Solana vs. Ethereum: Assessing how DEX volume has impacted SOL, ETH

- Solana outperformed Ethereum in terms of DEX volumes.

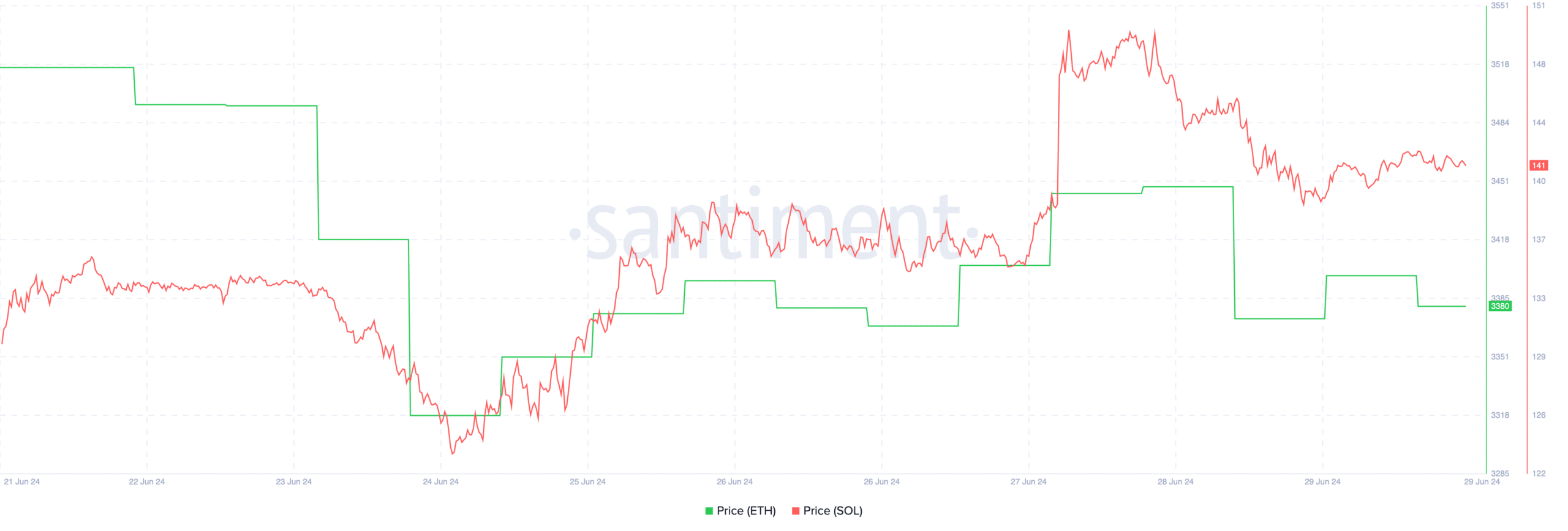

- The price performance of both SOL and ETH tokens were positive over the last 24 hours.

Solana [SOL] and Ethereum [ETH] have been one of the top cryptocurrency networks in the space.

Even though Ethereum has managed to retain its dominance in various areas for the most part, recent developments suggest that Solana could catch up with Ethereum soon.

Solana shows promise

Data from DefiLlama showed Solana surging ahead of Ethereum in daily DEX trading volume. Solana captured a significant lead, processing $1.148 billion compared to Ethereum’s $745 million.

This marks a shift in dominance within the DEX landscape, and could signal a growing preference for Solana’s faster transaction speeds and lower fees.

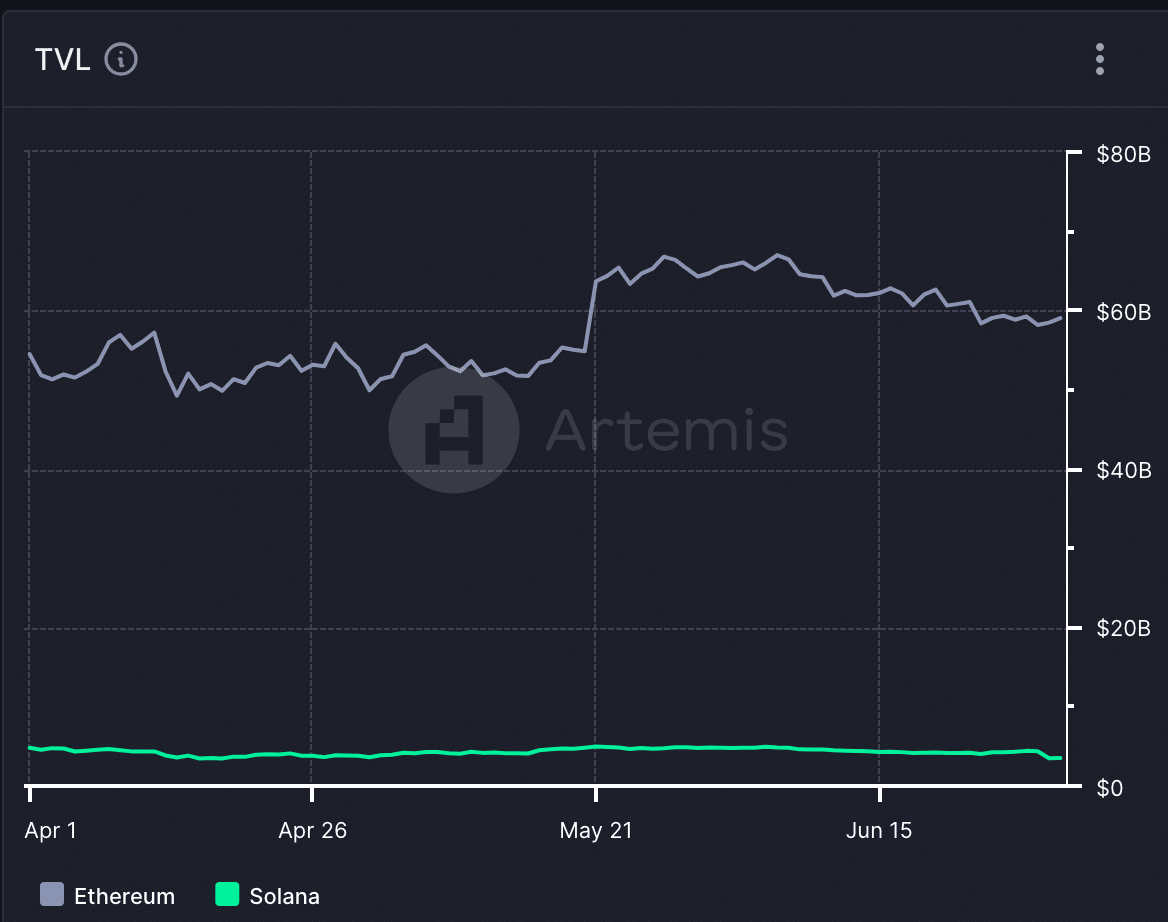

It’s worth noting that Ethereum remains the leader in overall DeFi total value locked (TVL), but Solana’s strong showing in DEX volume could help propel the protocol to new heights.

Even though Solana’s TVL was far behind Ethereum, Solana blew Ethereum out of the water in terms of overall activity.

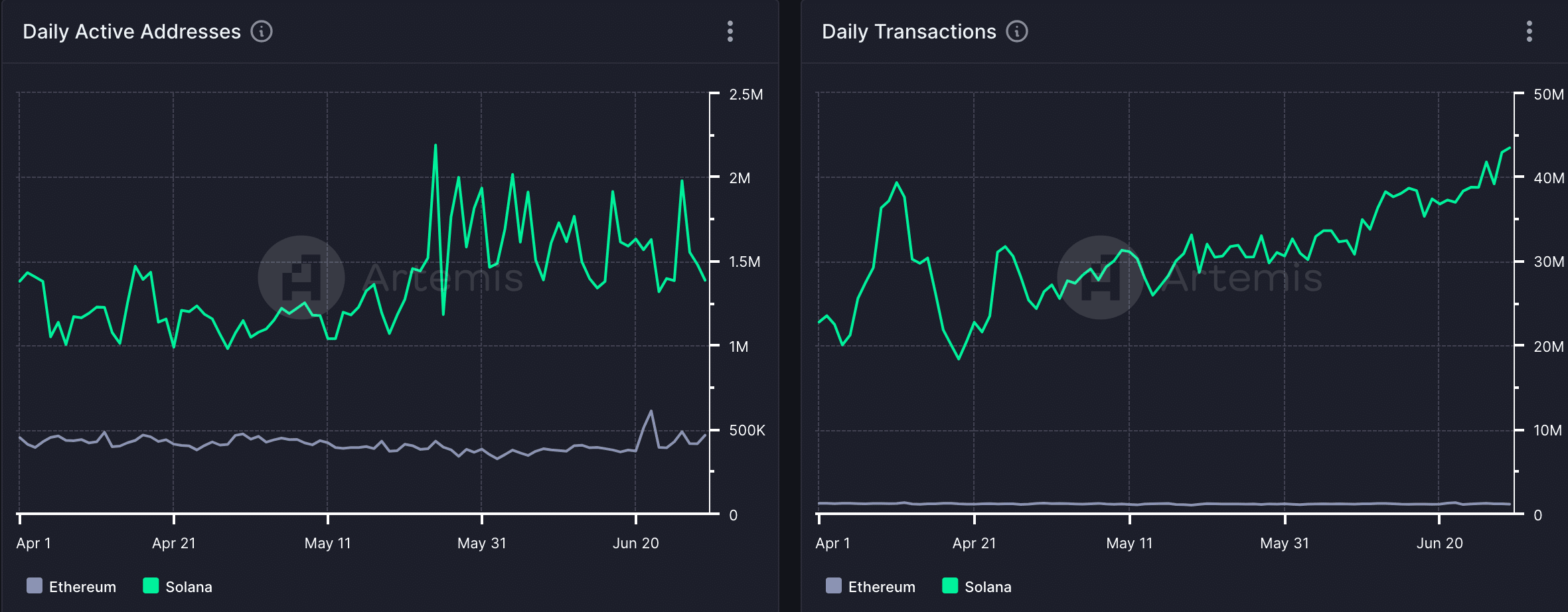

In terms of daily active addresses, the overall number of addresses on Solana had grown to 1.4 million whereas, the number of daily active addresses on the Ethereum network were 644,000 at the time of writing.

In terms of daily transactions, Solana showed significant dominance. At the time of writing, Solana 42.9 million transactions that were occurring on its network. Whereas on Ethereum, the number was around 1.1 million.

Looking at the finer details

Even though Solana managed to outgrow Ethereum in terms of activity, it is important to note that Layer-2s have not been taken into consideration while calculating activity.

L2s like Arbitrum [ARB] and Optimism [OP] act as scaling solutions for Ethereum, processing transactions off the mainnet but still leveraging Ethereum’s security.

Activity on these L2s translates to interest in the Ethereum ecosystem as a whole.

However, Solana’s impressive numbers raise questions about long-term sustainability.

The high transaction volume might be partly driven by speculative activity or meme coin trading, which may not translate into long-term value creation.

It’s crucial to see if this activity translates into building solid DeFi applications and attracting established projects.

Moreover, Solana’s architecture boasts faster speeds and lower fees, but it has faced criticism regarding network congestion and outages in the past.

Is your portfolio green? Check out the SOL Profit Calculator

If outages continue to occur on the Solana network, it could thoroughly impact the sentiment around Solana network and may steer some users away from the protocol.

At press time, both SOL and ETH tokens had benefited from the recent bullish sentiment rising in the crypto markets and grew by 6.6% and 3.4% respectively in the last 24 hours.