Solana: This minor setback did not stop SOL accumulation by day traders

- Following the rate hike, SOL’s price fell by 4%.

- This, however, did not stop day traders from accumulating the alt.

Solana’s [SOL] rebound to the $14.80 price mark prior to the Federal Reserve’s meeting on 14 December caused it to lead the cryptocurrency market with the highest intraday rally.

However, contrary to what was expected, the Federal Reserve raised the federal funds rate by 50 basis points (bps), following four consecutive increases of three-quarters of a percentage point in recent months.

Read Solana’s [SOL] Price Prediction 2023-2024

This caused SOL to shave most of its intraday gains to exchange hands at $14.28 at press time, a 4% decline from the intraday high of $14.86 registered on 14 December.

No cause for alarm

Although SOL’s price declined following the Federal Reserve’s announcement, the on-chain assessment revealed that the market did not suffer any mass hysteria, which often led to significant token dumping in the past.

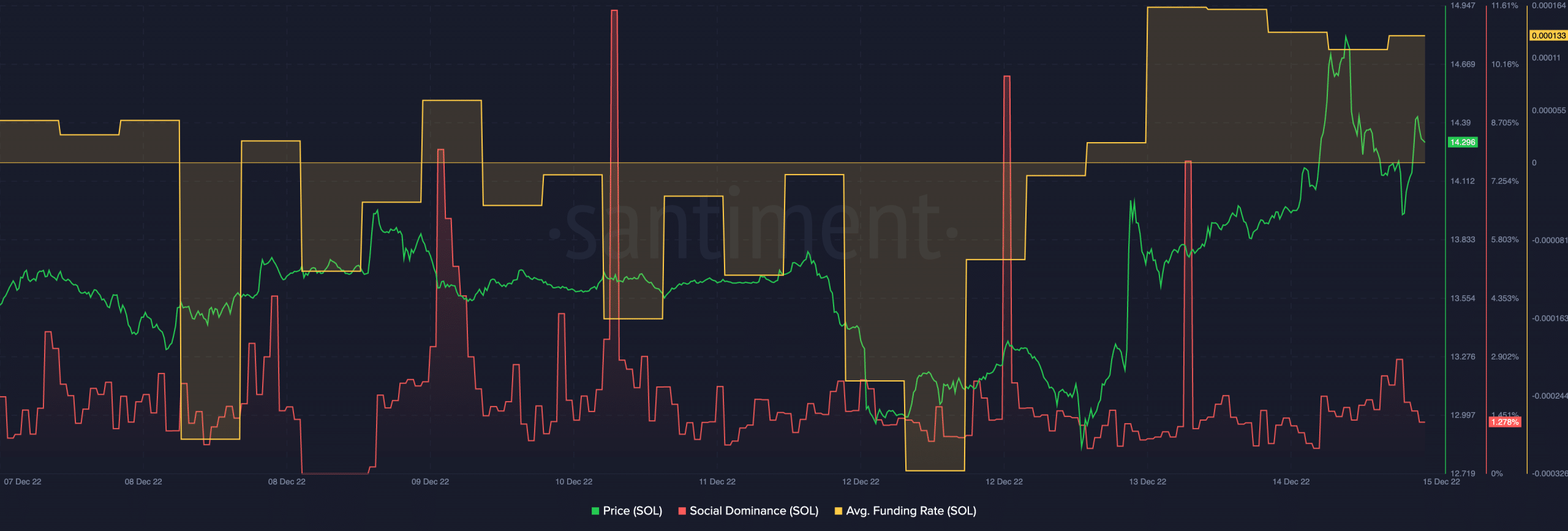

Data from the on-chain analytics platform Santiment showed that SOL’s Exchange Funding Rate remained positive even after the announcement. A positive funding rate indicates that long-position traders are dominant in the market, which is often a bullish sign. At press time, SOL’s Average Funding Rate was 0.000133.

Furthermore, SOL’s social dominance did not log any significant spikes following the rate hike by the Federal Reserve. A sudden surge in an asset’s social dominance following a major event is mostly market hysteria that usually precipitates a price reversal. On a decline as of this writing, SOL’s social dominance was pegged at 1.278%.

Day traders say yay to the accumulation

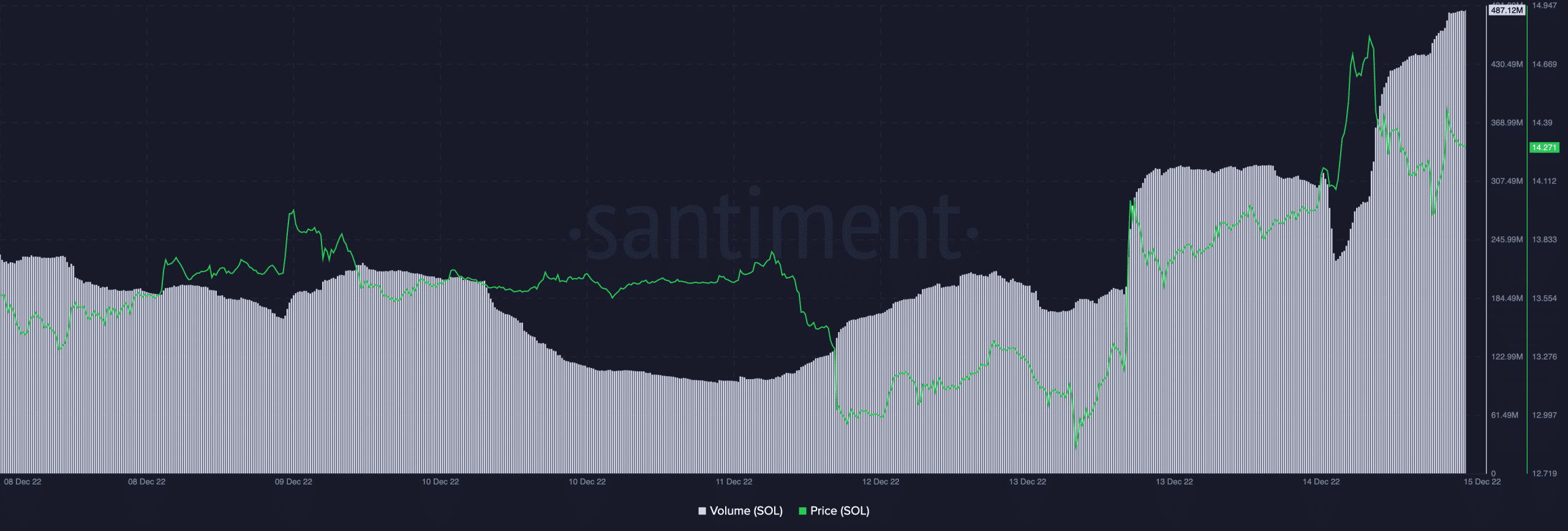

SOL’s assessment on a 4-hour chart to understand the behavior of day traders revealed a rally in coin accumulation.

At press time, SOL was oversold as its key indicators were positioned at oversold highs. For example, the Relative Strength Index (RSI) was stationed at 83.27. Likewise, on an uptrend, SOL’s Money Flow Index (MFI) was seen at 63.

Since the rate hike, SOL’s RSI and MFI have climbed steadily to be pegged at their current position. This showed that despite the minor price retracement following the Federal Reserve’s announcement, day traders did not stop buying SOL.

Moreover, SOL’s Directional Movement Index (DMI) revealed that buyers had control of the intraday market at press time.

The buyers’ strength (green) at 32.47 was solidly above the sellers’ (red) at 15.97. Additionally, the Average Directional Index (ADX) showed that the buyers’ strength was a rock-hard one that sellers might find impossible to revoke in the short term.

At press time, SOL’s price was up by 3% in the last 24 hours, and its trading volume was up by 50% within the same period- the highest daily trading volume in the last week.