Solana stabilizes at $147: Will SOL breakout soon?

- SOL has stabilized around $147, showing signs of consolidation despite a downturn.

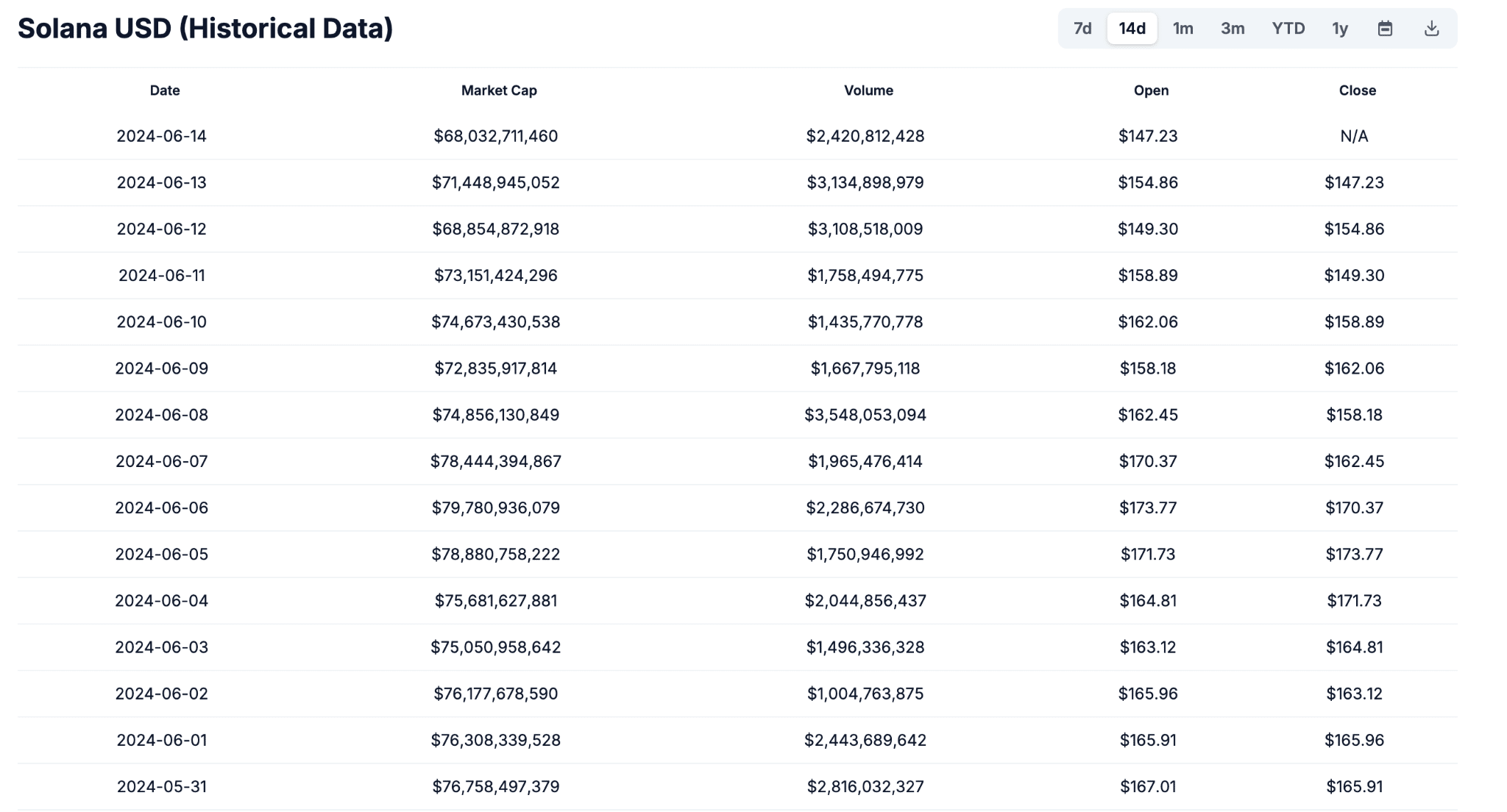

- Bearish patterns in the Ichimoku Cloud signal continued bearish sentiment.

Solana [SOL] has solidified its position as this cycle’s top performer, both in terms of price and network growth.

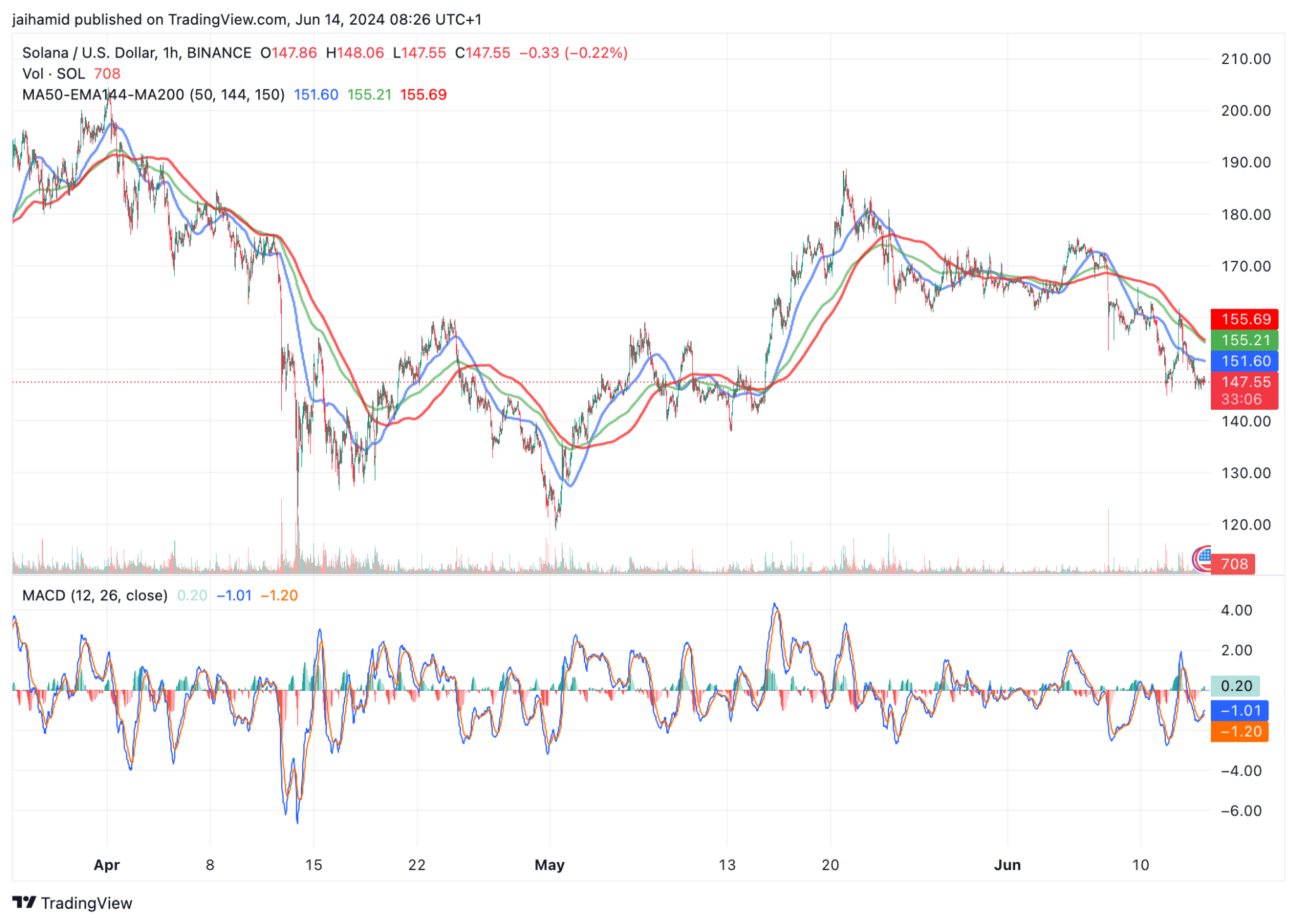

Despite facing some volatility, SOL’s price has recently stabilized at around $147, which is still significantly lower than its top from last month.

While the price has been stagnant within a certain circle over the past few weeks, SOL’s trading volume has consistently peaked, meaning traders are still very active.

However, the Ichimoku Cloud on SOL’s trading chart shows a bearish pattern. The cloud is predominantly above the price action for most of the depicted period, suggesting a bearish trend where the market is struggling to find bullish momentum.

The Kijun-Sen (blue line) is above the price action, reinforcing the bearish sentiment. The price shows repeated attempts to rise above the cloud but generally remains below it or re-enters it shortly after brief breakouts, highlighting the resistance to upward movement.

Recent price action from June 12th onward shows lateral movement with slight fluctuations, staying close to the $147 mark. Solana appears to be in a phase of consolidation.

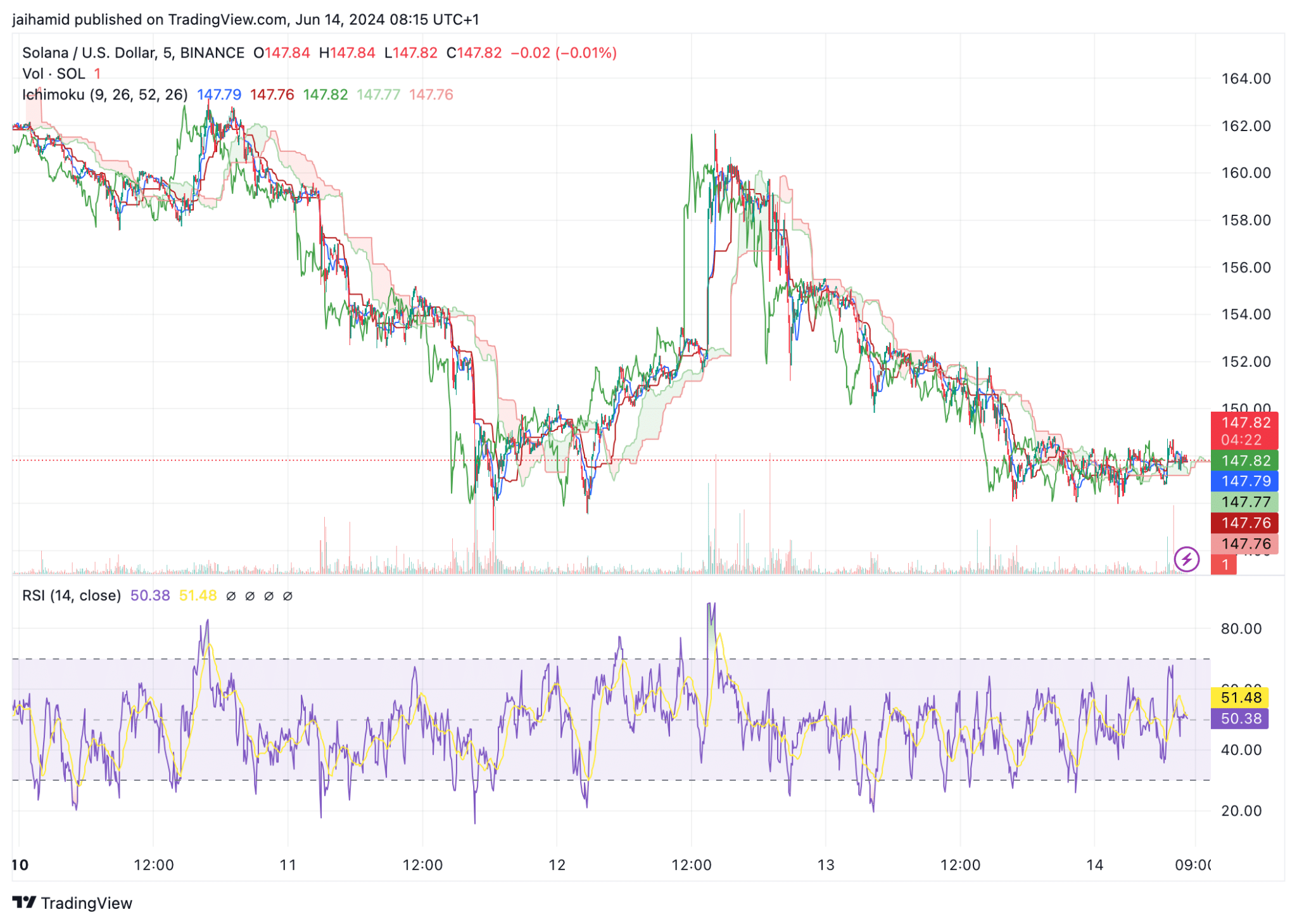

SOL exhibited some volatility from April to early May, with significant peaks and troughs. The price oscillated around the EMA144, suggesting some level of indecision in the market.

Post-May, there has been a clear downtrend as the price consistently stays below all three moving averages, emphasizing a strong bearish sentiment.

The consistent position below the MA200 (red line) further confirms the long-term bearish outlook. And the MACD is around the zero line, lacking strong momentum for both the bulls and the bears.

Is your portfolio green? Check out the SOL Profit Calculator

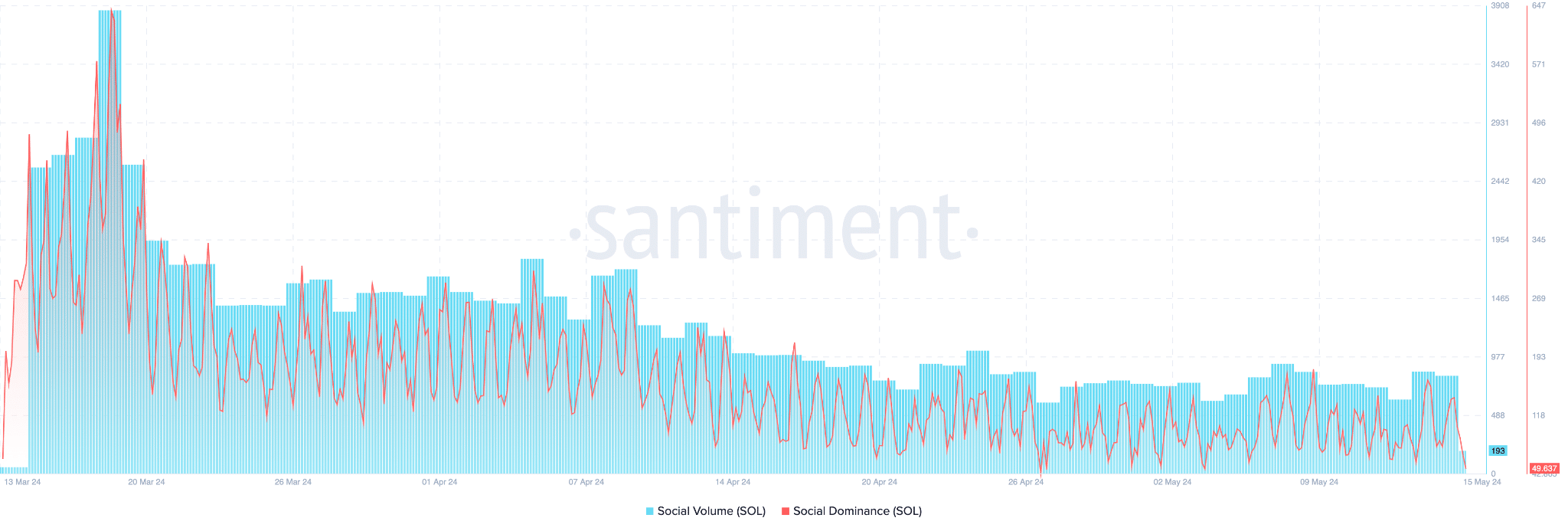

Moreover, both social volume and social dominance have declined, meaning Solana is no longer dominating conversations in the crypto communities on social media.

Also, the Fear & Greed Index sits comfortably on ‘fear.’