Solana [SOL] might retest June lows before another major rally and this is why…

Solana [SOL] has been struggling to recover above $40 after ending June on a bearish performance. This is despite its bullish start this month but the reason for this subdued performance is now evident upon further inspection.

It turns out that SOL has been trading within a wedge pattern underscored by descending support and ascending resistance lines since June. The higher support line has been pushing SOL’s short-term price action into higher lows. This is a sign that the bears have been losing their momentum but the descending resistance has also pushed the price into a tight zone.

SOL is about to exit the triangle pattern and it currently looks like a bullish breakout is on the way. However, there are factors that suggest a higher probability of a bearish retracement and a potential retest of mid-June lows. This means we might see it drop below $30 and as low as $28.

SOL traded at $37.09 at press time after pulling back from the high of $39.10 as of 15 July. This means it has been experiencing some sell pressure after briefly crossing above the resistance line. Its RSI is currently hovering within the 50% range and the MFI indicates that the accumulation is tapering out.

Cloudy with a chance of an attack from the bears

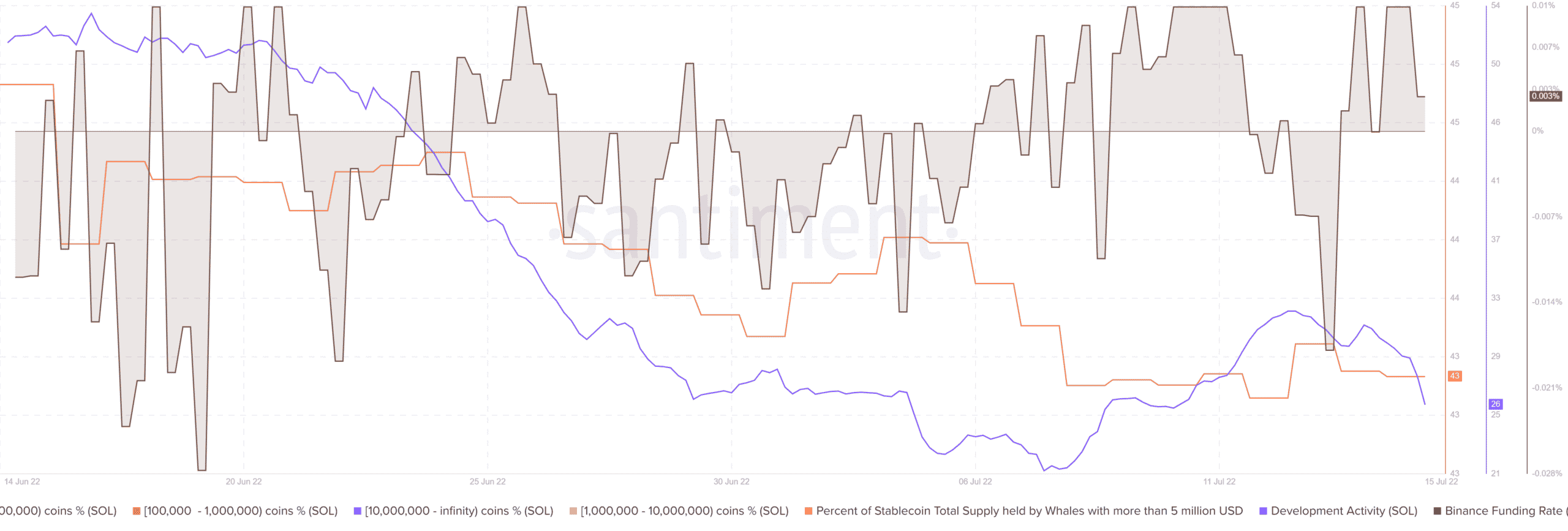

SOL’s Binance derivatives funding rate dropped substantially in the last 24 hours. This suggests that investor sentiment is shifting in favor of some downside after the price pushed into the descending resistance line. This observation is also backed by a drop in the supply held by whales by 0.19% in the last three days.

The drop in the supply held by whales means any more upside attempts will be too weak to counter the selling pressure from larger addresses. SOL’s current resistance retest may trigger another selloff thus potentially pushing down its price.

Solana’s development activity reduced significantly since 13 June and this may further dampen the sentiment in favor of the bears. Such an outcome may result in increased bearish pressure, hence the likelihood that it will break through the support line. If this happens, we might see a retest of sub $30 price levels.

Try try till you succeed

SOL’s current price action suggests that it might looking for a bullish breakout. Note that this is still possible especially with strong accumulation at current levels. This would likely occur if the overall crypto market yields bullish pressure. However, a selloff is more probable under normal conditions considering the latest upside, the resistance line and outflows from larger addresses.

![Cardano's [ADA] rally hinges on ONE condition - Will the whales follow or flee?](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-60-min-400x240.png)

![Ripple [XRP] has drawn increased investor optimism as both crowd and smart money sentiment indicators have turned bullish.](https://ambcrypto.com/wp-content/uploads/2025/05/Erastus-2025-05-15T132209.200-min-400x240.png)