Solana [SOL] hits $24 hurdle and retreats — Bulls can bid here

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL’s RSI on the four-hour chart headed to the oversold territory at press time

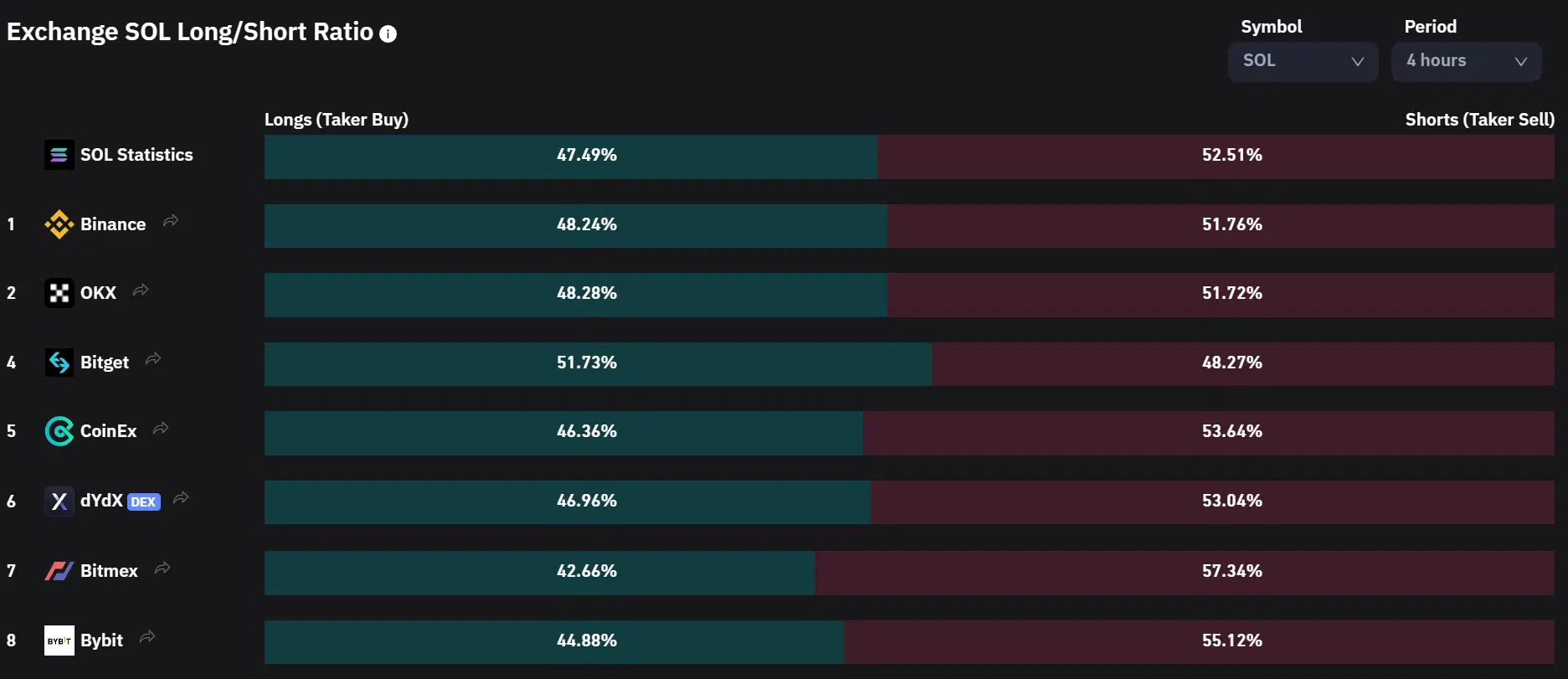

- Open interest rates declined as short positions dominated long positions at press time

At the end of April, Solana [SOL] investors were all smiles after receiving over 17% gains. Notably, SOL rallied from $20.36 to $23.99 before entering a correction. At press time, SOL’s retracement had shed over 11% of its value. It traded at $21.33.

Is your portfolio green? Check SOL Profit Calculator

According to a new report, the Solana network has seen increased traction lately, with trading volumes surpassing pre-FTX levels. Could it prop up SOL’s value in the short term?

However, if the FOMC announcement puts downward pressure on Bitcoin [BTC], SOL could retest key support and offer new buying opportunities.

Will sellers sink SOL further?

At press time, sellers had the upper hand on the market, as the price action was below 50-EMA and 1000-EMA. In addition, the RSI had slid near the oversold territory while the On-balance Volume (OBV) dipped further – Confirmations of elevated short-term selling pressure.

If BTC drops below $28k following the FOMC announcement, SOL could plunge further and retest the daily timeframe bullish order block and support zone of $19.34 – $20.40 (cyan).

A pullback retest and increased demand at the support level could see SOL rally toward the Fair Value Gap (FVG) of $23.19 – $23.98. The above level offer strong resistance toward SOL’s recovery. Further uptrend above the FVG could see SOL hit the supply zone at $26.

Two long trade set-ups are possible if that’s the case. First is an entry above $20.40, targeting $23.99 (FVG) with a stop loss of $19.00. The second setup involves an entry at $24.00, targeting $26 with a stop loss below $23.00.

A close below $19 will invalidate the bullish thesis above. However, the drop could slow at March swing low near $17.30.

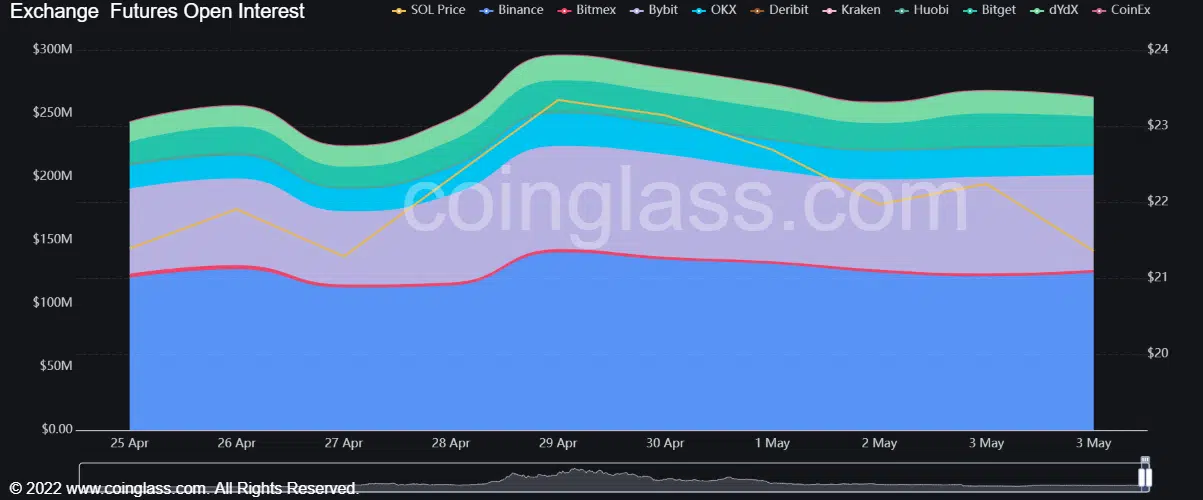

Open interest rates declined; short positions dominated

Read Solana [SOL] Price Prediction 2023-24

SOL’s open interest rate dipped slightly since 1 May. It dropped from $272.84 million on 1 May to $262.86 million at press time (3 May) – a slight drop in demand that favored near-term sellers.

Similarly, traders favored holding short positions over long positions, with shorts dominating at 52.51% in the past four hours – a mild-bearish sentiment that could push SOL lower if the trend persists.