Solana [SOL] moves to OTC via Grayscale: Is the token ready to rumble

- The Solana TVL has been wrenched despite recent liquid input into the ecosystem.

- Technical indicators showed that the SOL momentum remains favorable for buyers.

Solana [SOL] became the 16th digital asset listed by Grayscale Investment on Over-The-Counter (OTC) markets. The American digital currency management company manager made the announcement on 17 April. According to the press release acquired from GlobalNewswire, the Solana Trust would trade under the symbol GSOL.

How much are 1,10,100 SOLs worth today?

For the unversed, the OTC market is a decentralized market where participants trade financial instruments that are not listed on major exchanges. This move could potentially increase the adoption of SOL and pave the way for more institutional investment in the token.

Revelation of the investments

But according to Grayscale, putting GSOL as a public-quotation investment vehicle was not without thought. According to the firm, they made the decision to reveal the value of Solana held by the Trust.

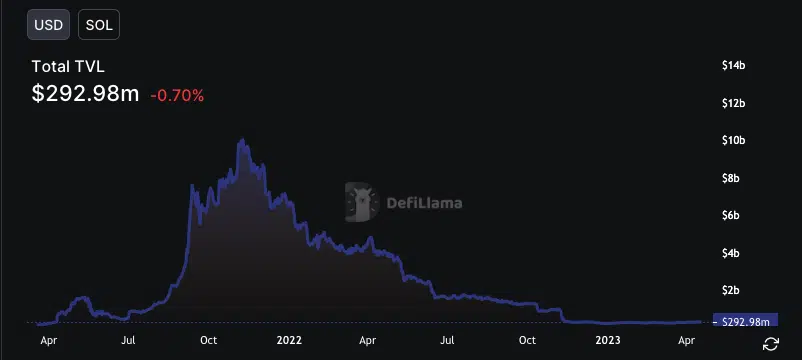

Following the development, the Solana Total Value Locked (TVL) reneged from its month-long 19.29% hike. Therefore, this means that the Proof-of-History (PoH) blockchain was still struggling with attractive significant investors’ deposits into its underlying chains.

And one major reason for this could be linked to the FTX collapse, which acted as the driver of Solana’s TVL exit from the billion-dollar mark.

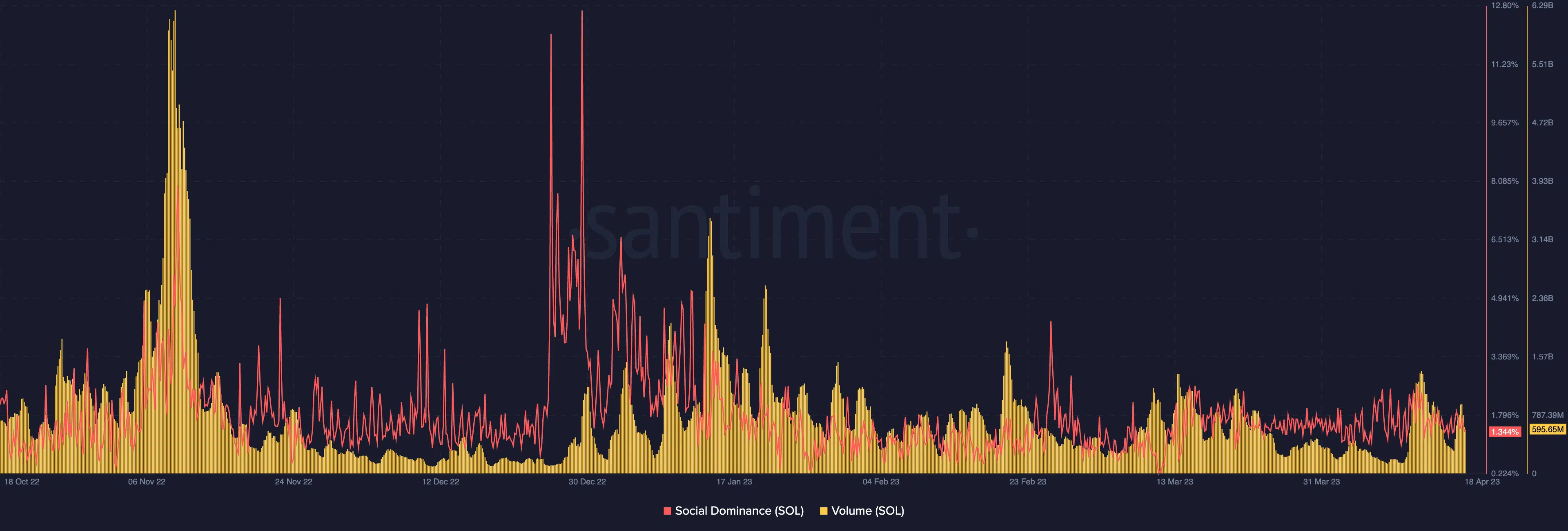

However, on-chain data showed that SOL still had some backing from notable market activity. For one, social dominance, which was at its lowest around March, peaked at 1.344% at press time.

Although quite minimal, the rise in dominance means that the discussions around the asset had increased. Hence, this could impact the motive to capitalize on SOL’s price, as it seemed far from the top.

The strength behind the SOL value

In the same vein, the volume had also increased. According to Santiment, the on-chain volume had increased to 595.65 million. Thus, this implies that there was strength behind the 12.79% seven-day uptick.

With respect to momentum, the Moving Average Convergence Divergence (MACD) was exhibiting bullish signals. Since the indicator had crossed from below the zero line, it means that traders could start opening long positions by taking advantage of increasing upward momentum.

Furthermore, the Relative Strength Index (RSI) was 64.67. Such an instance infers how the buying momentum has overcome possible selling pressure. However, SOL might need to avoid reaching an overbought region around 70 to escape a retracement.

Is your portfolio green? Check out the Solana Profit Calculator

In the interval, Grayscale noted that GSOL was not registered with the U.S. SEC. This was because the asset was not subject to the Securities Exchange Act.

However, the firm mentioned that the Trust would not generate any income. Rather, the company would distribute the assets as each share slowly decreases.

![Solana [SOL] price action](https://ambcrypto.com/wp-content/uploads/2023/04/SOLUSD_2023-04-18_07-13-06.png.webp)