Solana [SOL] jumps to an upper range – Is the $23.93 target reachable?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL hit its bullish target of $22.6

- However, development activity and weighted sentiment witnessed a dip

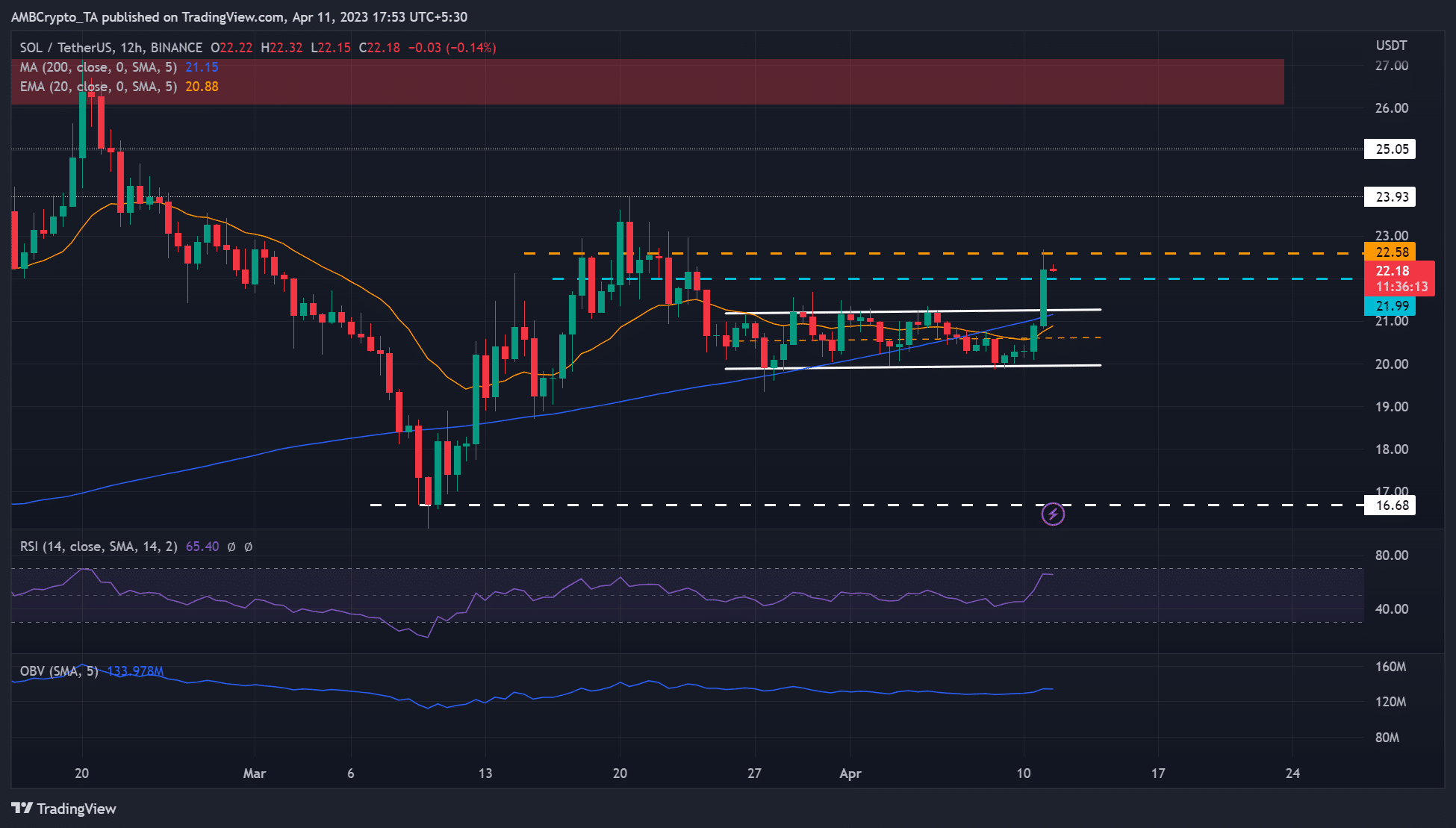

Solana [SOL] followed Bitcoin [BTC] and inflicted a breakout. BTC crossed $30K, hitting $30.$K before cooling off slightly at press time. Similarly, SOL also managed to hit its bullish target of $22.58 and eased into a key upper range.

Read Solana [SOL] Price Prediction 2023-2024

SOL witnessed a much-needed boost especially after the exchange Crypto.com became the latest to introduce the SOL staking service. Investors will thus, have more staking options to maximize their rewards.

Which way for SOL – consolidation, pump, or dump?

SOL appreciated by over 12%, rising from the channel’s lower boundary of $20 to the bullish target of $22.58. But the resistance range of $21.99 – $22.58 could slow the uptrend, especially if BTC fails to maintain its surge beyond $30K.

However, as the overall market remains upbeat for higher moves, any BTC move beyond $30K could tip SOL bulls to break above the upper range of $21.99 – $22.58. Such an upswing could set SOL to retest the immediate overhead resistance of $23.93 – a 6% potential rally.

One likely trade setup for such a potential upswing could be a long position with an entry at $22.58 after confirming an uptrend continuation. The lower range of $21.99 will be the stop loss, and the immediate target will be $23.93. The supply zone at $26 can slow any further uptrend momentum.

Conversely, a close below $21.99 may attract more selling pressure and could set SOL to retrace to the channel’s upper boundary of $21.21 or the mid-level of $20.57. These levels can act as shorting targets in such a downswing scenario.

Meanwhile, the Relative Strength Index (RSI) spiked to the overbought zone – showing a strong bullish sentiment and buying pressure. The On-Balance Volume (OBV) also saw an uptick, highlighting increased demand in the past few days.

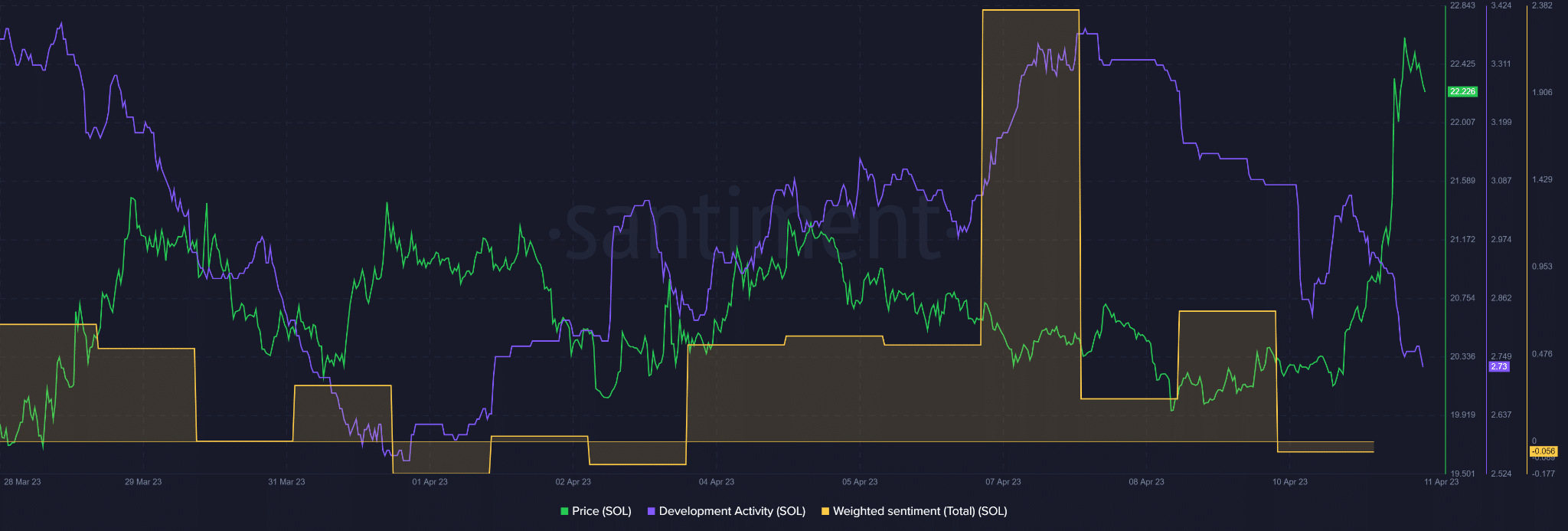

Development activity and sentiment declined

At press time, the development activity declined, bringing down investors’ confidence, as shown by the drop in weighted sentiment despite the recent rally. The trend could undermine a strong recovery.

How much are 1,10,100 SOLs worth today?

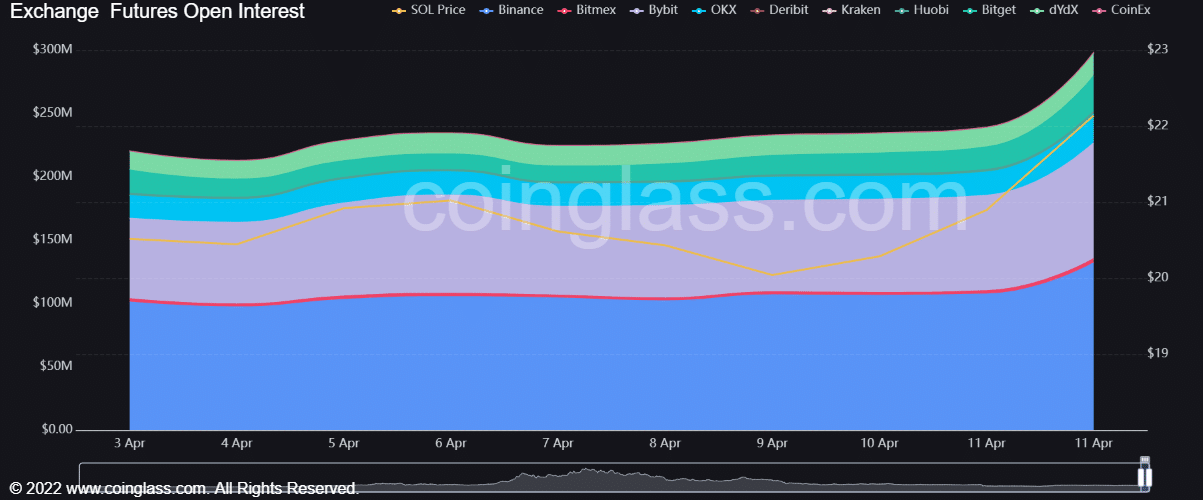

However, the open interest (OI) rate increased from April 10, showing an influx of money into SOL’s futures market. A cross above $23 alongside a rising OI will reinforce the bullish sentiment.