Binance lawsuit: 10% of crypto market cap now termed ‘securities’

- The SEC has listed 10 new crypto tokens as “crypto asset securities.”

- The SEC’s crypto securities ambit now covers tokens worth $100 billion.

The total number of cryptocurrencies defined as securities by the United States Securities and Exchange Commission (SEC) has now risen to 61, as the regulatory body has filed its latest lawsuit against Binance, the world’s largest crypto exchange by trading volume.

Fallout from the Binance – SEC lawsuit

In the latest lawsuit filed yesterday, the SEC has charged Binance for allegedly violating securities laws. It has included 10 cryptocurrencies in its classification of securities, namely, Binance Coin [BNB], Binance USD [BUSD], Solana [SOL], Cardano [ADA], Polygon [MATIC], Cosmos [ATOM], The Sandbox [SAND], Decentraland [MANA], Axie Infinity [AXS], and Coti [COTI].

All the tokens stumbled immediately thereafter.

| Cryptocurrency | Price | Price drop (1-day) |

| BNB | $277.72 | 11.07% |

| BUSD | $1.00 | 0.06% |

| SOL | $19.95 | 7.16% |

| ADA | $0.35 | 6.20% |

| MATIC | $0.83 | 5.99% |

| ATOM | $10.01 | 6.29% |

| SAND | $0.52 | 13.07% |

| MANA | $0.46 | 11.01% |

| AXS | $6.65 | 6.85% |

| COTI | $0.06 | 8.14% |

The SEC’s “crypto asset securities” ambit now covers tokens worth over $100 billion, or around 10% of the total crypto market capitalization, which was $1.09 trillion at press time.

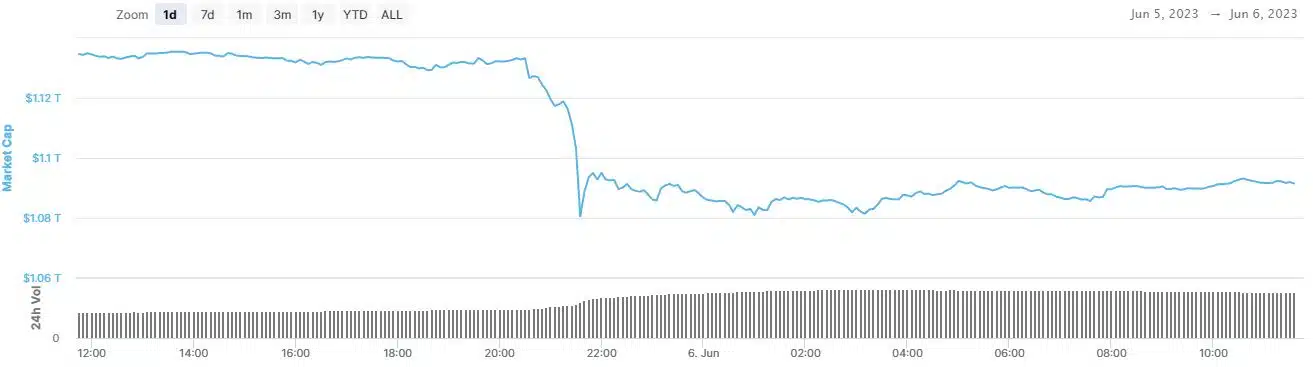

The total market capitalization of the crypto market also fell 3.5% to $1.09 billion within a day.

Source: CoinMarketCap

This is a significant development for the crypto industry, as the SEC’s decision to name a specific token as a security can make brokers reluctant to offer it, which can impair its liquidity and price.

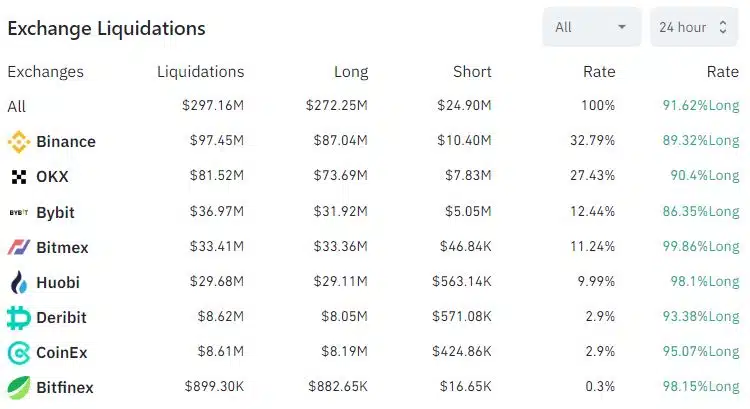

As per Coinglass’ data, traders suffered over $297 million in losses over the past 24 hours. Binance witnessed the largest liquidation of funds during the period, i.e. $97.45 million.

Source: Coinglass

Will SEC’s action lead to regulatory clarity?

It must be noted that the SEC is battling another regulatory agency, the Commodity Futures Trading Commission (CFTC), over whether the assets are securities, as the SEC claims, or commodities, which would fall under CFTC’s control.

SEC Chair Gary Gensler has declared on multiple occasions that he believes almost every cryptocurrency is a security, except for Bitcoin [BTC]. In an interview with the Intelligencer magazine, he said that these tokens:

“Are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

Bitcoin, the largest cryptocurrency, fell below $26,000 for the first time since mid-March, reflecting a drop of 3.82% within a day.