Solana [SOL] closed Q4 2022 with a decline in key growth metrics

![Solana [SOL] closed Q4 2022 with a decline in key growth metrics](https://ambcrypto.com/wp-content/uploads/2023/01/1672378848503-53d755f8-a4e8-49ef-8cda-1bc1f1666b94.jpg)

- Solana ended 2022 with a decline in some of its key growth metrics.

- So far this year, the chain has seen increased user activity.

House to over 350 decentralized applications (dApps), a new report from Messari revealed that leading open-source blockchain Solana closed the 2022 trading year with a significant drop in its key growth metrics and revenue.

Titled “State of Solana Q4 2022,” Messari found that the “persistent bear market paired with the collapse of FTX” had a negative impact on the network’s growth between October and December 2022. This led to a severe decline in user activity on the chain.

How much are 1,10,100 SOLs worth today?

Interestingly, while Solana suffered a drop in user activity in Q4 2022, “average daily transactions in the aggregate and transactions per second (TPS) still increased because network performance improved,” Messari said.

However, the improved performance of Solana in Q4 2022, following a number of prolonged network outages earlier in the year, failed to impact Solana’s financials positively.

According to the report, average transaction fees on the network fell by 49% in Q4 2022. Having spent the whole trading year declining, average transaction fees on Solana fell by 90.3% on a year-on-year basis, Messari noted.

In addition, revenue on the chain fell by 28% in Q4 2022. “Total quarterly revenue declined by 83.3% YoY,” the on-chain data provider found.

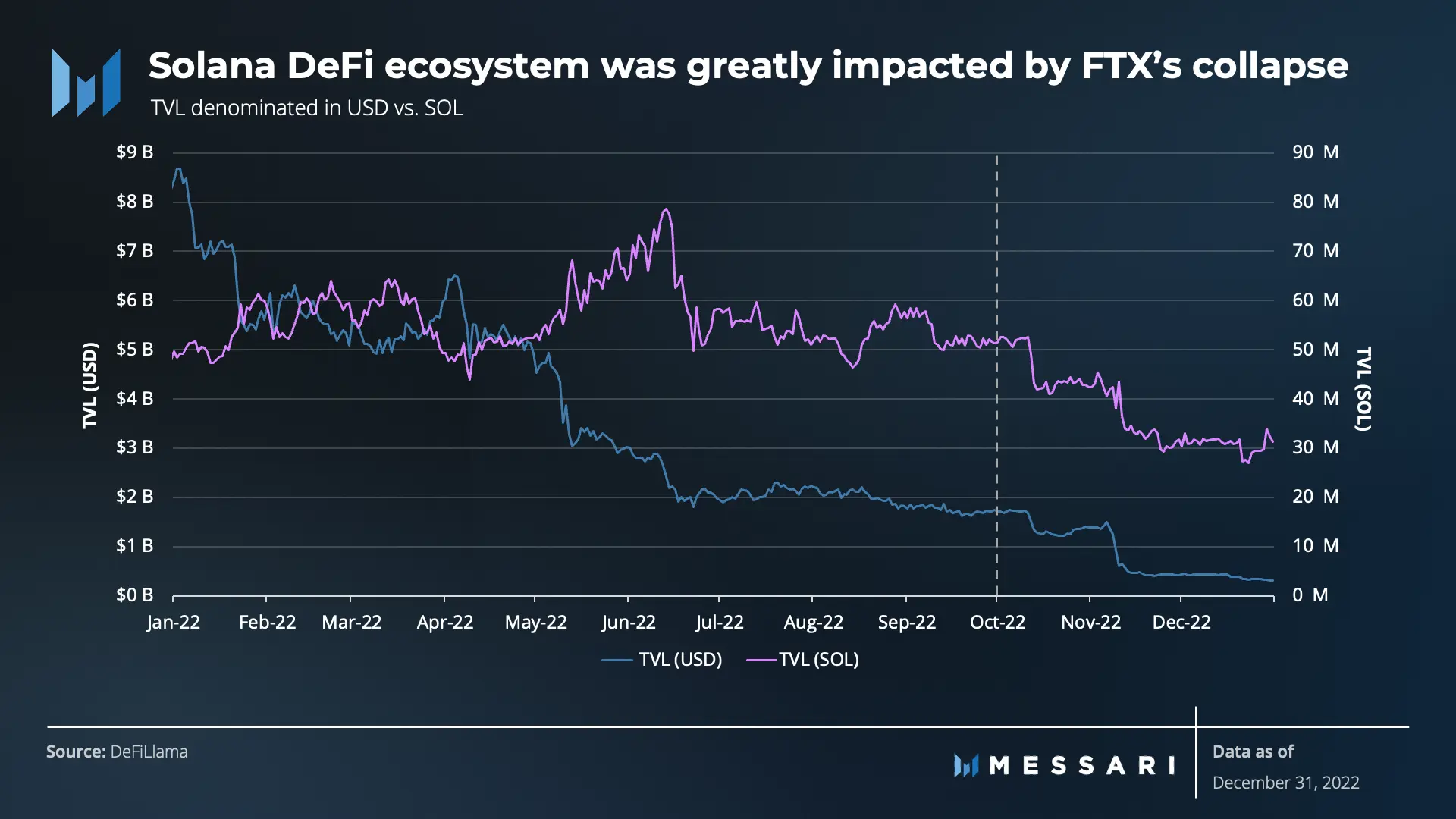

Further, the DeFi vertical of the Solana ecosystem suffered a huge blow to its total value locked (TVL) in Q4. The report stated that the severe decline was primarily due to “Mango Markets exploit in October and the collapse of FTX in November.” In SOL terms, Solana’s TVL had declined by 26% by the end of Q4 2022 following FTX’s fallout.

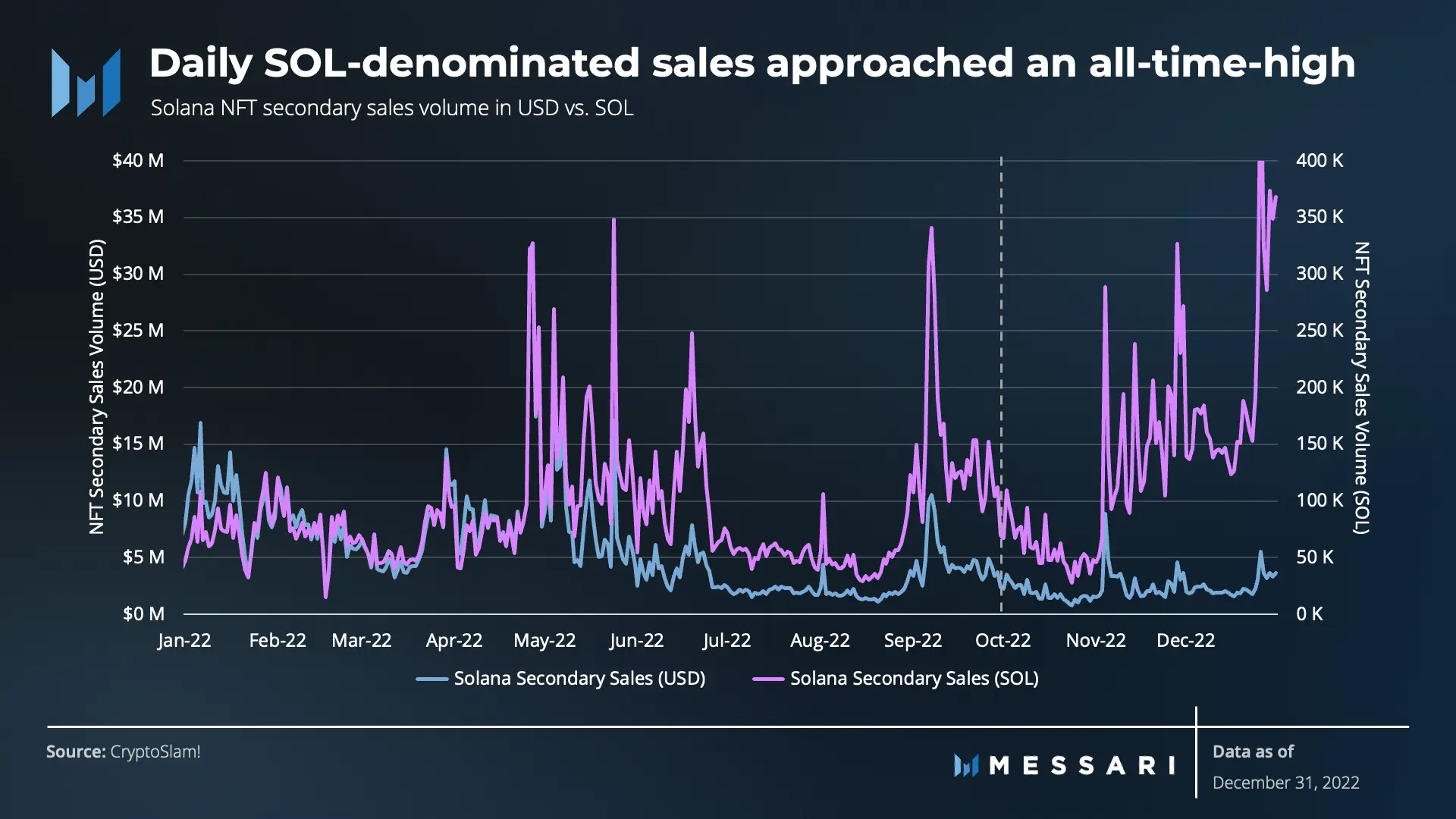

As for NFTs on the network, Messari found:

“The total number of daily new NFTs decreased QoQ for the first time, down 65%. However, this decline came after a significant surge in Q3. Though minting was down QoQ, average NFT mints per address increased, signaling that power users are emerging.”

Is your portfolio green? Check the Solana Profit Calculator

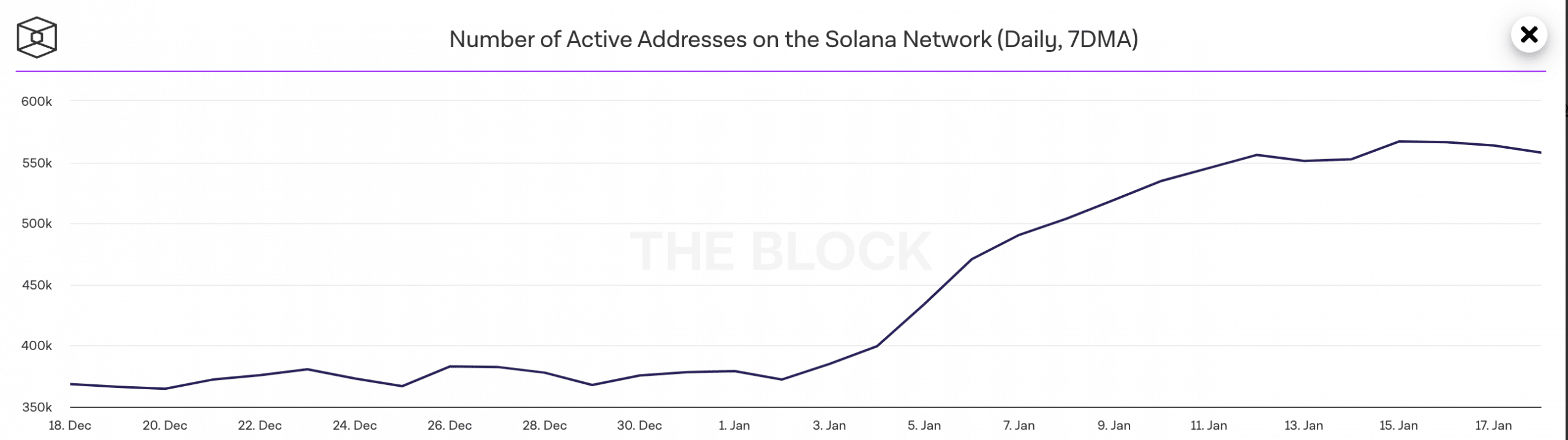

User activity on Solana so far this year

According to data from The Block, Solana has seen an uptick in its daily account of active addresses since the year began. With 557,770 daily active addresses as of 18 January, the count of daily active addresses on the chain has grown by 47% since 1 January.

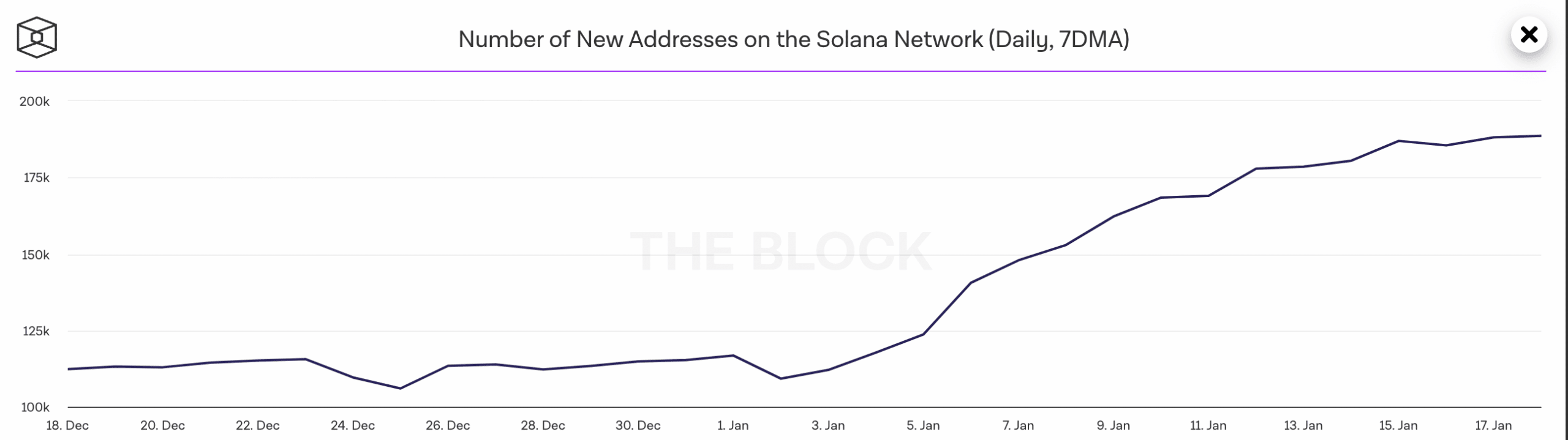

Likewise, the number of new addresses on the chain has rallied. Per The Block, this daily count of new addresses on Solana has grown by 62% since the year began.