SOL outclasses ADA, ETH, but here’s why a breakout remains elusive

- SOL’s demand area has turned into a selling interest zone.

- Solana’s TVL was far ahead of Cardano’s, and the token’s price action against ETH favored SOL.

Solana’s [SOL] performance in the last seven days has been woefully inadequate for its holders. And out of the top 10 assets in market cap, Cardano [ADA] was the only asset that performed worse than SOL.

Realistic or not, here’s SOL’s market cap in ADA terms

Set to break higher

However, Bloomberg Intelligence’s market analyst, James Coutts, noted that there has been a change in SOL’s technical structure. According to Coutts, the previous $26.31 support level has turned into resistance.

#Solana Technicals: interesting setup with old support acting as new resistance. The $30-$40 level was where a lot of insiders began dumping on retail in the previous bull mkt. ? pic.twitter.com/ofI3o69CC8

— Jamie Coutts CMT (@Jamie1Coutts) July 20, 2023

In his tweet, the analyst compared this scenario to the last bull market, when insiders dumped the token around $30 – $40. When this happens, it simply means that the demand zone has now become an area of selling interest.

Further, this means buyers have tried to break through the area but have been unable to drive prices higher.

Despite the possibility of a further downtrend, Coutts mentioned that SOL has shown signs of strength, especially against Ethereum [ETH]. One instance he referred to was the period when the SEC labeled SOL as an unregistered security.

Although the token tumbled as of then, it didn’t fall as much as it did in 2022 when it nosedived because of the fall of the FTX exchange. Coutts said,

“The SEC-induced selloff was not enough for the asset to trade below the 2022 low. Price is now consolidating vs ETH but the setup for break higher is there.”

SOL tops ADA

But the analyst was quick to mention that Ethereum had more solid fundamentals than Solana despite the latter’s faster speed and lower transaction costs. Hence, he deemed it fit to compare Solana with another Proof-of-Stake (PoS) blockchain— ADA.

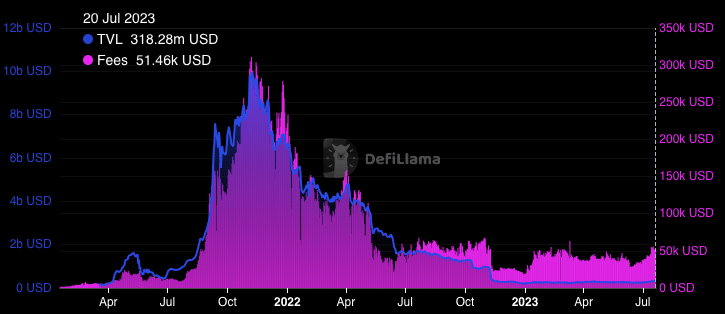

While Cardano’s market cap is slightly higher than Solana’s, the same cannot be said for its Total Value Locked (TVL). The TVL measures the rate of unique smart contract deposits into protocols under an existing chain.

At press time, Solana’s TVL was $313.75 million. Cardano, on the other hand, had a TVL of $185.87 million. This means that market participants have locked in more capital with the aim of enjoying more proceeds in Solana than in Cardano.

It was also the same situation when comparing fees generated by both blockchains.

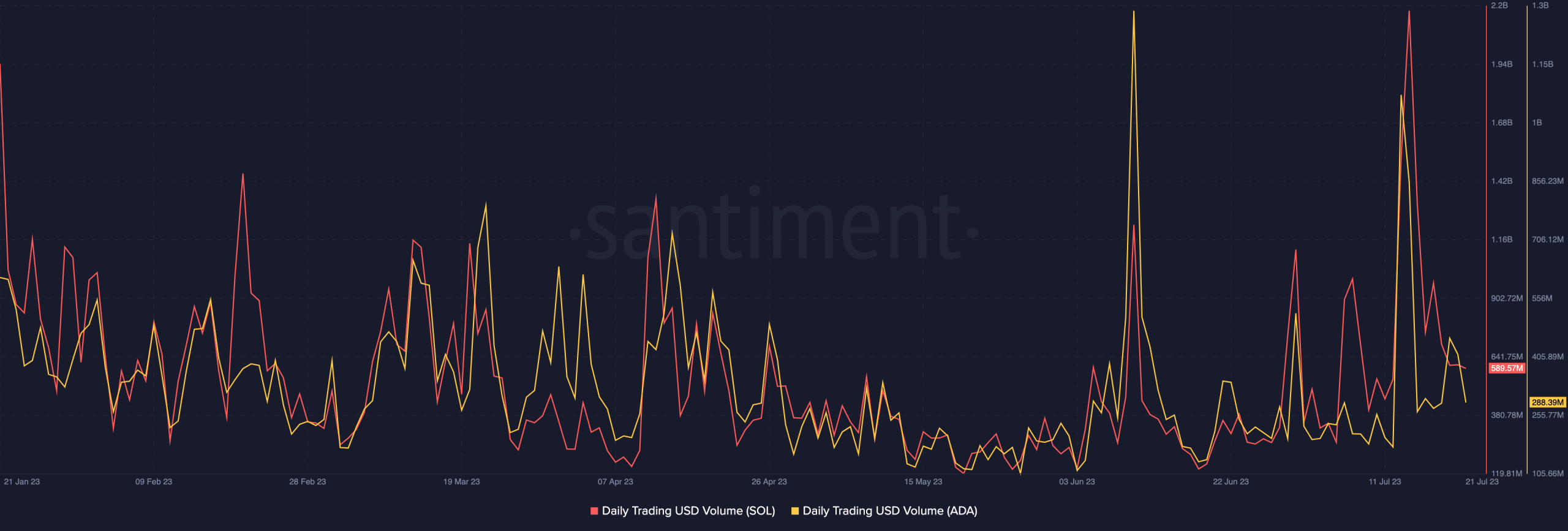

While TVL rarely impacts prices, Santiment showed that Solana’s daily trading volume was higher than Cardano’s. This metric indicates the total amount of assets traded on a daily basis.

How much are 1,10,100 SOLs worth today?

At the time of writing, Solana’s trading volume was $589.57 million. Meanwhile, Cardano’s volume was $288.39 million. But it was noteworthy to mention that both volumes fell.

Therefore, if SOL were to break out from the $26.31 resistance, then the volume might need to increase significantly.