Solana gets dragged into centralization vs securities tussle

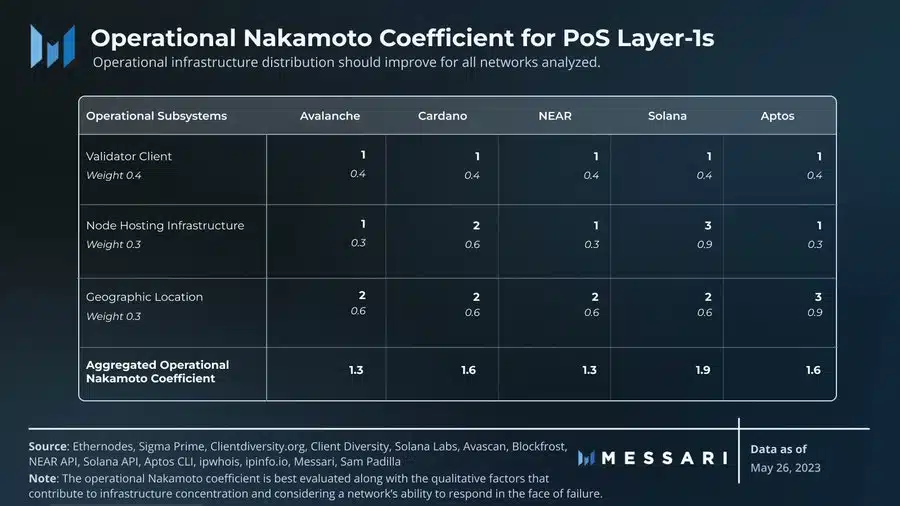

- Solana’s aggregate operational Nakamoto Coefficient was 1.9.

- SOL exhibited some recovery in the last 24 hours as it rose 2.7% to $19.28.

With many altcoins alleged to be securities in the United States Securities and Exchange Commission’s (SEC) latest filing, the spotlight has switched to the decentralization narrative, which is at the heart of blockchain technologies.

Is your portfolio green? Check out the Solana Profit Calculator

Amidst this raging debate, the on-chain analytics firm published a report analyzing the degree of decentralization among different chains. Proof-of-stake network Solana [SOL], with an aggregate Nakamoto coefficient of 1.9, seemed to have outperformed its peers.

Solana ticks most boxes

The Nakamoto Coefficient, created by former Coinbase CTO Balaji Srinivasan, is a widely used measure of the decentralization of a blockchain. A higher value indicates that the network has numerous nodes and is thus more decentralized and safer.

Solana’s high reading was a combined result of its performance in areas like infrastructure concentration, validator distribution, and stake distribution.

As opposed to networks like Avalanche [AVAX] and Cardano [ADA] which have a single point of failure, Solana has two validator clients with a third in development.

A validator client is a software that a node operator runs to verify transactions and contribute to a network’s security. The diversity in validators means Solana was less vulnerable to malicious attacks.

It should be noted that Solana faced network outages in the past owing to its overreliance on a singular validator client. This prompted the network to change its strategy.

Solana was also the least dependent on dominant providers like Amazon Web Services (AWS) and Google Cloud in infrastructure concentration. Over 70% of its stake was hosted on non-dominant providers, with AWS accounting for only 15%.

However, the one area where Solana would need to work on was geographic distribution. Solana had the poorest stake distribution by continent, with most of its validators and stake heavily concentrated in United States.

Recovery on the cards?

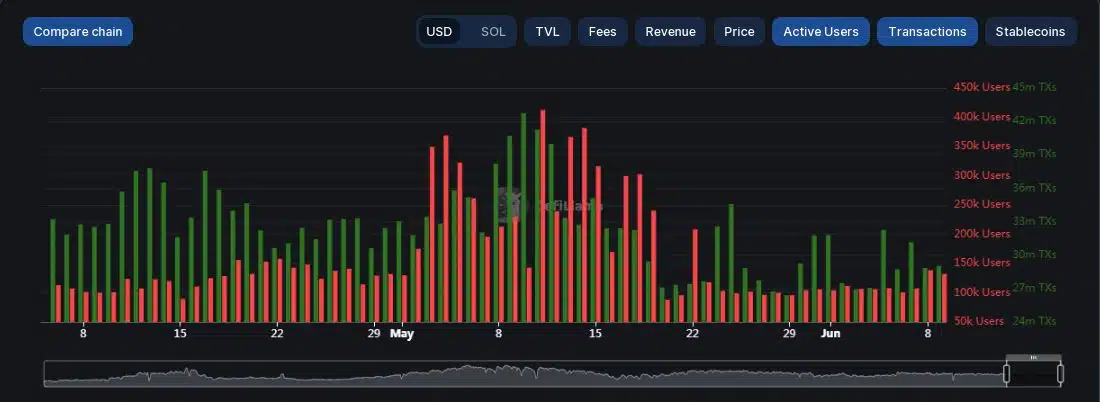

The low volatility phase sucked trading energy out of the Solana network. As per DeFiLlama, the number of active users and transactions significantly dipped in the second half of May.

However, the last two days saw an uptick in activity as the user base increased by 28% on 8 June, the highest in over two weeks.

Realistic or not, here’s SOL’s market cap in BTC’s terms

SOL exhibited some recovery in the last 24 hours as it rose 2.7% to $19.28 at press time, data from CoinMarketCap showed.

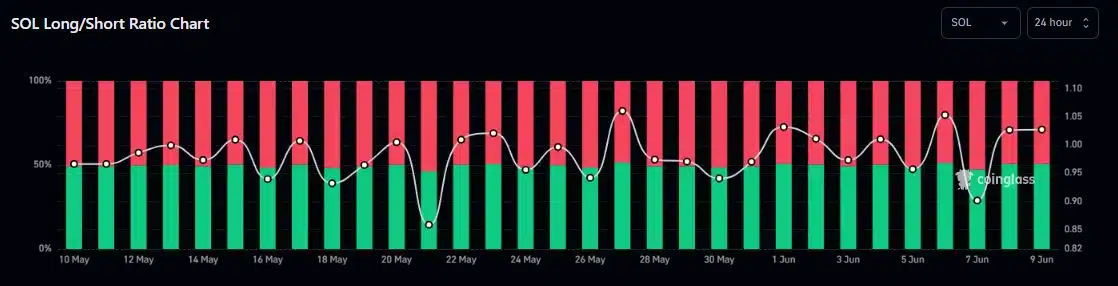

The resurgence was met well by bullish leveraged traders in the futures market as they took long positions for SOL, as per Coinglass.