Solana under $200 – Understanding what’s next for SOL’s price now

- Solana consolidated in a rising wedge pattern below the $200 level.

- SOL’s TVL including Staking, Borrows, and Liquid Staking hits $20 Billion.

Solana’s [SOL] price has decreased by more than 1.50%, currently trading at $191, while its volume has declined by 16% to $2 billion, according to CoinMarketCap.

The chart shows a rising wedge pattern forming below the $200 resistance level, a pattern that often precedes a potential reversal to the upside during bullish markets.

Despite this, the ascending support line has consistently held, showing strength as prices made higher lows, suggesting a bullish undercurrent.

Solana has struggled around the $200 level, which acts as strong resistance, indicating that this price level is critical for future bullish momentum.

Should Solana break above this resistance, it could trigger a significant rally, targeting the next resistance levels at $236 and possibly extending above $400 in Q1 of 2025.

However, failure to surpass $200 might result in a pullback to lower support levels around $180.

The formation within this wedge, combined with trading volume and market sentiment, will be key indicators for Solana’s potential direction in the first quarter of the year.

Watch these levels closely for signs of either continuation or reversal in trend.

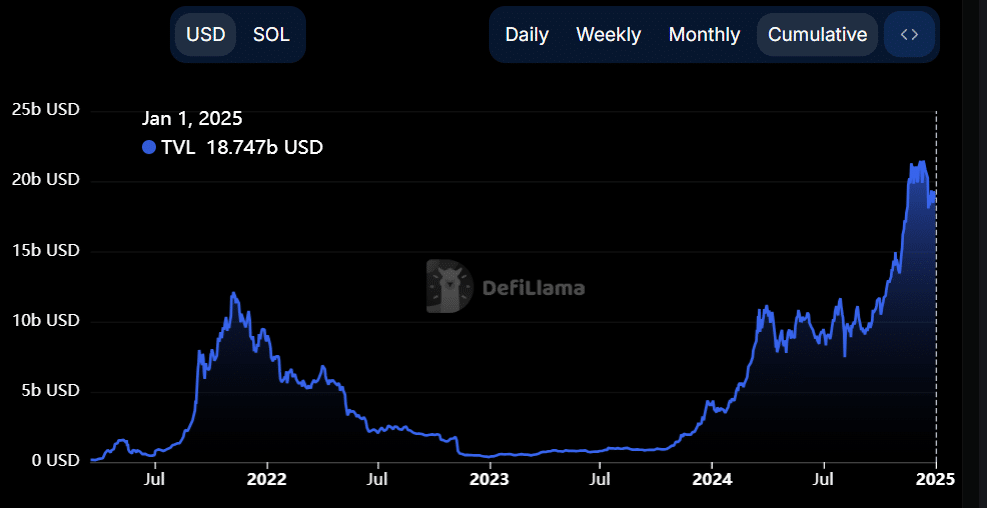

Solana’s Total Value Locked

Solana also showed a strong financial ecosystem in 2024, evidenced by a Total Value Locked (TVL) of $20 billion, an all-time high, signaling robust participation in staking, borrowing, and liquid staking.

Stablecoins market cap reached $5.226 billion, reinforcing its liquidity framework.

Daily fees collected amounted to $3.22 Million, reflecting high network usage, while volume totaled $3.293 Billion.

With $803.19 Million in perpetual volume and active addresses at 4.12 Million, the network’s expansive activity underscored potential price appreciation.

Solana’s market cap stood at $91.682 Billion, with the coin trading at $189.47, at press time, positioning it for possible growth into 2025.

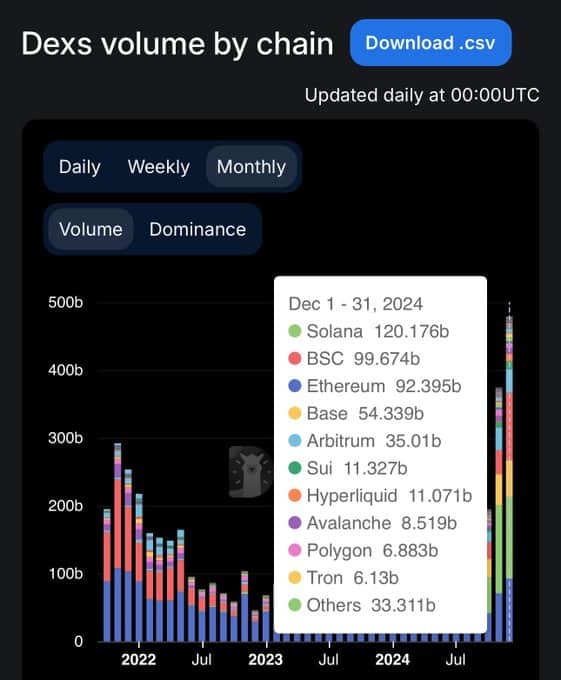

Pumpdofun’s monthly revenue

Looking at the data for the month of December 2024, Solana demonstrated significant financial performance, notably in its DEX trading volume and revenue generation from Pumpdotfun, exceeding $80 million.

This surge, positioned Solana at the forefront with $120 Billion in DEX trading volume and 25% market dominance, affirming its growing ecosystem.

BSC and Ethereum [ETH] followed closely, with volumes of $99.674 billion and $92.395 billion, respectively, highlighting competitive dynamics within the sector.

Read Solana’s [SOL] Price Prediction 2025–2026

However, Pumpdotfun faced criticism for the significant offloading of SOL tokens, impacting investor trust with minimal gains for most wallet holders.

Solana’s ability to attract users through meme coin launches suggests a potential bullish trend into 2025, provided it maintains market leadership and resolves underlying trust issues.