Shiba Inu’s recovery faced difficulty – Where can investors look for gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

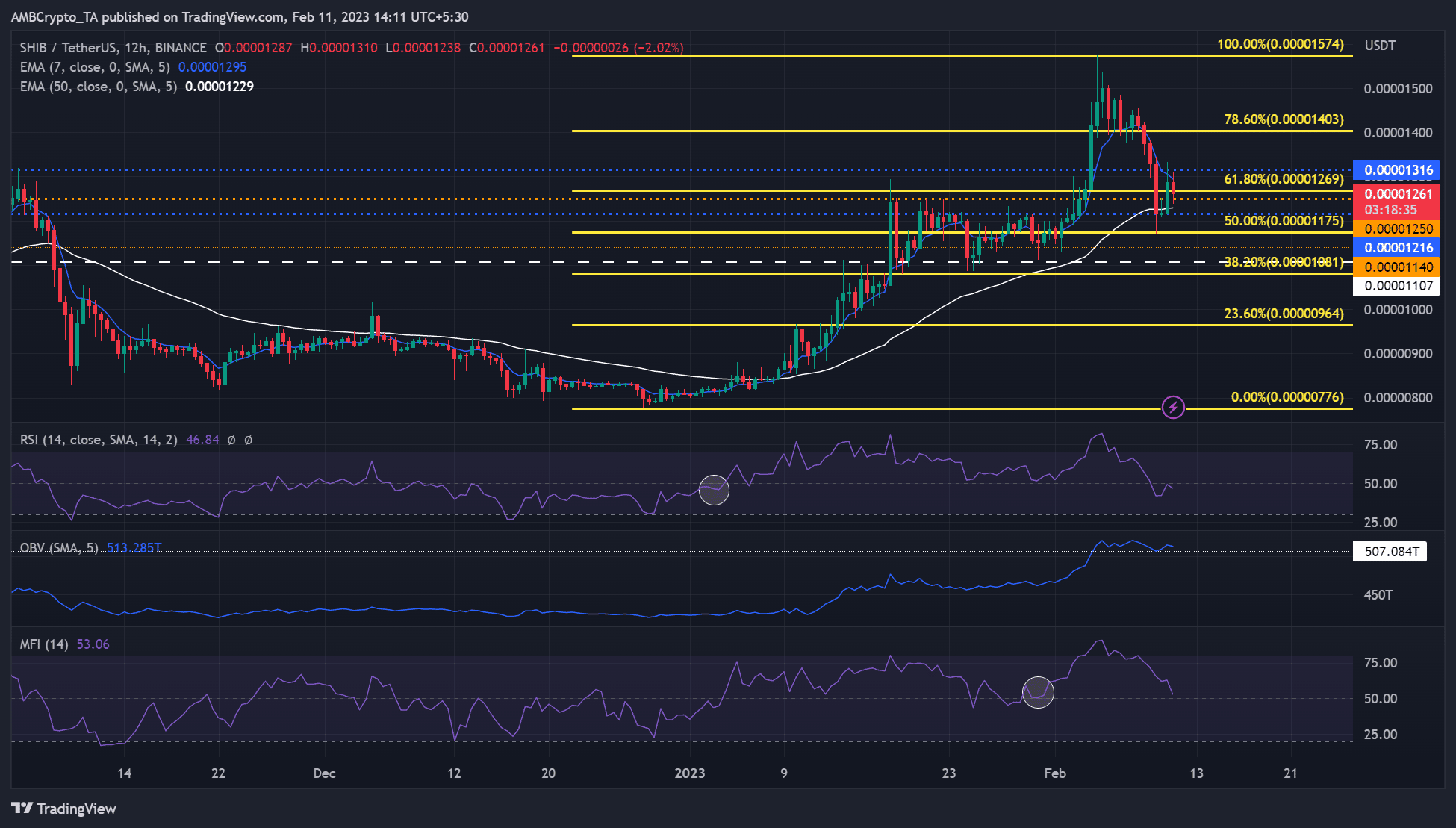

- SHIB attempted a recovery after finding a steady break at $0.00001216.

- A spike in short-term sell pressure could undermine a strong recovery.

Shiba Inu’s [SHIB] optimistic recovery met countering efforts from bears. After the early February FOMC announcement, Bitcoin [BTC] lost hold of the $23K zone, setting the meme coin to plunge.

Read SHIB Price Prediction 2023-24

SHIB found steady support at $0.00001216 and fronted a price recovery. However, it failed to bypass the hurdle at $0.00001316, giving bears an upper hand. At press time, the meme coin’s value was equivalent to its November 2022 level.

Is a retest of the 50% Fib level likely?

At press time, BTC struggled to reclaim its $22K zone. Similarly, SHIB faced difficulty closing above the 61.8% Fib level of $0.00001269. With a bearish structure, as indicated by the RSI, SHIB could retest the 50% Fib level.

Such a move would allow investors to benefit from a short-selling opportunity at $0.00001216. The RSI faced rejection at the mid-level, further reinforcing the bears’ advantage at press time.

How much is 1,10,100 SHIBs worth today?

However, the Money Flow Index (MFI) has always rebounded from the mid-level on the 12-hour timeframe chart. Therefore, if the pattern repeats, it will indicate an increasing demand for SHIB.

Any uptick in buying pressure would tip bulls to overcome the hurdle at $0.00001316. But the move will invalidate the bearish bias described above.

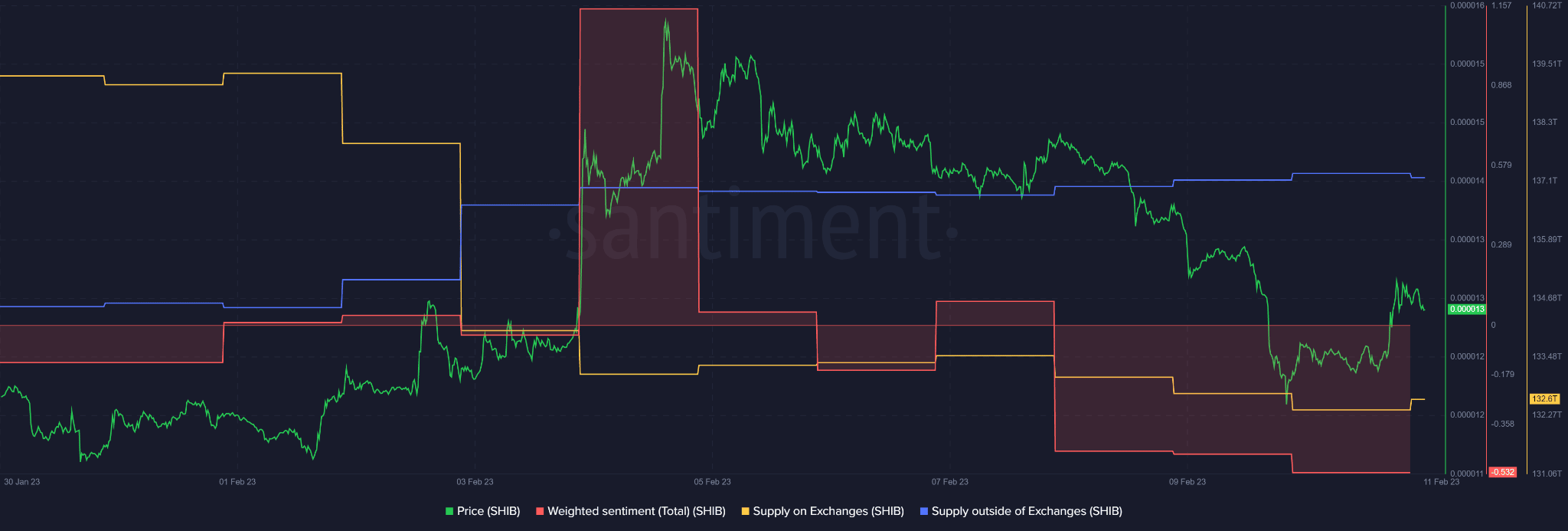

SHIB saw short-term pressure as bearish sentiment increased

SHIB recorded little demand as short-term supply increased. According to Santiment, the Supply on Exchanges recorded an uptick, indicating that more SHIB were moved to the exchanges for offloading.

It denotes the short-term sell pressure which could delay SHIB’s long-term recovery.

Correspondingly, the Supply out of Exchanges registered a drop, indicating that demand for SHIB was little compared to the supply. Such a supply-demand imbalance could set SHIB for a short-term devaluation.

In addition, SHIB’s positive weighted sentiment has waned significantly since 3 February – after the FOMC announcement. Sobriety set in after a temporary market euphoria following the 25-basis Fed rate hike.

The negative sentiment and bearish outlook could undermine the meme coin’s recovery.

However, a bullish BTC and a surge into the $22K zone could boost SHIB’s recovery, so it is worth tracking the king coin’s price action.