Shiba Inu’s Shibarium: Should L2’s delayed launch concern your BONEs?

Memecoins have created a flutter in the crypto-markets ever since they burst on to the stage. Their valuation, unanticipated price fluctuations, and their connections to tech czars have become a subject of significant coverage, both within and outside crypto-circles. However, critics have often questioned the lack of real world utility of this set of crypto-assets. Shiba Inu [SHIB], the second-largest memecoin with a market cap of more than $5 billion, has tried to address these concerns through the launch of applications like layer-2 (L2) scaling solution – Shibarium – and the decentralized exchange (DEX) ShibaSwap. At the heart of these projects, lies the token Bone ShibaSwap [BONE].

The utility-enabled token, BONE, has had a roller-coaster ride in 2023. After climbing all the way upto its highest value in more than a year in February, the altcoin has descended sharply in subsequent months.

As a result, effectively all the gains made in the initial bull run of 2o23 have been reversed. At the time of publication, BONE was tottering at $0.7659, down 1.35% in the last 24 hours, as per CoinMarketCap data.

Realistic or not, here’s BONE’s market cap in SHIB’s terms

The ‘BONE’ of contention

ShibaSwap is a decentralized finance (DeFi) protocol offering passive income-generating services like staking, liquidity pools, and yield farming. Launched in July 2021, its primary objective is to expand the utility and capability of the Shiba Inu ecosystem.

BONE serves as a governance token within the ShibaSwap ecosystem, thus enabling BONE holders to propose and vote on changes to the ShibaSwap protocol through the Shiba Inu Doggy DAO.

Apart from this, BONE serves as the gas token for the upcoming L2 blockchain, Shibarium, which is currently in its test Beta phase. As per an earlier tweet, it was revealed that BONE would also play a critical role in the burning of SHIB tokens – an act carried out to deplete an asset’s circulating supply to increase its value in the future.

According to Puppyscan, the Shibarium beta explorer, the number of transactions on the network have been steadily increasing, logging a daily average count of 400,000 over the last week. In fact, the total number of BONE addresses went past 15 million.

Recent FUD around exchange listings

BONE is an ERC-20 token based on the Ethereum [ETH] blockchain and its supply has been capped at 250 million. The vast array of use cases tied to BONE made it the talk of the town in the days leading up to Shibarium launch. The hype translated in its listing on major crypto-exchanges like OKX [OKB], Huobi Global [HT], CetoEx, and Flitpay.

The high-profile listings have instilled hope in the Shiba Inu fanbase that the utility token will make its debut on the world’s largest crypto-exchange, Binance [BNB]

However, the community expressed concerns over rumours that the development team is restricting the listing of BONE on several exchanges. The fears were allayed by a developer who cited the delay in the launch of the Shibarium mainnet as one of the main reasons behind exchanges not listing the token.

Shibarium Beta, which went live on 11 March, is now undergoing rigorous testing before its inevitable mainnet launch. In fact, a popular member of the community quoted a development team representative as saying that testing is going well and that August is being targeted for its release.

Latest updates on #Shibarium

A spokeperson from the team said that testing is going well, and they are speeding up the release and, in his opinion (not a fact), August might be a good target for release.#SHIBA #Crypto #BONE #LEASH pic.twitter.com/FJX4ZpK4Fl— SHIB INFORMER (@ShibInformer) May 23, 2023

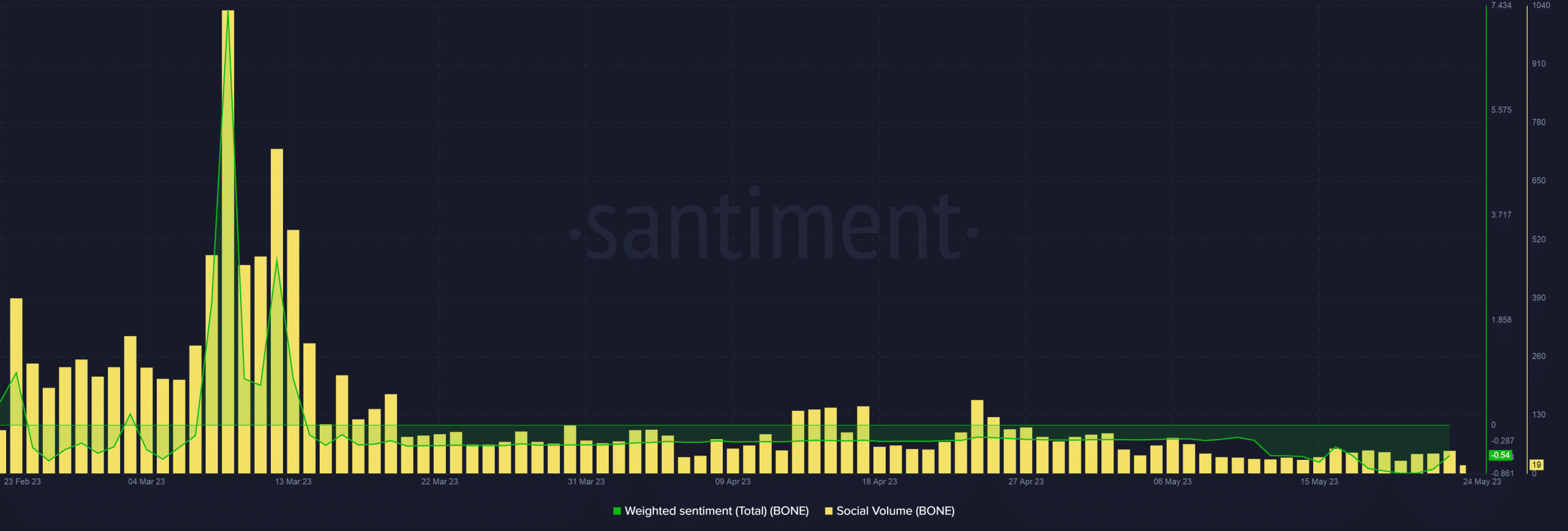

However, the delay in the launch, coupled with the prolonged downtrend, negatively affected investors’ sentiment. The same was fairly positive during the Shibarium Beta launch phase. On the contrary, since then, the social buzz around the coin has declined progressively.

Is your portfolio green? Check the Bone ShibaSwap Profit Calculator

Whales buy the dip

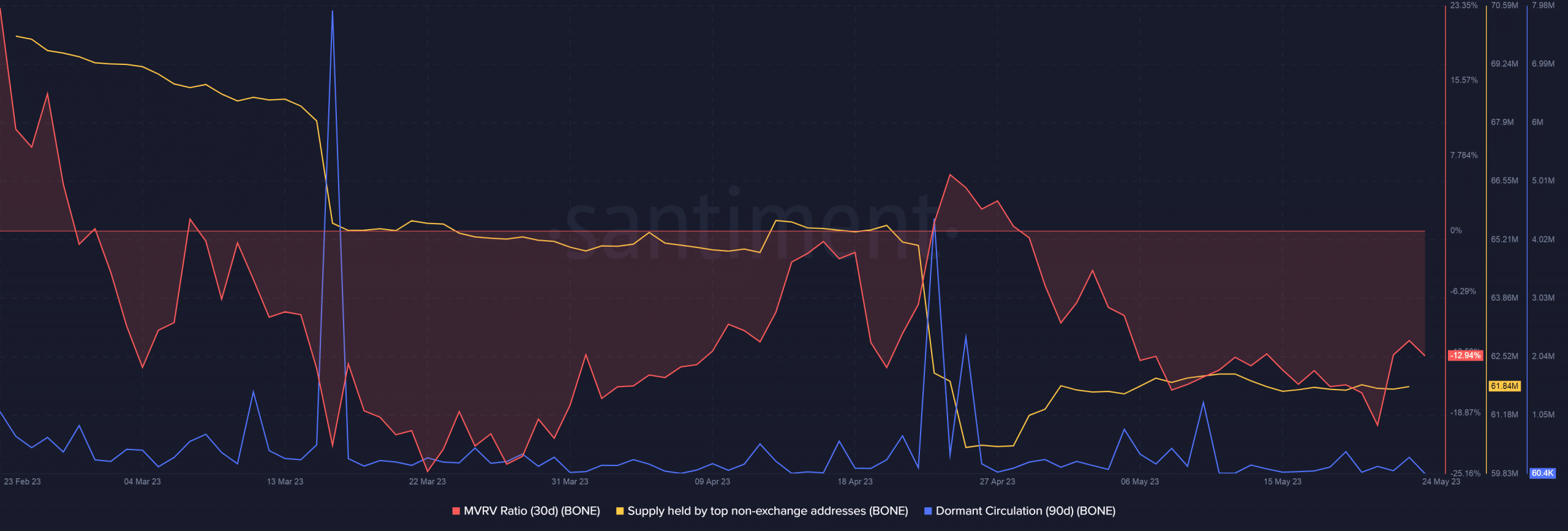

As BONE’s price trended south, most investors were staring at big losses on their holdings. According to Santiment, the 30-day MVRV Ratio was negative throughout May and hit -12.94% at press time. This meant that most addresses would incur a loss of 12.94% on average.

Interestingly, large addresses utilized this opportunity to stack their portfolios with BONE tokens as the supply held by top non-exchange addresses rose. The 90-day dormant circulation has dropped too after the intense selling wave of late April, implying that these users were in an accumulation phase.