Should Ethereum’s flexibility be valued more than its market cap

Ethereum is huge. Now, in terms of market cap, it might be just half of Bitcoin’s value. However, here is a visual representation of some of the important projects based on the chain.

At first glance, protocols such as Uniswap, USDC coin, Metamask, Chainlink, and many more can be seen. And yet, over time, Ether hasn’t accrued the explosive growth of these rising projects, despite the fact that it practically provides the foundational grounds.

Regardless, this might be one of Ethereum’s most unique strengths.

“To never get lost in a ruthless industry”

The digital asset space is a cut-throat industry if the token is not termed ‘Bitcoin.’ Survival is competitive. Tokens associated with Bitcoin (Bitcoin Cash, Bitcoin SV, Bitcoin Diamond, etc.) too haven’t been able to keep up with consistent returns.

With narratives changing every cycle and new projects rising to every new occasion, Ethereum has somewhat found a place in every single one of these sectors.

Yes, Ethereum has been at the forefront of all altcoins since 2019. However, its ability to remain relevant during every cycle is commendable. If the last couple of years are analyzed, it started with decentralized finance of DeFi, which introduced the sector to yield farming.

Now, on defiprime.com, 242 DeFi projects are listed, out of which 220 are built on Ethereum.

DeFi summer 2020 was the talk of the town and by the end of the year, another bullish cycle began. After the same, NFTs took over the scenes.

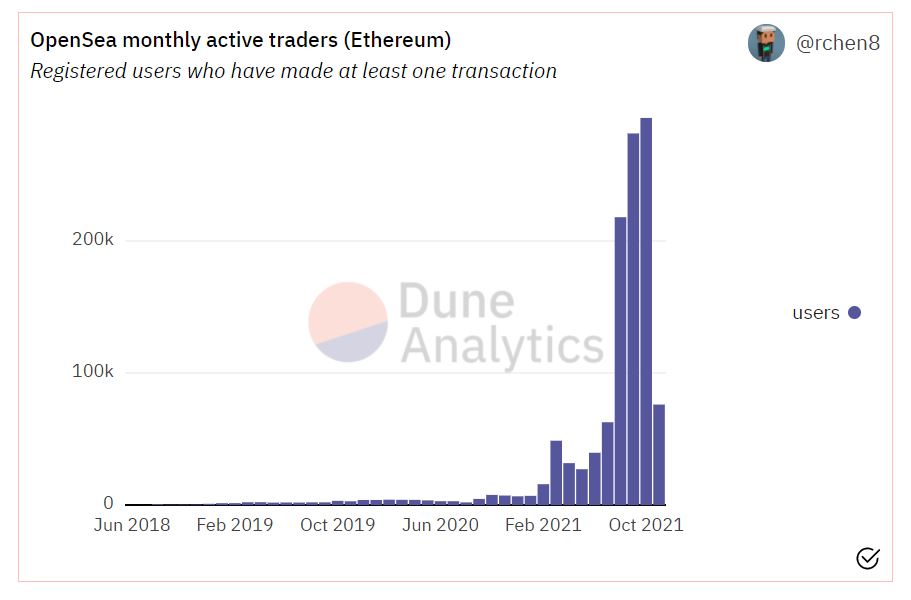

Now, which protocol had the most active traders in the NFTs market? OpenSea. What is OpenSea built on? No points for guessing.

In October 2021 itself, OpenSea monthly active traders from Ethereum hit an all-time high of 293,150, leading September’s 281397 users by a few hundred.

Ethereum and Metaverse – ETH keeps finding its mark

At the moment, one of the most talked-about developments is the Metaverse, where Virtual and Augmented Reality is deemed as the future of social interaction and possibly, commercial portals.

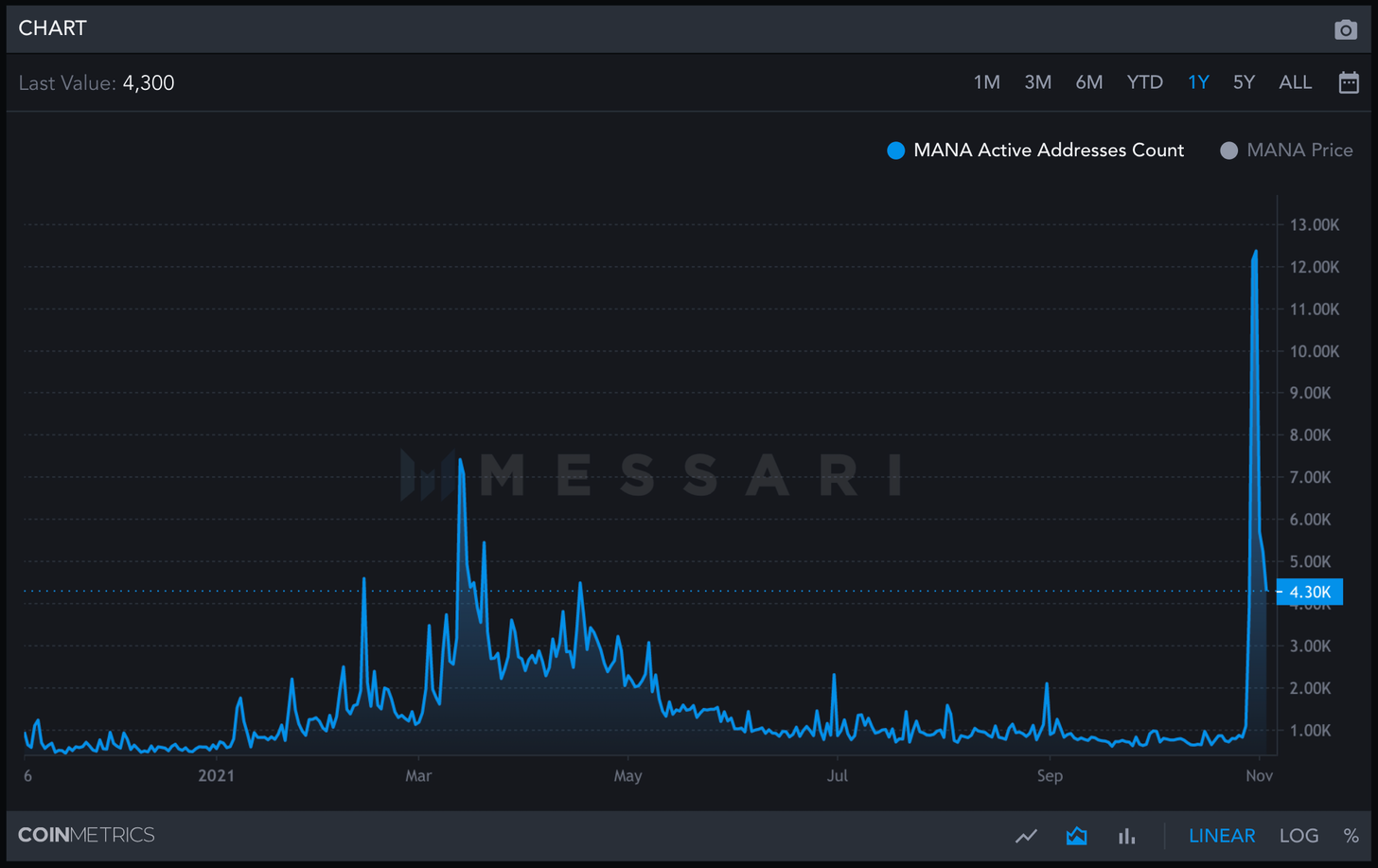

Thanks to Facebook’s rebranding announcement, Decentralands’s MANA token witnessed a 400% hike over the past week. Its address count also registered a massive spike, beating its previously high levels.

A domino effect possibly led to the rise in daily active addresses for Axie Infinity as well, with addresses touching 939,427. Additionally, CryptoPunks also saw a lot of movement over the same timeframe. But, average sale prices have dropped down by 50% since the beginning of 2021.

Regardless, the common thread between all these remains one – Ethereum.

Strength in versatility

Now, bringing back the previous point in context, Ether’s value has never incurred explosive growth based on all the projects developed on its chain. However, it has led to the blockchain being the most dependable in the market.

Ethereum’s versatility and consistent relevance is its biggest strength. Also, consistent value appreciation can be deemed more valuable over its long-term growth.

While Bitcoin is player 1 in the digital asset space, Ethereum might be changing the game altogether.