Solana: SOL’s price might hit these targets within the next week

- Bearish sentiment around SOL has been dominant lately

- Metrics seemed to support the possibility of an incoming rally though

The crypto-market’s present condition has restricted several cryptos from showcasing high volatility in their price action over the last few days. Solana [SOL] was not an exception, as its price consolidated on the trading charts. However, the situation for SOL might change soon next week as there are signs it might turn a bullish leaf. .

Solana investors are losing confidence

According to CoinMarketCap, SOL’s price has moved somewhat sideways since 5 April, as its value only moved marginally in the last 24 hours. At the time of writing, SOL was trading at $177.34 with a market capitalization of over $78 billion, making it the 5th largest crypto. The sluggish price action had a negative impact on its social metrics too.

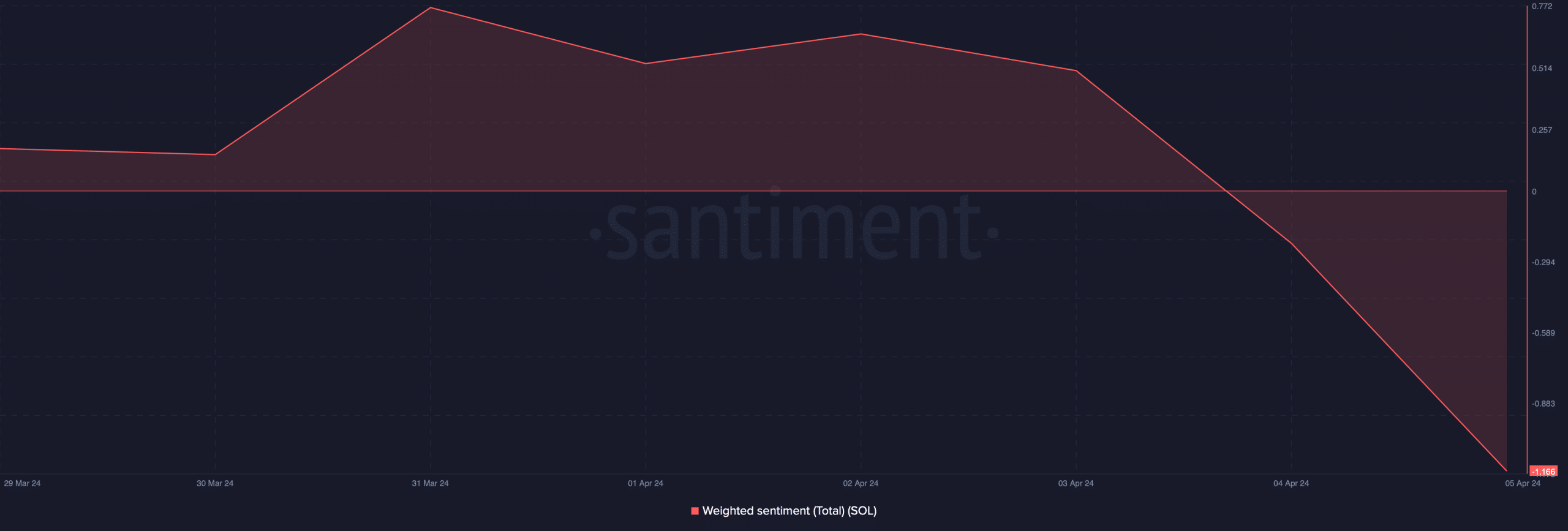

In fact, AMBCrypto’s analysis of Santiment’s data revealed that SOL’s weighted sentiment was in the negative zone. This meant that bearish sentiment had an upper hand in the market.

Here, it’s worth noting AMBCrypto recently reported that more than 75% of all non-vote transactions on the chain failed – The highest ever recorded failure for Solana. Despite these setbacks, however, the coming week might look different for SOL as the token’s price has been moving inside a bull pattern.

Solana to turn bullish next week?

Crypto Tony, a popular crypto-analyst, recently posted a tweet highlighting the fact that SOL’s price has been moving inside a bullish symmetrical triangle pattern. A breakout from such a pattern often results in bull rallies.

However, it must be noted that SOL is still mid-way in the pattern – A sign that it might take a few more days for the token’s price to turn volatile.

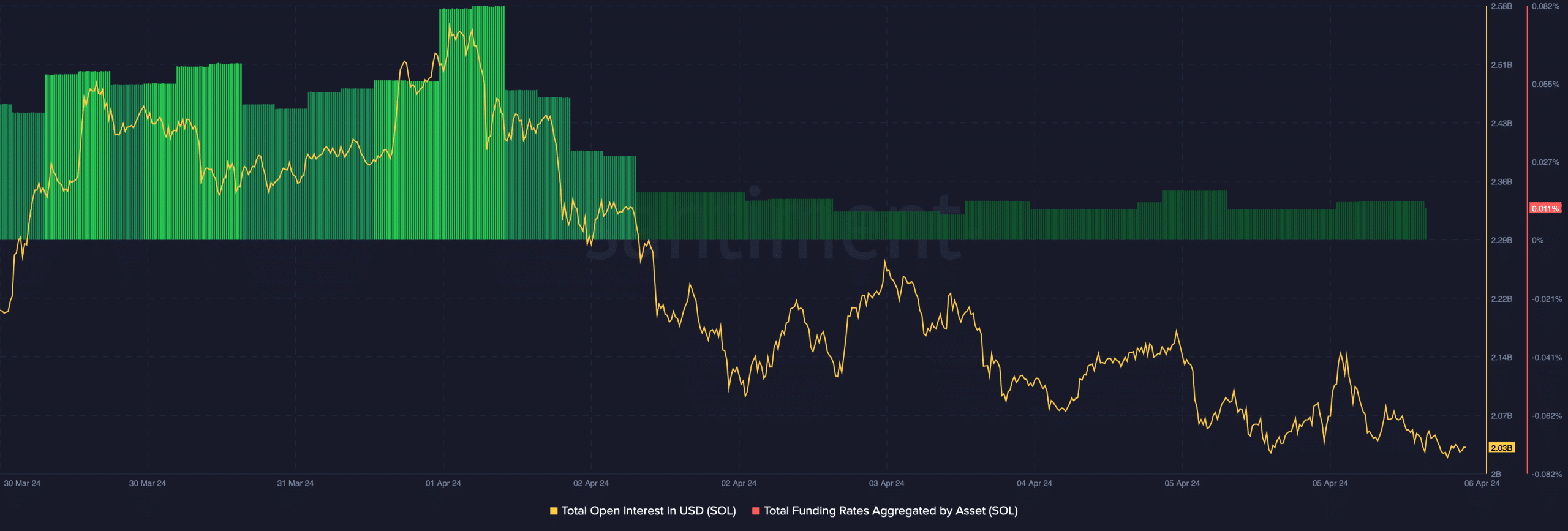

AMBCrypto then checked SOL’s metrics to find whether they also supported the possibility of a price uptick over the next week. We found that SOL’s funding rate dropped, indicating that derivatives investors have not been buying SOL at its lower price.

Additionally, its open interest also fell along with its price. This is usually a good sign of an upcoming trend reversal.

We then took a look at Hyblock Capital’s data to see what would be SOL’s next possible target if a bull rally happens next week.

Realistic or not, here’s SOL market cap in BTC‘s terms

As per our analysis, Solana’s liquidation will rise sharply near the $192-mark. A hike in liquidation often acts as resistance, which restricts a token’s price from moving further up. Therefore, if SOL gains bullish momentum, it might comfortably hit $192 before a slight correction.