Shiba Inu can rally, yes, but the ‘Dogecoin-killer’ needs to ‘shed’ this

Shiba Inu’s price is struggling to climb like other altcoins as it is being weighed down. According to on-chain metrics, the threat of a potential sell-off is strong, and this weight needs to be shed before SHIB, the “Dogecoin killer,” can move higher.

Shiba Inu’s woes multiply

Shiba Inu’s price action has registered negative 4% returns over the last 24 hours. In fact, it shows no signs of moving higher. Three on-chain metrics reveal the reason for the meme coin’s sluggishness.

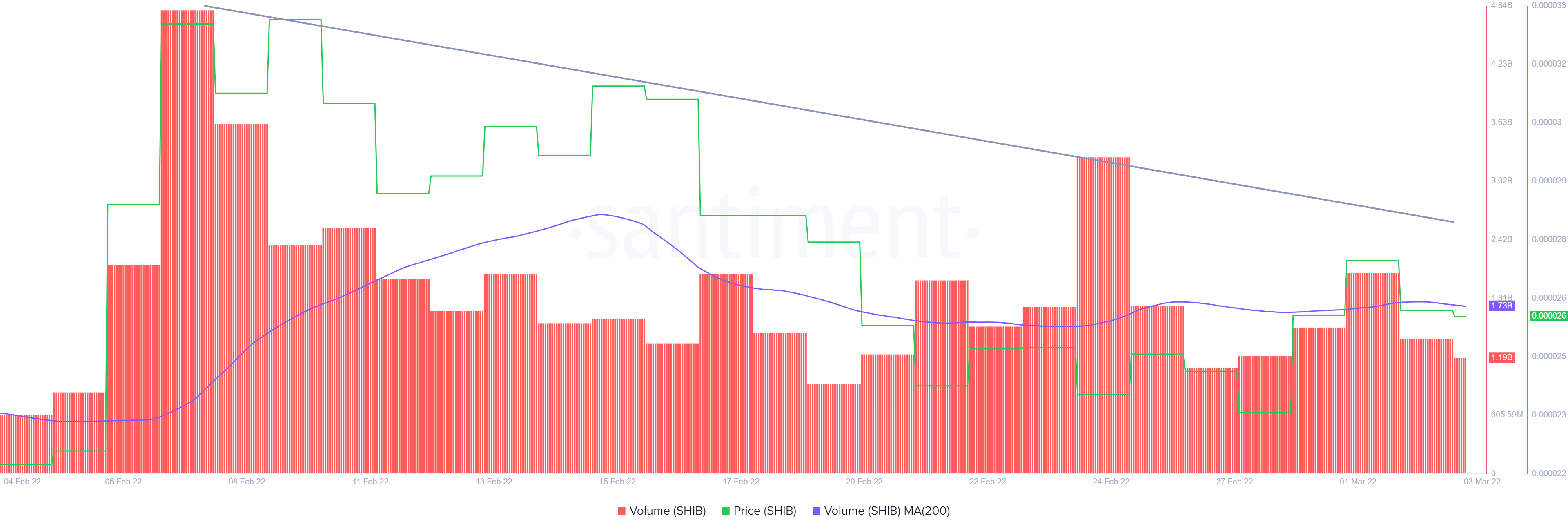

The first and the most significant metric is the steady decline in on-chain volume from 4.79 billion to 1.19 billion. This 75.15% drop in on-chain volume is a sign of the lack of interest among users at its current price levels.

The fall in the same also paints a picture of retail investor sentiment, which is primarily uncertain due to the ongoing war between Russia and Ukraine. In times like these, it is obvious market participants look towards assets that can act as a hedge like Bitcoin, Ethereum, Gold, etc.

The full picture, thanks to these metrics

The 365-day Market Value to Realized Value (MVRV) model was hovering at around 15.84%, at press time. This suggested positive sentiment among holders. This indicator is used to assess the average profit/loss of investors who purchased SHIB tokens over the past year.

A negative value below -10% indicates that short-term holders are at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone.”

However, a positive value suggests that these holders are in profit and hence, act as potential sell-side pressure. A potential flash crash could be the key to triggering these investors to offload their holdings.

Therefore, the second on-chain metric adds to the above index and clearly paints the presence of potential sell-side pressure.

Further adding depth and flavour to the sell-side pressure for Shiba Inu is the supply of SHIB on exchanges. Over the last month, the number of such tokens increased from 152 trillion to 154 trillion, indicating a net inflow of 2 trillion tokens.

At the current price level, these tokens represent $26 million worth of tokens sent to exchanges and serve as sell-side pressure favoring the bears.

All in all, the outlook for Shiba Inu looks uncertain and grim, mostly leaning bearish. The massive increase in potential selling pressure combined with the lack of interest among investors serves as a perfect concoction required to brew a disaster.

Therefore, market participants need to note that these warning signals need to disappear before the “Dogecoin-killer” tries to move higher.