Solana: Despite steady structural support, here’s why SOL is still not in the clear

Solana is back above $40.41 thanks to a bullish performance in the last few hours prior to this press. The cryptocurrency has been struggling to recover from its bearish performance which was largely influenced by its network woes.

Despite its recovery, SOL is still trading within the lower range, close to its structural support level. This level seems to be holding strong, as it has done in the last few weeks. However, the multiple retests of the same level may result in weakness if SOL holders grow weary, potentially triggering more downside. On the other hand, there is a significant probability of a bullish bounce back from the current level.

When will SOL’s high-stakes balancing act end?

SOL seems to be walking a tight rope where it is trying to avoid breaking through the structural support. However, that act can only last so long and will eventually result in a bullish breakout or a break below support. SOL’s price traded at $40.24 at press time, with its RSI hovering below the 50% level and above the oversold level.

SOL’s MFI was close to 41, with slight accumulation aiding its current upside. However, just like the RSI, it highlights the prevailing uncertainty and lack of significant volatility in SOL’s price action. Its DMI indicator confirms the lack of directional momentum.

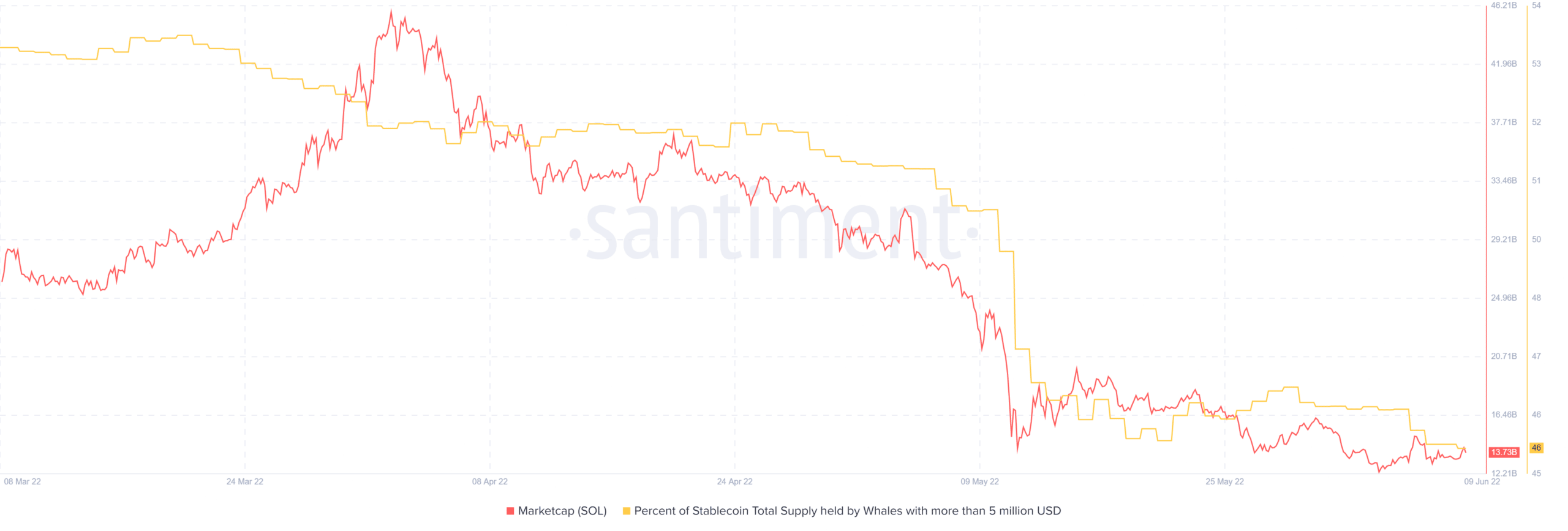

Solana’s on-chain metrics reveal why SOL’s price action is stuck in a low activity zone. Its market cap dropped significantly since the start of June and its supply held by whales metric highlights a similar outcome.

The market can and whale supply metric confirm that a significant number of SOL holders have lost faith in SOL. On the other hand, there is still significant retail activity taking advantage of the lower price levels by buying the dip.

Conclusion

SOL experienced multiple network issues within a few months and this may have dented investor sentiments. It explains the latest outflows but the other side of the coin reveals a network that has been put to the test.

Those viewing Solana from a glass-half-full perspective may recognize the challenges as opportunities to identify network weaknesses earlier on. Solana’s current situation will ultimately come down to how strong it will become after solving its issues.