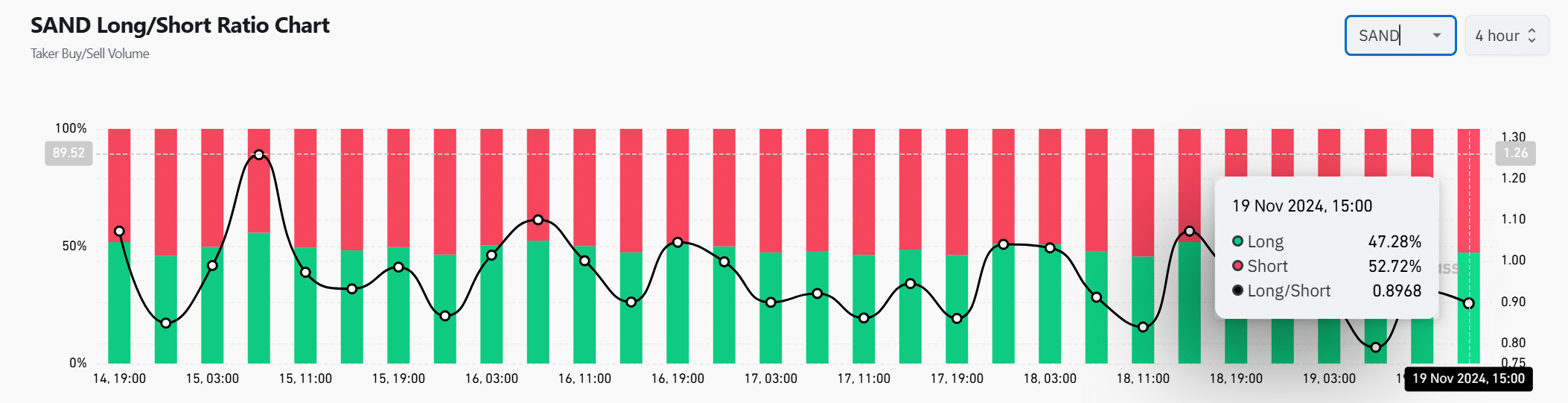

Short bias reveals contrarian opportunity

At press time, the long/short ratio revealed that 52.72% of traders were holding short positions against 47.28% longs, with an overall ratio of 0.8968.

While this indicated a slightly bearish sentiment, such conditions often create opportunities for a short squeeze. If SAND breaks through resistance, liquidations of short positions could accelerate upward price movement.

Realistic or not, here’s SAND market cap in BTC’s terms

Is the altcoin ready for a breakout?

The Sandbox’s bullish on-chain signals and technical setup suggested that a breakout above $0.375 may be increasingly likely.

While the Stochastic RSI hinted at possible near-term retracement, strong on-chain metrics and institutional interest supported a long-term bullish outlook. If the key resistance is breached, SAND could rally towards $0.50 in the coming days.