SHIB prices slide 20% in 7 days – A sign of market top?

- SHIB plunged by more than 20% over the week.

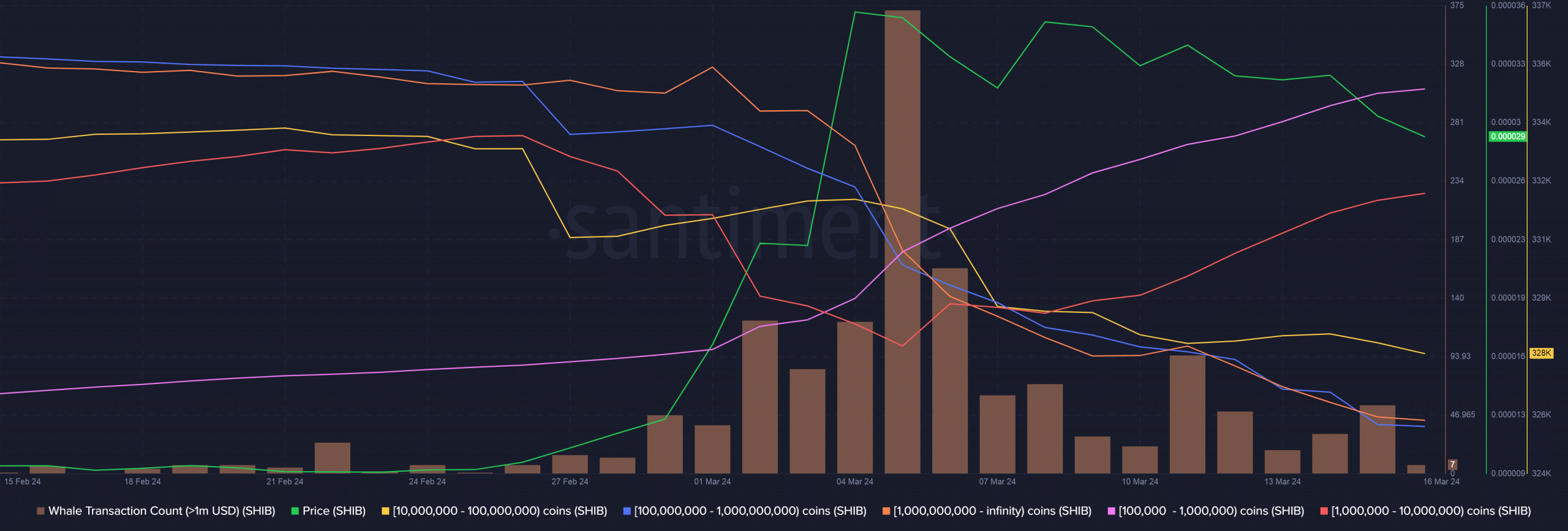

- Wallets with more than 10 million coins witnessed a significant drop over the week.

Has the memecoin frenzy hit its peak? Well, looks like it, at least for Shiba Inu [SHIB].

The dog-themed token has plunged by more than 20% over the week, and in the process crashing out of the top 10 list of cryptos by market valuation, according to CoinMarketCap.

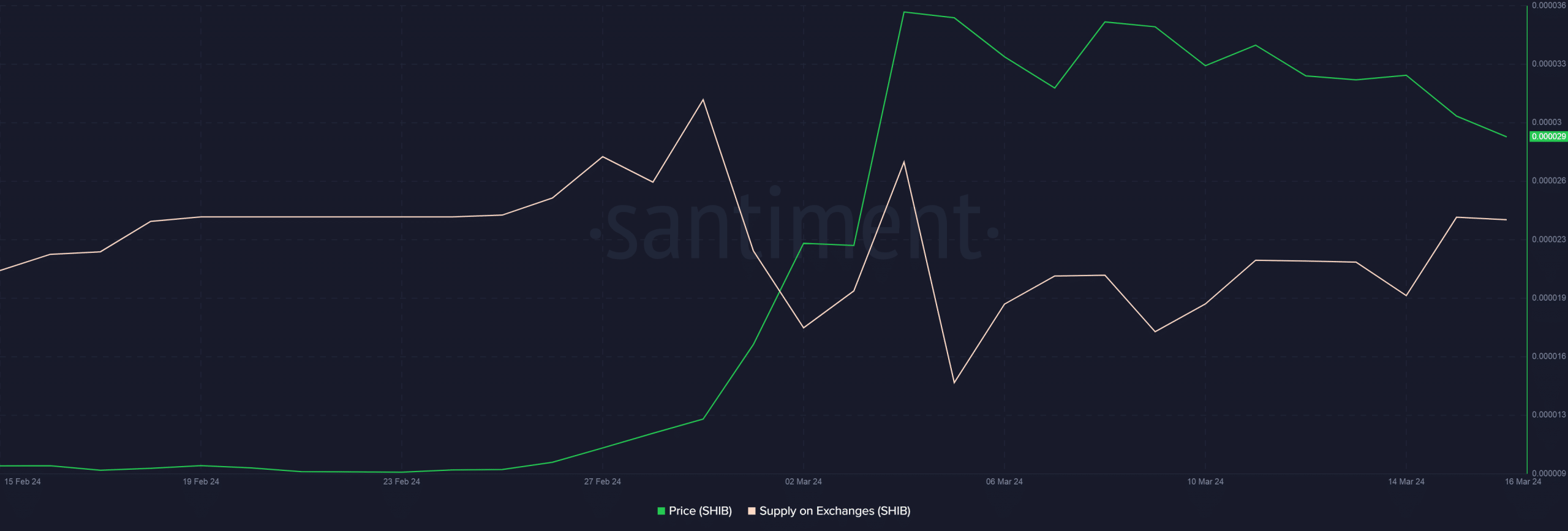

What furthered the anxiety of the SHIB army was the movement of large sums of SHIB tokens to centralized exchanges.

According to on-chain data tracker Spot on Chain, a smart whale transferred 1.24 trillion SHIBs to Binance and Gate.io on the 15th of March. The deposited sum equated to $36 million at the time of writing.

Selling this amount would fetch the investor over $23.5 million in profits. And going by the track record, there was a higher likelihood of this happening.

The whale has been locking in gains recently, having realized more than $46 million in profits by dumping their Floki [FLOKI] and Big Time [BIGTIME] holdings.

Spot on Chain spotted at least three whales, including MakerDAO [MKR] founder Rune Christensen, who sold their SHIB holdings for profit in the week.

Interestingly, SHIB wallets holding more than 10 million coins witnessed a significant drop over the week, as per AMBCrypto’s analysis of Santiment’s data, corroborating the aforementioned findings.

Moreover, SHIB’s supply on exchanges rose steadily in recent days, coinciding with price declines. This lent further credence to the profit-taking narrative and the bull market top.

Note that whale investors are known to be more informed about the market’s intricacies, and they generally distribute coins when they are convinced that market has hit its peak.

Read SHIB’s Price Prediction 2024-25

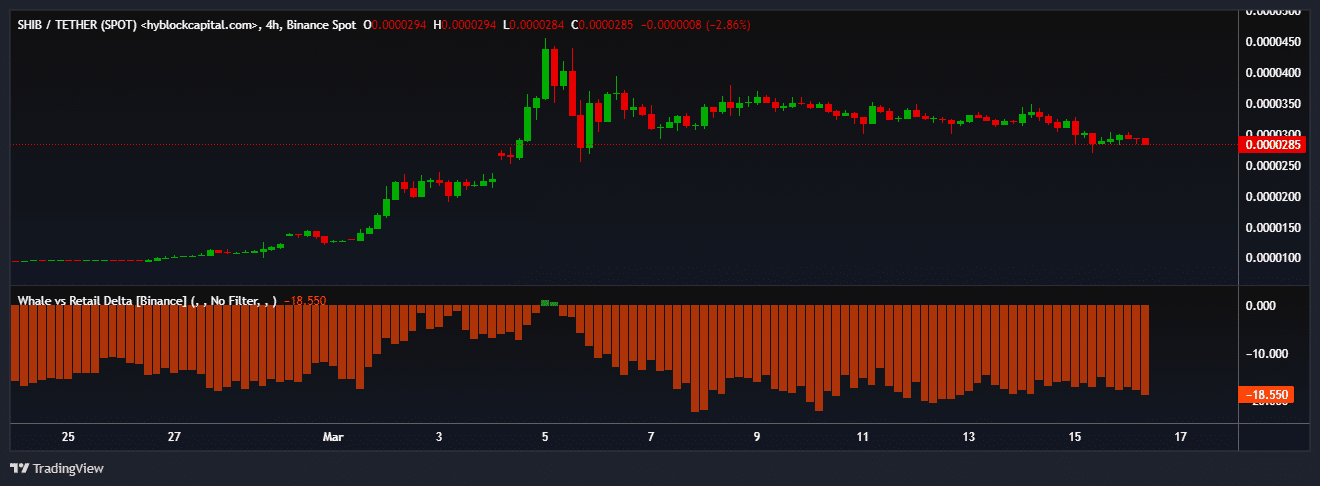

Shiba Inu whales’ bearish stances were visible in the derivatives market as well.

As per AMBCrypto’s analysis of Hyblock Capital’s data, whales had a lower long exposure than retail at press time, indicating that most of them were not too optimistic of price gains in the future.