Solana [SOL]: Bulls and bears tussle for this key level

![Solana [SOL]: Bulls and bears tussle for this key level](https://ambcrypto.com/wp-content/uploads/2023/03/image-1200x800-2.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL was bullish on the 4-hour chart.

- The funding rate was positive, but development activity stagnated.

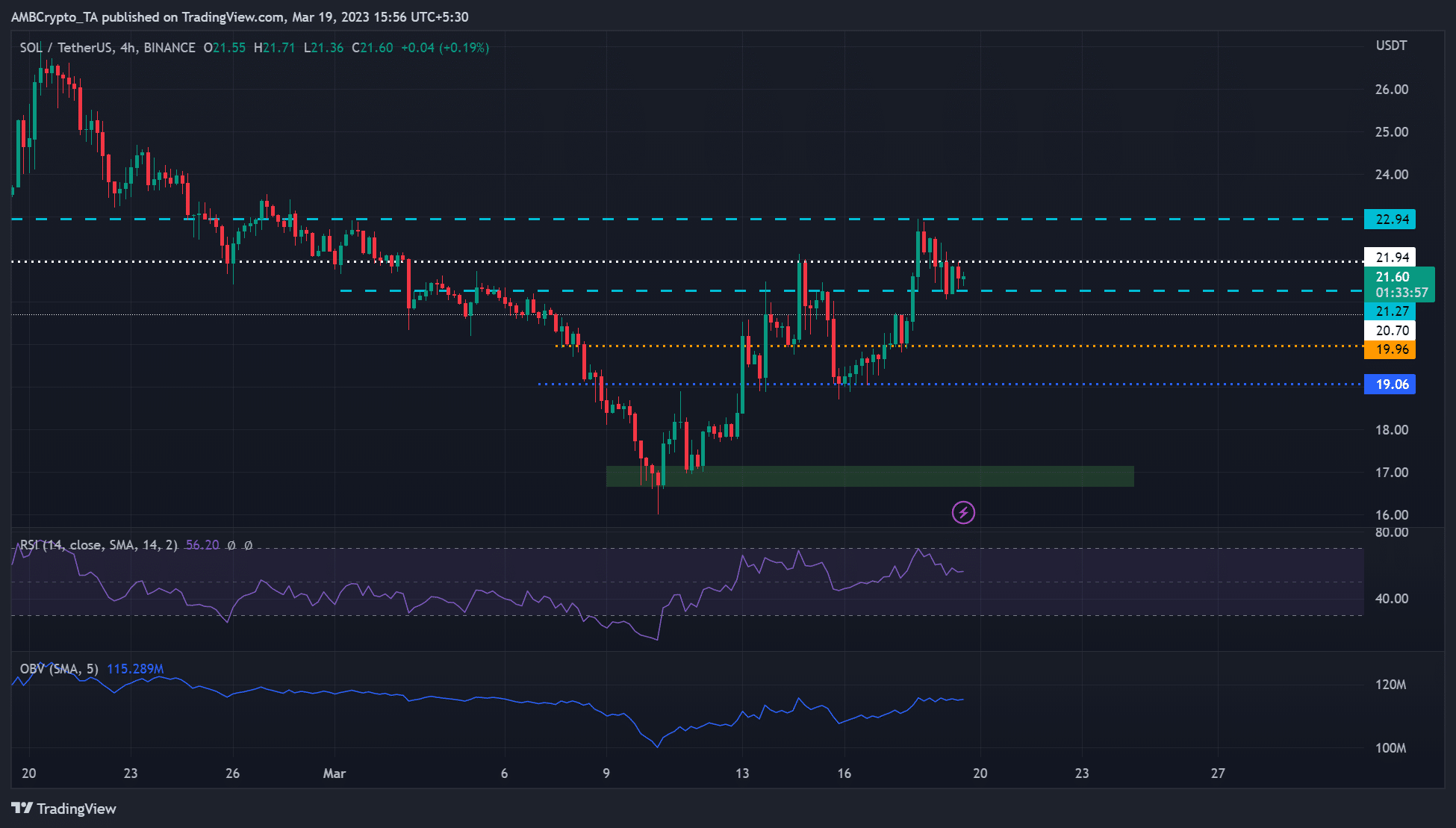

Solana [SOL] recovered strongly in the past few days. It appreciated over 40% after seeing aggressive demand at the lows of $16 on March 10. It broke above its previous high of $21.94 but hit a price ceiling of $22.94, setting it for a retracement.

Is your portfolio green? Check out the SOL Profit Calculator

At press time, Bitcoin [BTC] struggled to maintain the $27K zone. Any drop below $27K could push SOL to breach key support, while a surge beyond $27K could give bulls slight hopes of defending the crucial support.

SOL saw increased demand at the discounted levels of $16, setting it for the first leg of recovery. But the first phase of recovery faced a rejection at $21.94, sinking SOL to $19.06. The second leg of recovery inflicted a bearish breaker, pushing SOL beyond the bearish order block at $21.94.

However, the recovery hit the price ceiling of $22.94, attracting bears who sank SOL to $21.27. At press time, SOL oscillated in the lower range of $21.27 – $21.94.

The lower range price action could give bears more leverage if BTC breaks below $27K. It could tip short-term bears to pull SOL to $20 if SOL closes below $21.27. Far south, $19, $18, and $17 are key support levels that could slow the drop.

Alternatively, SOL could increase to its upper range of $21.94 – $22.94 and surge upwards if BTC increases beyond $27K. Other key resistances above the overhead obstacle of $22.94 were $24 and $25.

The Relative Strength Index (RSI) retreated from the overbought territory and fluctuated slightly above the mid-point of 50. It showed buying pressure eased, but selling pressure was still imminent. The OBV (On Balance Volume) fluctuated, showing unstable demand, which could offer bears the upper hand.

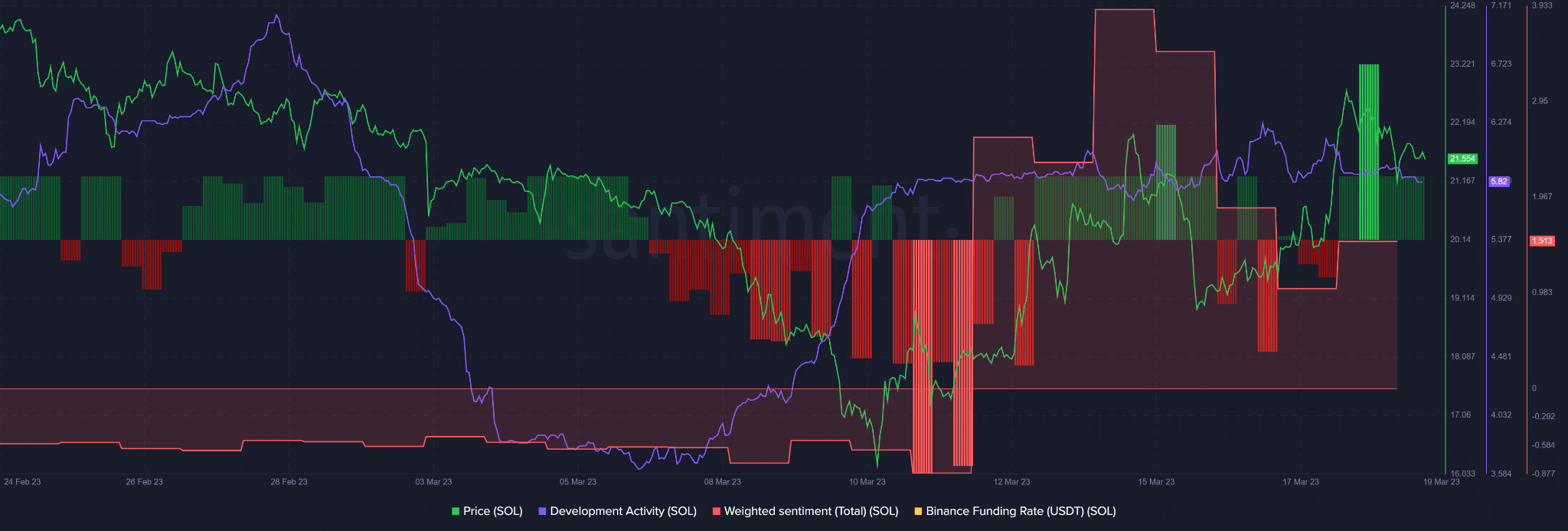

Funding rate and sentiment were positive

According to Santiment, SOL registered positive funding rates, showing bullish sentiment in the derivatives market. Similarly, the weighted sentiment was positive and increased slightly at the time of writing, indicating that investors were bullish on the asset.

Read Solana’s [SOL] Price Prediction 2023-24

However, the development activity has fluctuated in the past few days, which could unnerve investors. As such, investors should track this front alongside BTC’s movement to make better moves.