SEC confirms: Proof-of-Work mining isn’t a securities violation – Crypto miners rejoice!

- SEC’s stance on PoW mining removes regulatory uncertainty, benefiting miners and fostering industry growth.

- Altcoins outperformed major PoW assets, signaling a shift in investment trends post-SEC clarification.

The U.S. Securities and Exchange Commission (SEC) recently confirmed that Proof-of-Work (PoW) mining activities do not fall under securities regulations.

This clarification, specifically for cryptocurrencies like Bitcoin [BTC], Litecoin [LTC], and Bitcoin Cash [BCH], provides miners with much-needed legal certainty. As a result, miners can now operate without the fear of being regulated as securities, which has long been a concern in the industry.

This decision is significant for miners, as it eliminates uncertainty about the legal status of PoW mining. It establishes a clearer regulatory framework, allowing miners to expand operations without fear of legal challenges under securities laws.

Additionally, it reassures investors, boosting their confidence in PoW mining projects and fostering greater trust in the sector.

How are market participants reacting to these developments?

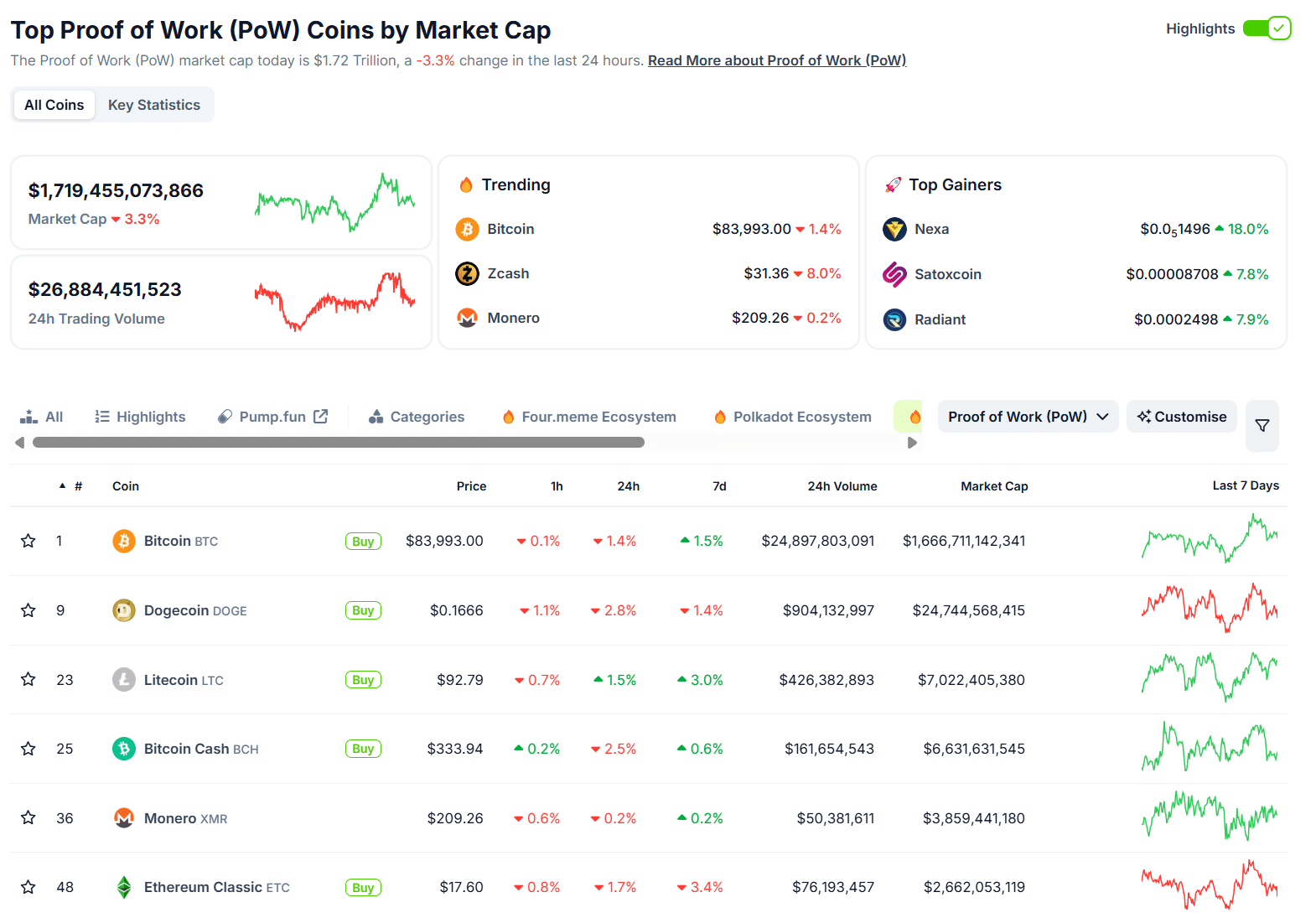

The market showed noticeable shifts in response to the SEC’s decision. Major PoW assets like Bitcoin and Dogecoin recorded losses, with Bitcoin declining 1.4% to $83,993 and Dogecoin dropping 2.8% to $0.1666. Bitcoin Cash also fell by 2.5%, reaching $333.94.

In contrast, smaller PoW altcoins outperformed, with Nexa surging 18% to $0.0051496, while SatoXcoin and Radiant gained 7.8% and 7.9%, respectively.

This trend indicates investors are shifting funds from larger assets to smaller PoW altcoins. The SEC’s clarification strengthened Bitcoin’s status as a commodity.

While sentiment for larger assets remained steady, interest in emerging PoW coins increased significantly.

What does this mean for the future of cryptocurrency regulations?

This SEC clarification ties into the broader trend of more defined, transparent cryptocurrency regulations. The SEC has also clarified its stance on meme coins, confirming they don’t constitute securities.

Furthermore, the end of the legal battle with Ripple provides additional certainty. These developments point to a future where the regulatory landscape for cryptocurrencies is more structured, with less reliance on enforcement actions.

Is the SEC’s decision a bullish signal for crypto?

The recent SEC clarification on PoW mining presents a positive outlook for the crypto industry. Miners can now operate with confidence, while investors can explore emerging PoW coins with clearer guidelines.

While Bitcoin and other large-cap PoW assets saw losses, the growth in altcoins signals that investors are positioning for long-term gains.