SOL consolidates near local highs – is a reversal imminent?

![Solana [SOL] consolidates near local highs - Are more gains likely?](https://ambcrypto.com/wp-content/uploads/2023/03/paolo-feser-sI2pmha9vRI-unsplash-scaled-e1677762856946.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SOL consolidated between $20 – $27 in the past few weeks.

- Open interest (OI) rates steadied, suggesting a potential price reversal.

Solana [SOL] continued consolidating near local highs, showing buyers aren’t exiting just yet. Despite last week’s network outage, SOL didn’t drop below the support; a retest could offer ideal buying opportunities.

Read Solana;s [SOL] Price Prediction 2023-24

SOL dropped toward the crucial $20 support level

The daily chart showed that the Relative Strength Index (RSI) sliding below the 50-mark, which signified a bearish sentiment at press time. Similarly, the OBV (On Balance Volume) declined gently, indicating limited buying pressure, which could further tip the scale in favor of the bears.

Therefore, bears could push SOL to $20. A retest of the $20 support level could offer new buying opportunities. Bulls could target the resistance level at $27, which would result in a potential 27% hike. If bulls overcome the selling pressure zone at $27, they could push SOL to the next resistance level at $30.60, adding another potential hike of 12%.

On the contrary, a break below the $20 support will invalidate the bullish thesis and offer bears additional shorting opportunities. Short-sellers could target the 200-day EMA (exponential moving average) of $18.06. An extended correction could be slowed at $15.

Is your portfolio green? Check out the Solana Profit Calculator

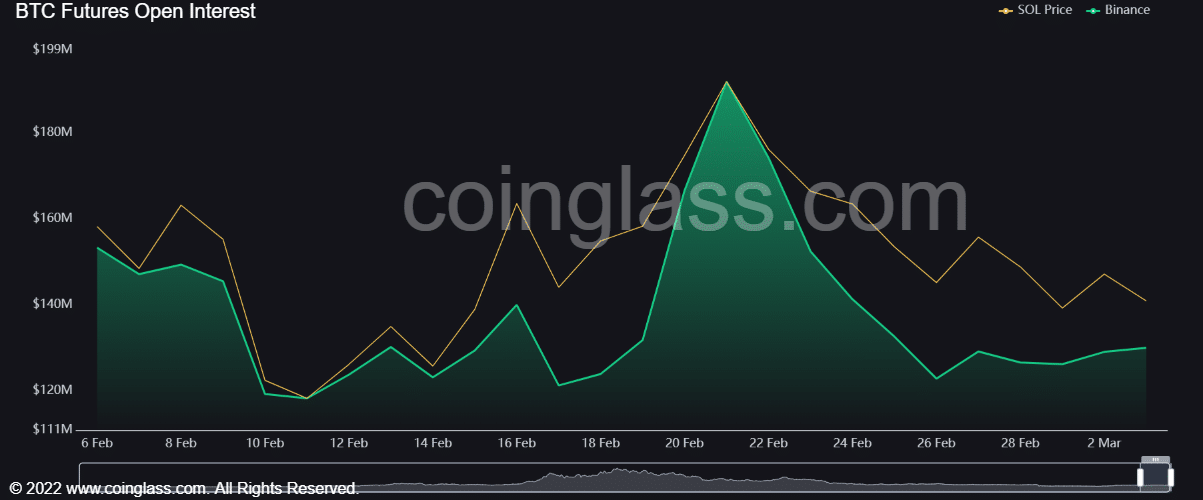

SOL’s open interest rates steadied after a sharp decline

SOL’s open interest (OI) rate declined from 20 February, according to Coinglass. It showed that more money moved out of SOL’s futures market – a bearish signal. However, the OI stabilized after February 26 and formed a divergence with price action at the time of writing. Thus, the OI could pivot to the upside and inflict a potential price reversal.

Moreover, more than $800k worth of long-positions were liquidated in the past 24 hours, according to Coinalyze. On the contrary, only about $100k of short-positions were liquidated in the same period. It reinforces the underlying bearish sentiment at the time of writing, which could work in favor of the bulls waiting for SOL’s drop to $20.