SNX’s 116% rally on the back of growing stablecoin demand means…

The recovering market has been benevolent for many altcoins such as Synthetix, more so than others. In fact, in addition to this, their use cases have grown as well. However, this also fuels a leading question. While the considerable rallies are looking good right now, will they still survive once the bullishness slows down?

Synthetix and its organic rally

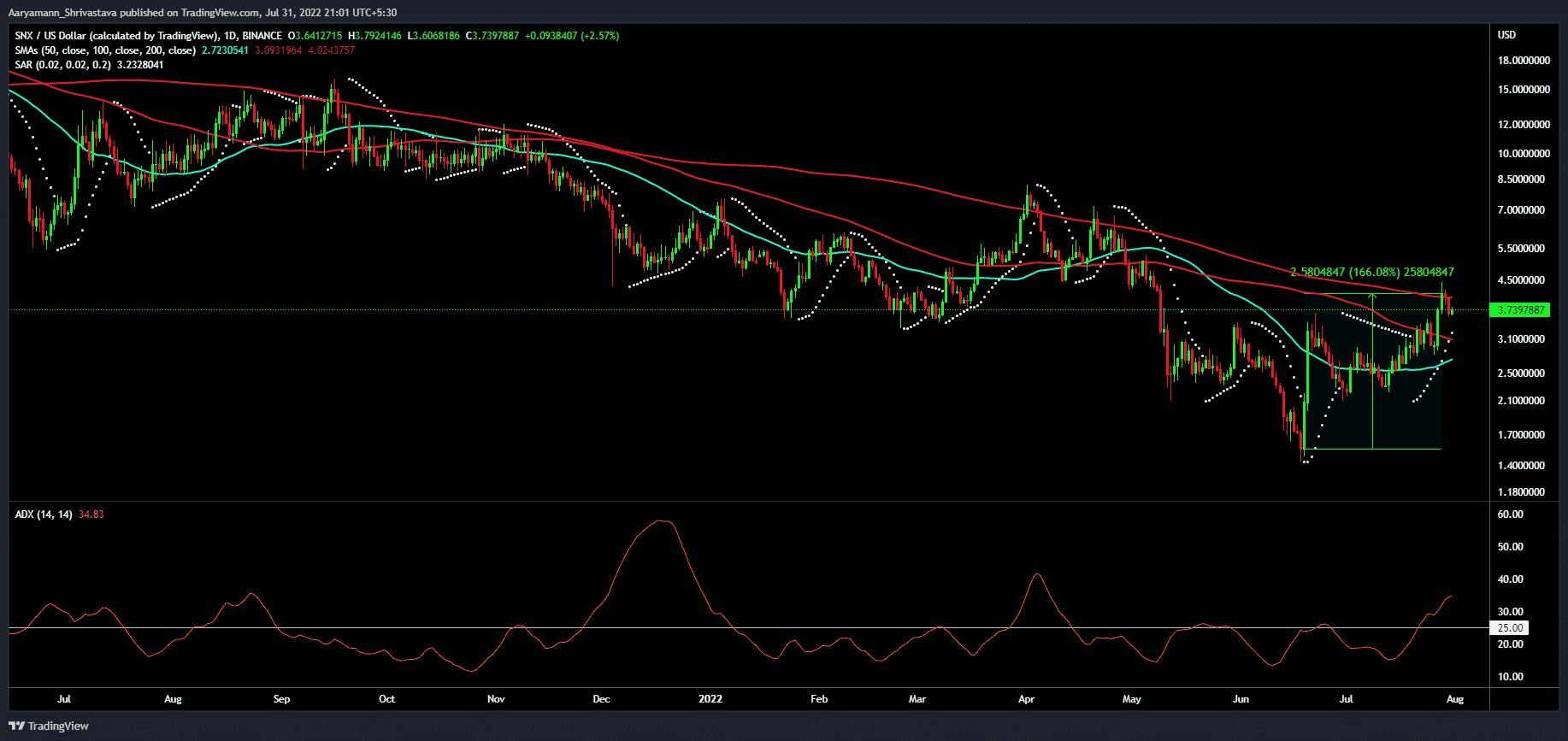

After May and June’s crash, SNX declined from its local top of $7.7 to $1.5 in the span of a month.

However, within a month of the same, the altcoin recovered all of June’s losses and pretty much half of May’s dip by rallying by 116.08%. This pushed the altcoin’s trading price to $4.02.

At the time of writing, SNX was changing hands at $3.78 on the charts.

Synthetix price action | Source: TradingView – AMBCrypto

Along with this rally, earlier this week, the synthetic stablecoin of the Synthetix platform sUSD was enabled as collateral on the AAVE V3 platform on Optimism.

Not only this, but Synthetix’s atomic swaps were also integrated with another DEX aggregator – OpenOcean.

By doing so, the DeFi protocol can be seen doing well as both an asset and a dApp. Also, by the looks of it, this growth will continue, provided SNX does not face a bear attack anytime soon.

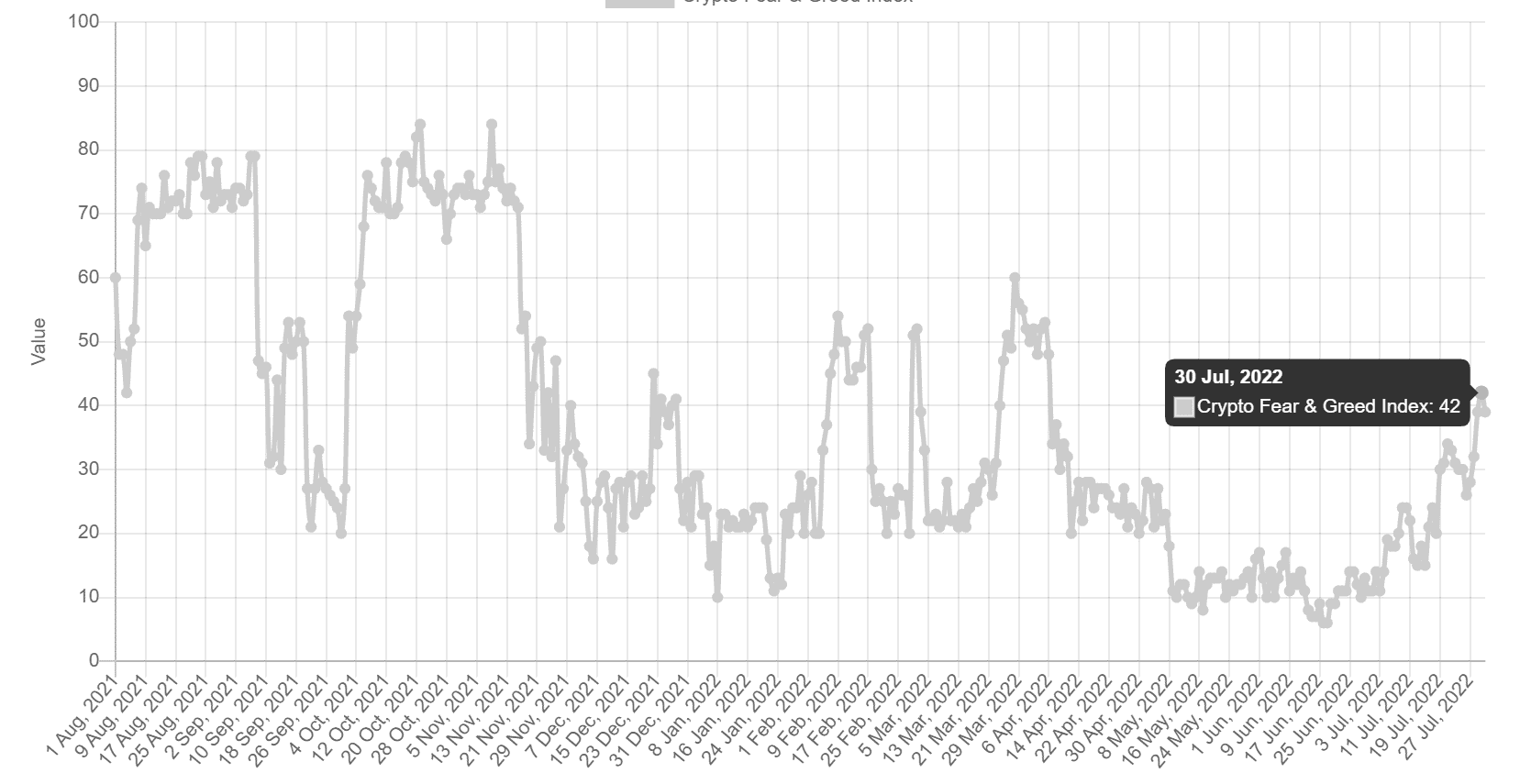

The chances of the same happening seem to be declining by the day as the fear in the market is disappearing. At the time of writing, the Crypto Fear and Greed Index was almost at its four-month high. Worth pointing out, however, that while it inclined towards greed, the same was still relatively far away.

Besides, SNX already has the support of the 50-day Simple Moving Average (SMA) (blue) line and the 100-day SMA (pink) line. In fact, during the rally, at one point, the altcoin was also above the 200-day SMA (red) before slipping below it again in the last 48 hours (ref. Synthetix price action image).

Finally, SNX seemed to be exhibiting rising bullishness as the Parabolic SAR’s white dots remained positioned below the candlesticks. What’s more, the Average Directional Index (ADX) being above the 25.0-threshold highlighted that the uptrend was gaining strength.