Solana is up 13% in 24 hours – Here are the reasons why

- SOL maintained a bullish narrative despite broader market sell-offs.

- Solana recorded the highest stablecoin transfers in the first three months of 2024.

Solana [SOL] defied the broader market bleeding to post an impressive show at the price charts. The fifth-largest cryptocurrency gained 13% in the last 24 hours, and over 27% during the week, even as Bitcoin’s [BTC] flash dump triggered a broader market sell-off.

The outperformance catapulted SOL to the top of LunarCrush’s AltRank metric recently, underscoring higher social engagement with the coin. A higher rank on the metric, which measures a cryptocurrency’s community and traction, is often a signal to retail investors to pay attention to the asset.

Solana becomes No.3 in DeFi

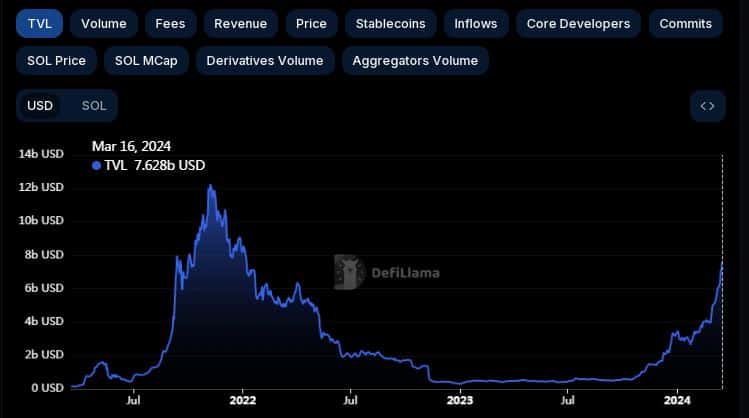

The jump in prices boosted the USD value of the deposits on the Solana blockchain. According to AMBCrypto’s analysis of DeFiLlama’s data, the total value locked (TVL) rose 8.19% in the last 24 hours to $7.59 billion.

With the latest surge, Solana became the third-largest decentralized finance (DeFi) chain, surpassing BNB Chain [BNB] for the first time ever.

Recall that Solana’s fortunes were hit badly in the fall of 2022, owing to its exposure to the now-fallen cryptocurrency exchange FTX [FTT].

The TVL crashed as low as $300 million with little improvement seen during much of 2023. Solana DeFi was declared dead by many critics at this time.

However, things changed dramatically from October 2023, resulting in a 13x jump in TVL until press time. AMBCrypto reported how crucial partnerships and robust on-chain fundamentals aided the turnaround.

Stablecoin transfers surge

Apart from TVL growth, Solana also took the lead in terms of on-chain stablecoin volume.

As per AMBCrypto’s analysis of Artemis’ data, Solana recorded the highest volumes in the first three months of 2024, leapfrogging traditional powerhouses such as Ethereum [ETH] and Tron [TRX].

Solana’s ascension implied its growing stature as the go-to network for stablecoin settlements.

How much are 1,10,100 SOLs worth today?

What is SOL’s “future?”

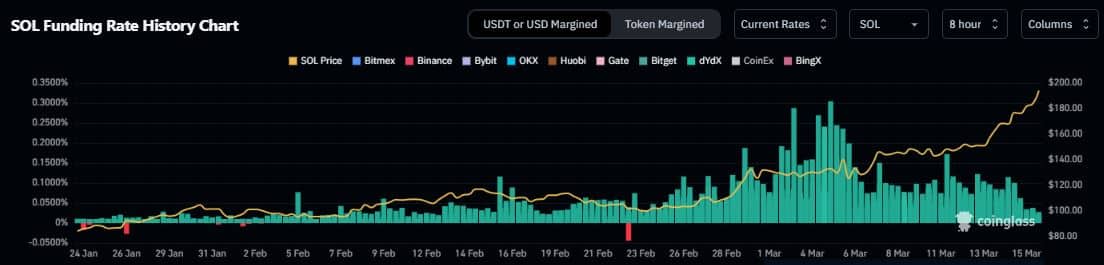

AMBCrypto investigated SOL’s futures market using Coinglass’ data and discovered a positive funding rate. This meant that long positions were paying fees to short positions, implying a dominance of the former.

Interestingly, SOL’s Open Interest (OI) didn’t show a notable rise as like price, growing barely by 0.36% in the last 24 hours.