SHIB price prediction: The next move of Shiba Inu holders should be…

- SHIB was quiet last week as PEPE overshadowed other legacy meme coins.

- SHIB’s market indecision meant that it could extend its price range.

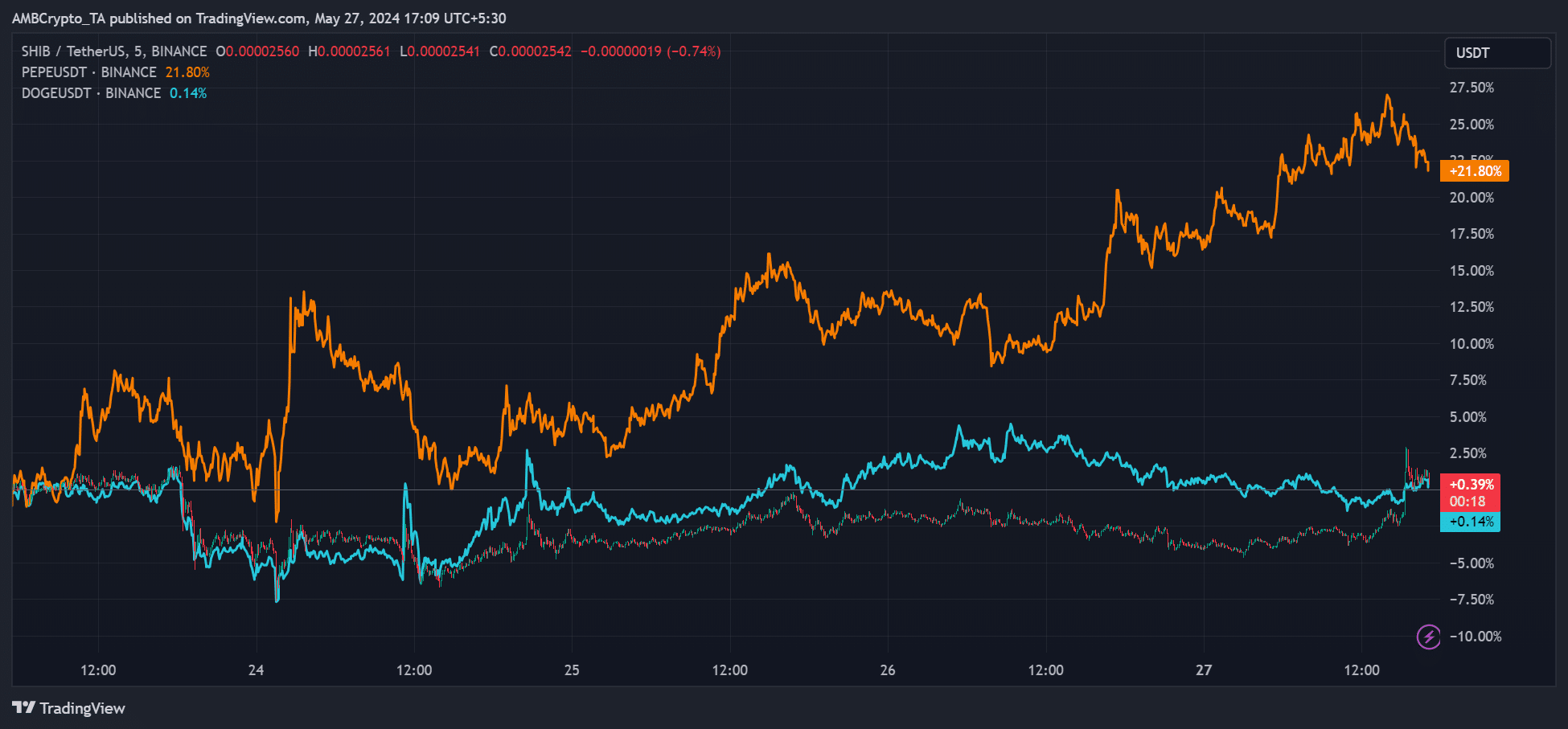

Shiba Inu [SHIB] short-term holders were outperformed by their Pepe [PEPE] colleagues last week.

In the past five trading days, Shiba Inu price prediction and comparison showed that SHIB and Dogecoin [DOGE] yielded below 1% gains, while PEPE mooned and offered its speculators +22% gains.

PEPE has been printing new ATHs (all-time highs) recently, probably attracting interest from other memecoins like SHIB.

At press time, PEPE had $3 billion in daily trading volume, while SHIB and DOGE had $500 million and $1 billion, respectively, per CoinMarketCap.

In other words, PEPE’s volume was 6X that of SHIB and 3X to DOGE. So, the market has FOMO’ed into PEPE’s recent upswings.

This can be discouraging to SHIB’s short-term holders, as the memecoin has maintained its sideways structure since mid-April. So, is a breakout likely for SHIB, and what are the key targets to consider?

Let’s explore charts for some insights.

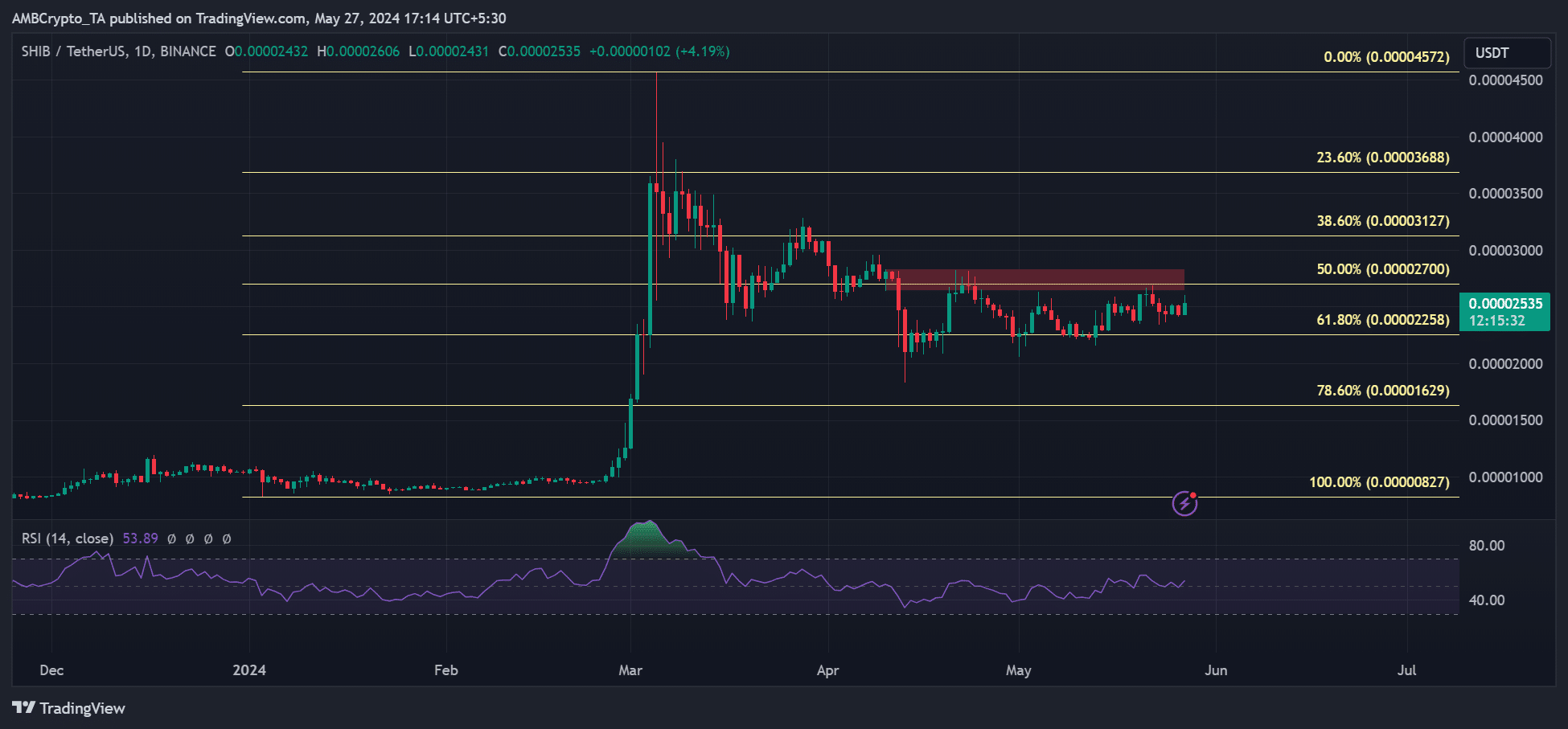

SHIB price prediction: The boring consolidation phase

Since mid-April, SHIB has remained below $0.000027. Over the same period, it has been swinging between 50% and 61.8% Fib levels.

Despite retesting the range-high a couple of times, the resistance, which doubles as a bearish order block (OB) marked red, has been a key hurdle for further upside.

SHIB bulls could only see more upside if they bypass the hurdle with a decisive daily candlestick close above 50% Fib level.

However, the neutral RSI (Relative Strength Index) showed that strong buying pressure for the needed upside breakout wasn’t in place yet. This meant that SHIB could remain stuck for a while.

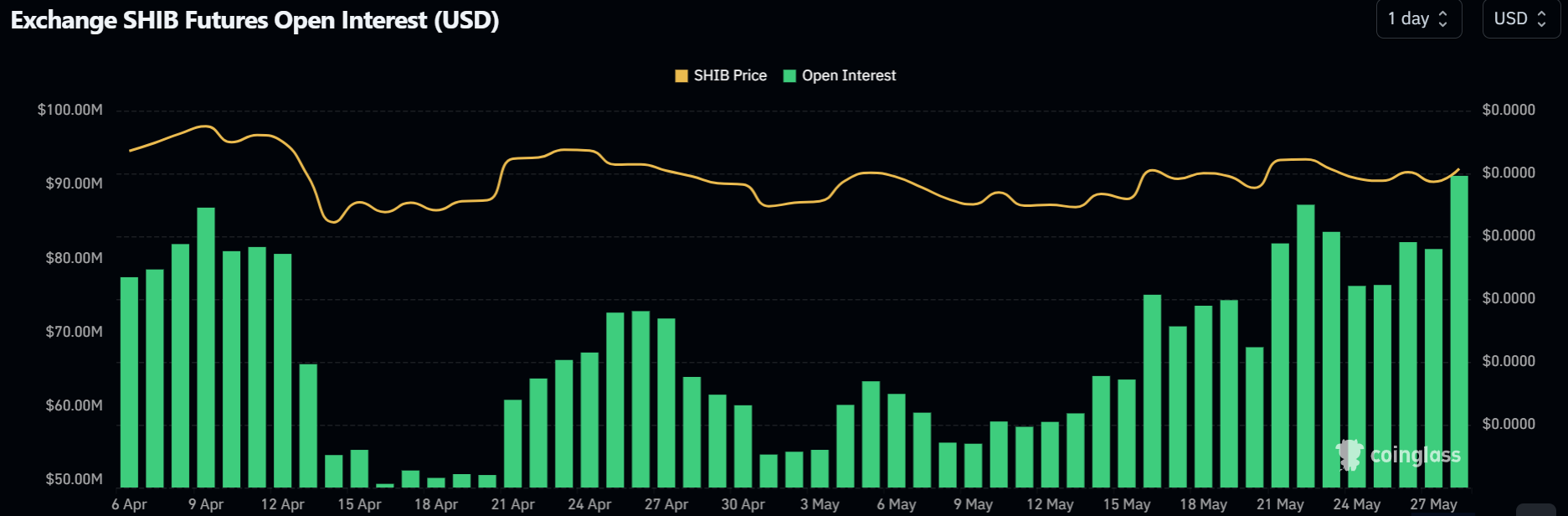

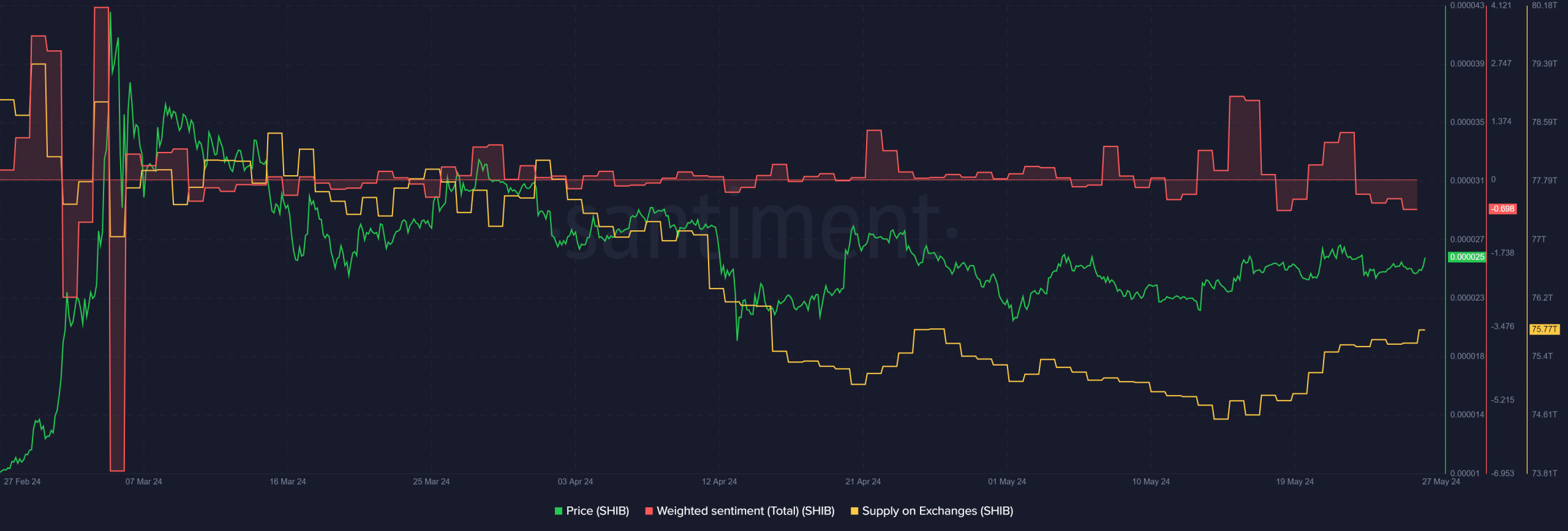

The neutral and market indecision scenario was further confirmed by mixed signals on the futures market and on-chain metrics.

According to Coinglass, SHIB’s open interest (OI) has surged to $90 million, indicating rising bullish sentiment in the futures market. However, on-chain data printed an opposite signal.

Notably, the Supply on Exchanges spiked and signalled a surge in sell pressure as more SHIBs were moved to exchanges for offloading.

Additionally, the sentiment dipped into the negative territory, denoting a negative attitude toward SHIB’s price prospects.

Read Shiba Inu Price Prediction 2024-2025

The network traction hasn’t picked up, too, as established by a recent AMBCrypto report.

That said, SHIB could extend its price range to gather enough momentum for a potential breakout. If so, SHIB traders could exploit the range of highs and lows for profit-taking and re-entry.