Solana flips Tron in stablecoin volume – Will it impact TRX?

- Tron lost its top spot in stablecoin volume to Solana.

- Legal troubles with SEC pose regulatory uncertainties, impacting Tron’s credibility and market sentiment.

Tron [TRX], once a dominant force in stablecoin volumes, witnessed a significant shift as Solana took the lead in that aspect.

The month of December marked Solana’s rise with a stablecoin transfer volume of $24.58 billion USDC, surpassing Tron’s $6.54 billion USDT and Ethereum’s $3.88 billion DAI, according to Artemis’ data.

Solana makes a comeback

The change in stablecoin dynamics raised concerns about Tron’s future trajectory. The loss of its top position to Solana could potentially impact Tron’s market standing and user confidence, signaling a need for strategic adjustments in its approach.

There has been a notable shift in the status quo.

Here are the stablecoin transfer volumes for the month of December:

? @solana: $24.58B USDC

? @trondao: $6.54B USDT

? @ethereum: $3.88B DAI pic.twitter.com/vjdQVAD1qp— Artemis (@artemis__xyz) January 2, 2024

Legal problems for Tron

Moreover, legal hurdles loomed over Tron as the SEC charges founder Justin Sun and affiliated entities, including Tron Foundation Limited and BitTorrent Foundation Ltd., with the unregistered offer and sale of crypto asset securities.

The allegations of wash trading could add more regulatory scrutiny for Tron.

This legal challenge may affect market perception, with potential impacts on credibility and trust within the crypto community.

Operationally, the resources directed toward legal matters could divert attention from core development and growth initiatives, influencing sentiment.

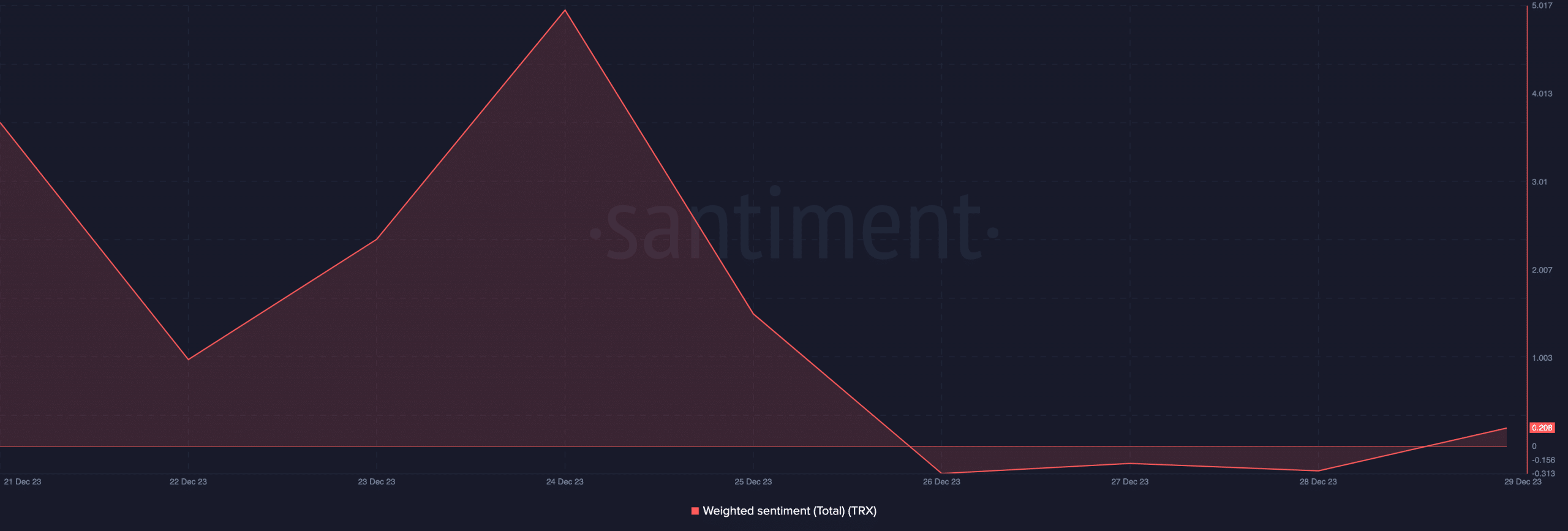

At press time, the weighted sentiment around TRX had fallen. This meant that, on the social front, negative comments were outnumbering positive ones.

However, amid these challenges, Tron was actively exploring opportunities to bolster its ecosystem.

A strategic partnership between TRON DAO and ChainGPT combines artificial intelligence (AI) with blockchain, aiming to enhance user support through an AI-powered chatbot.

These developments may help in turning the tide in favor of Tron as interest in AI grows.

On another positive note, TRON’s mainnet underwent a significant upgrade with the implementation of Stake 2.0. This upgrade enhances TRON’s staking model, providing increased flexibility and improved resource utilization.

With approximately 46 billion TRX staked, Stake 2.0 has garnered 31%, while the older Stake 1.0 holds the remaining 69%.

The overall staking rate for TRX has increased to 52% over the year, indicating growing confidence and participation in TRON’s staking ecosystem.

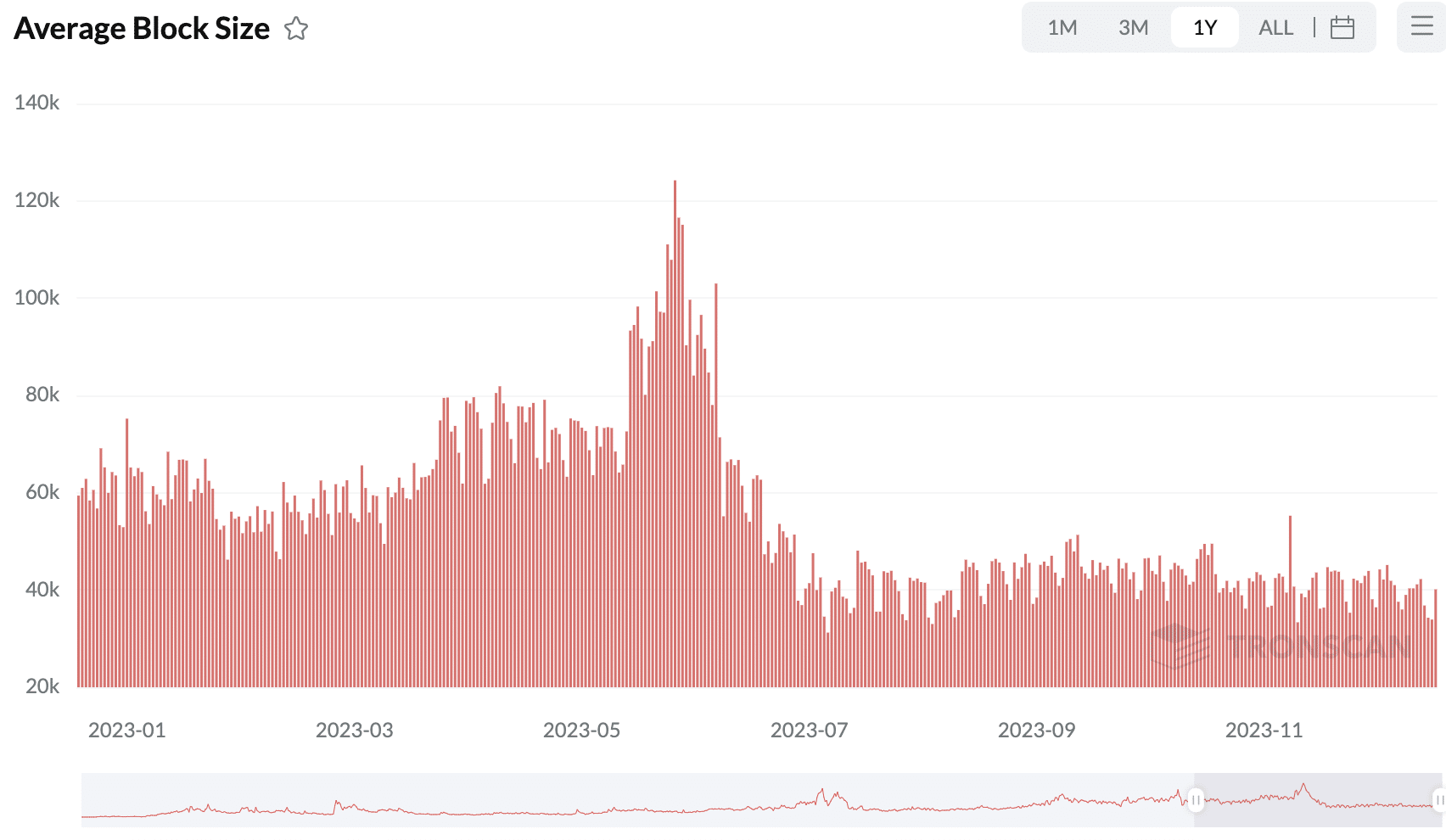

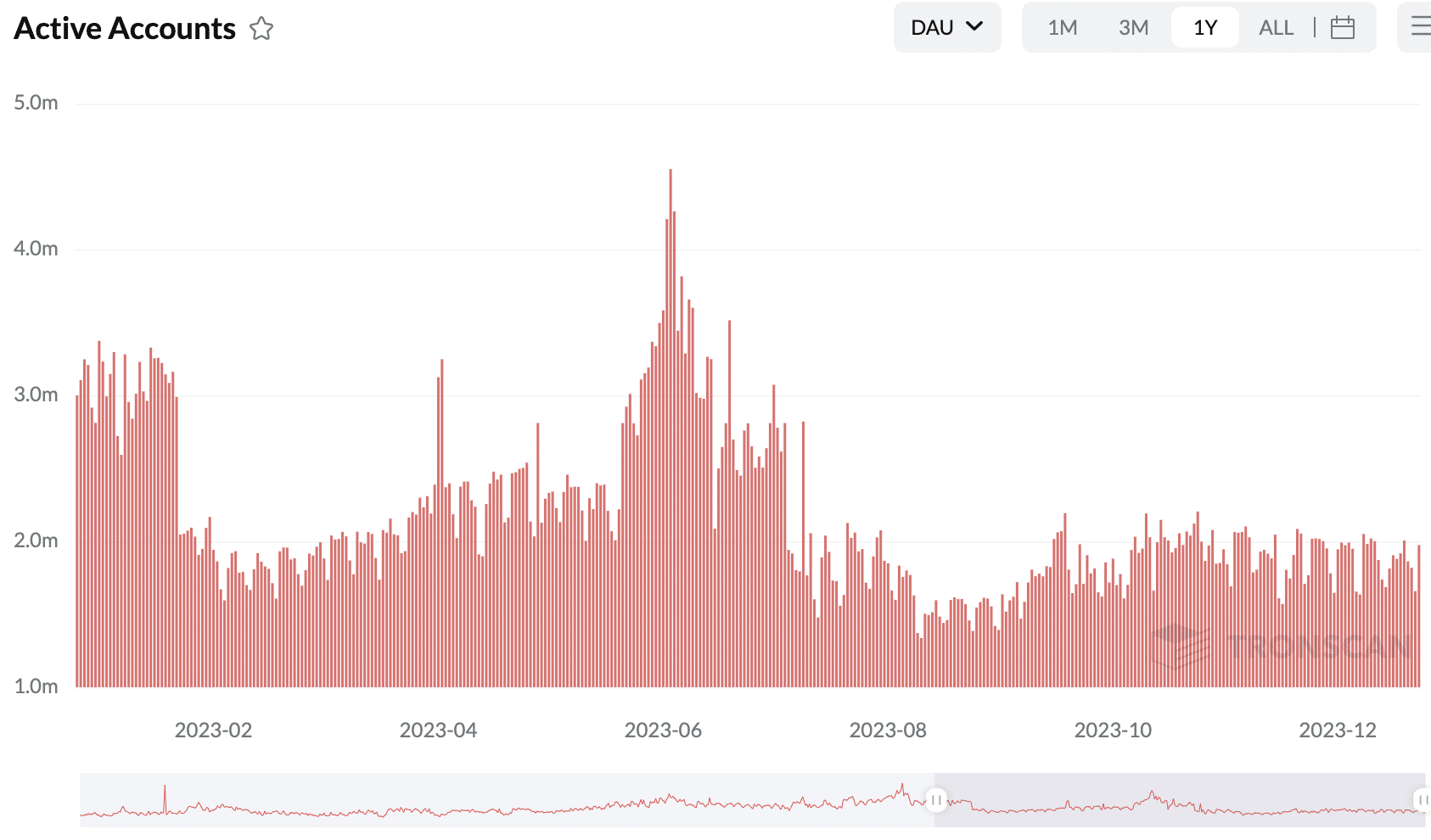

Examining TRON’s user activity, the network maintained an average of 1.9 million daily active accounts, reflecting a steady baseline with a modest decrease of 4.7% in daily active accounts compared to the previous month.

This data suggested a stable user engagement level on the TRON network, albeit with a slight dip in transactional activities.

Read Tron’s [TRX] Price Prediction 203-24

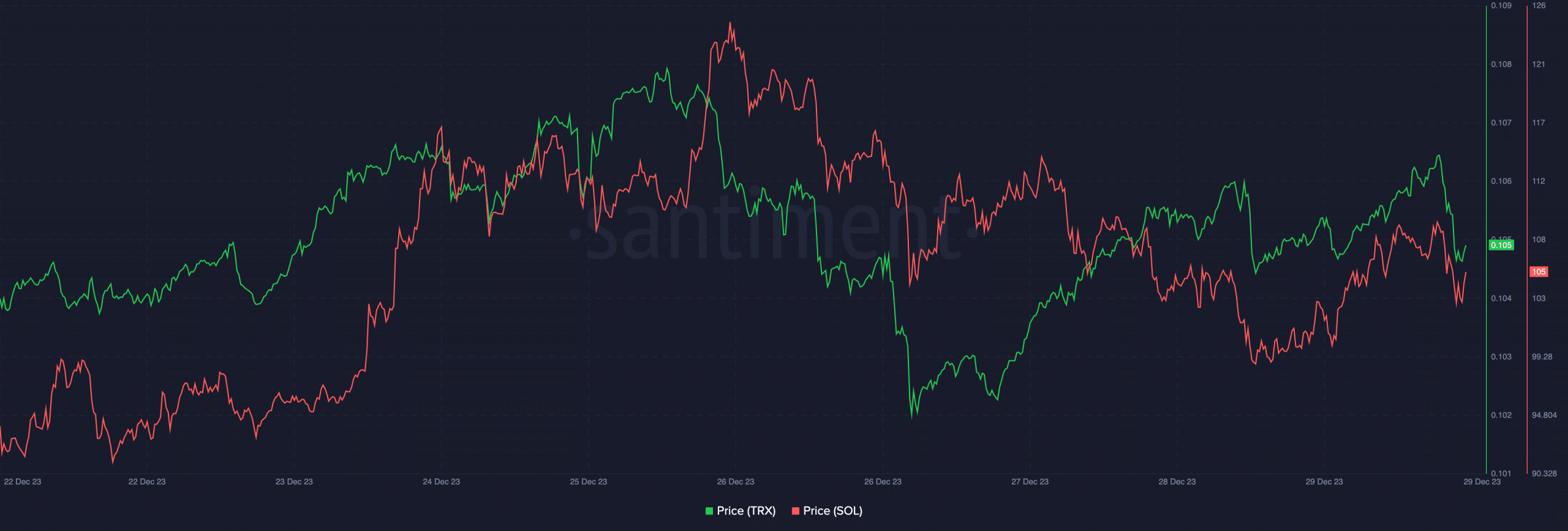

In the midst of these developments, TRX’s current price stood at $0.109931, showing a marginal decline of -0.01% in the last 24 hours.

Despite Solana taking the throne from TRX in terms of stablecoin volume, the price of SOL also fell.