LINK may alter its bullish course if these holders make a strong move

- LINK’s price indicators stood in a firm position as bulls dominated the market.

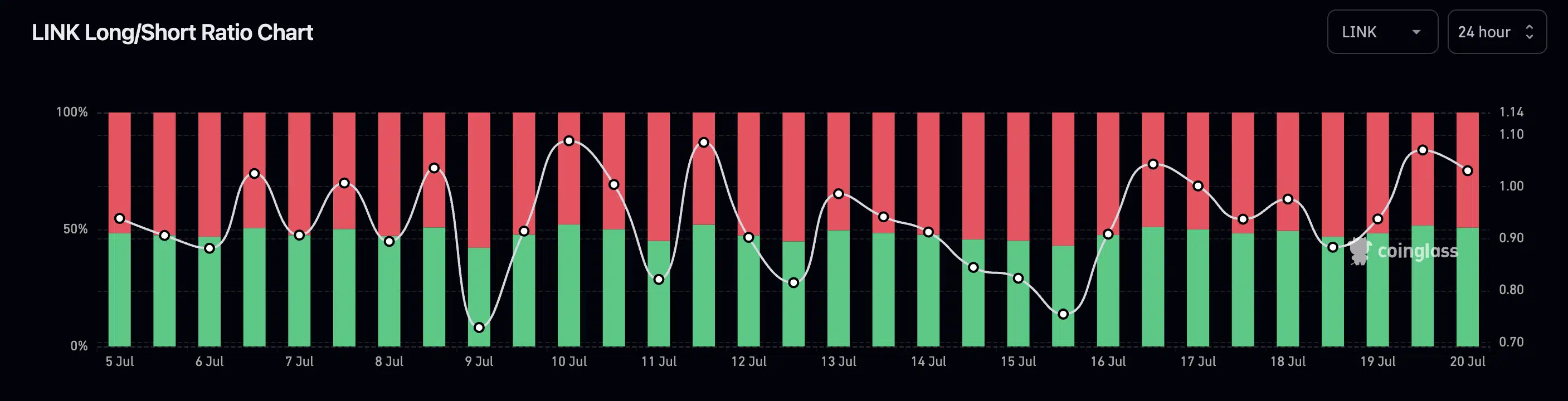

- LINK’s long/short ratio could indicate a move in the opposite direction over the next few days.

Chainlink [LINK], at the time of writing, didn’t show any signs of weakness as it traded at $8.18 as per CoinMarketCap. Additionally, the altcoin traded at a gigantic surge of almost 18% in the last seven days and 16% in the last 24 hours.

LINK holders had a lot more to look forward to as this latest update indicated that LINK had no intention of stopping. On 20 July, data intelligence platform Santiment tweeted this about the state of LINK.

? #Chainlink has seen an increase in whale transactions and overall trading volume as of late. An increase in market involvement would be a welcome sight for patient $LINK traders watching prices stay flat. Check out our latest insight on the asset. ? https://t.co/gdX4fsJkGB pic.twitter.com/EaJSDbDR7i

— Santiment (@santimentfeed) July 20, 2023

Is your portfolio green? Check out the Chainlink Profit Calculator

As per the tweet, the overall LINK trading volume and whale transactions witnessed a significant rise over the last few days. Furthermore, as reported by AMBCrypto, the balance of addresses holding between 0 and 1 million LINK increased substantially.

This stood as a clear indication that investors were responsible for LINK’s ongoing rally.

Is correction on the cards?

Taking into consideration LINK’s daily chart, it could be seen that LINK stood in a position of strength. At press time, the Relative Strength Index (RSI) moved into the overbought zone and stood at 72.11. Considering the position of the RSI a slight reversal in trend could be on the cards.

Furthermore, LINK’s Moving Average Convergence Divergence (MACD) also displayed the strength of the ongoing bullish wave. The MACD made a bullish crossover exactly a month ago on 20 June and made a move above the zero line on 30 June. The MACD has since been moving above the zero line.

The Awesome Oscillator (AO) too stood as a mark of LINK’s strength.

Despite the indicators in full swing, LINK’s metrics didn’t exactly scream rally. As per Santiment’s chart, LINK’s weighted sentiment touched the highest peak over the last month on 17 July. However, 18 July saw the weighted sentiment drop with the same intensity. Thus, indicating a dwindling investor sentiment toward the altcoin.

Additionally, LINK’s social dominance saw its third-highest peak on 17 July over the last 30 days. However, its social dominance too witnessed constant ups and downs indicating some indecisiveness on the social front. Although LINK’s volume reached a peak of 3.37 billion on 20 July, at press time, the volume dropped to 1.22 billion.

Read Chainlink’s [LINK] Price Prediction 2023-2024

The press time figure of 1.22 billion was after a slight recovery. The recovery could be a sign that retail investors were jumping on the LINK bandwagon.

Things could get tricky

Upon considering LINK’s 24-hour long/short ratio, at press time, it indicated a move in favor of short holders. At press time, long positions captured 50.76% of the market whereas short positions captured 49.24%. The increasing dominance of short positions could call for a price correction as selling pressure would overtake buying pressure and could put investors in a delicate spot.