SOL could regain its lost confidence thanks to Solana’s latest integration

- Solana Pay finally rolls out on Shopify and it may change payment processing.

- SOL maintains relative strength despite the recent sell pressure.

Imagine a future where blockchain and cryptocurrencies facilitate payments while shopping. Solana Pay aims to achieve that and it recently made an important stride through its integration with Shopify.

Is your portfolio green? Check out the Solana Profit Calculator

According to Solana’s latest announcement, Solana Pay’s Shopify integration will allow merchants and entrepreneurs to leverage WEB3 payments. This will allow them to bypass transaction fees and third-party payment processing.

Note that any WEB2-based third-party payment processors usually add an extra cost to transactions. The deployment of WEB3-based solutions could thus be a game changer not only for merchants but also for shoppers.

1/ ?️Shopify ?Solana Pay

Today, Solana Pay integrates with @Shopify, empowering the millions of entrepreneurs and merchants on Shopify to accept fast, web3 native payments with no transaction fees through the end of 2023. https://t.co/q63KeBllXB

Learn more ? pic.twitter.com/QEb1LzqS51

— Solana (@solana) August 23, 2023

This acts as an important milestone for the Solana blockchain because it could mark the start of more such integrations to come. If successful, Solana could unlock robust network utility. This could also increase the chances of securing more demand around SOL.

Will the development trigger a favorable investor sentiment?

News of Solana Pay’s integration with Shopify has the potential to influence market sentiment. This is because the development ushers in the potential for real-world use cases.

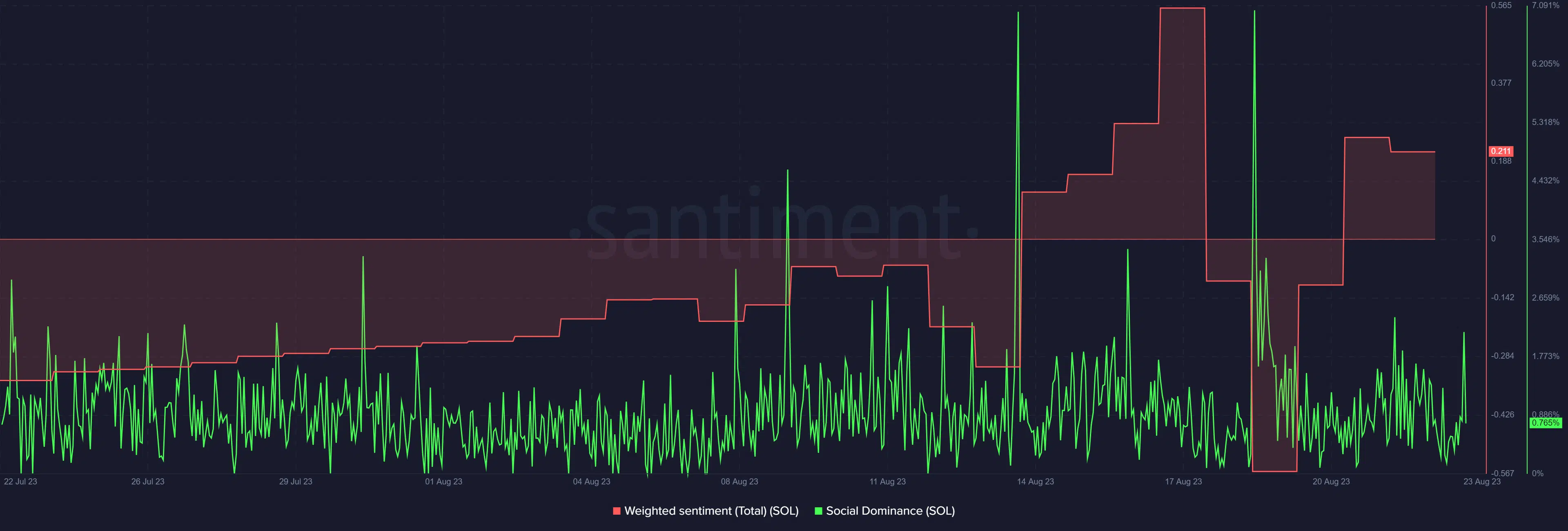

We observed a surge in Solana’s social dominance in the last 24 hours at press time. This suggested that the market reacted to the news.

The social dominance was still low compared to its largest spikes. However, the weighted sentiment achieved a more noteworthy uptick in the last three days. In other words, investors received a confidence boost which correlates with recent market lows.

Solana’s native cryptocurrency SOL recently dipped to a $20.31 low during Tuesday’s (22 August) trading session. It rallied by almost 5% in the last 24 hours which suggested that the market reacted favorably to the Solana Pay and Shopify integration.

Most of the top cryptocurrencies by marketcap were deeply oversold after the recent crash. However, SOL maintained some relative strength which helped it avoid the oversold zone.

We also observed that SOL maintained a healthy premium from its June lows. In contrast, some of the top cryptos such as Bitcoin came close to their June lows while ETH fell below its lowest price in June.

Realistic or not, here’s Solana’s market cap in BTC’s terms

SOL was partly able to maintain some relative strength courtesy of healthy demand activity. Its volume metric registered a net gain since 21 August.

While the volume spike suggested the return of demand in line with the recent price action, SOL’s future remains uncertain. An erosion of the low market confidence could send prices back on a bearish trajectory.