Solana: Why a major pullback could be on the horizon

- Solana’s $127 price level remains a critical battleground, acting as both support and resistance.

- If SOL breaks through, it could climb higher, but the road ahead isn’t easy.

The $127 price level is a significant technical marker for Solana [SOL], which has been serving as both support and resistance in recent trading sessions.

Overcoming this barrier is crucial for Solana to target higher resistance levels, such as $140 and $150.

However, several factors make this a challenging feat. One key concern is weak DeFi activity, which remains below pre-election levels. This suggests that on-chain engagement has yet to recover.

On top of that, with market uncertainty in play, many traders are unstaking SOL, adding to potential selling pressure.

A whale recently unstaked 60,298 SOL at $127, reinforcing this level as a strong supply zone and a potential distribution point.

Consequently, the Relative Strength Index (RSI) is trending downward, but it hasn’t yet reached oversold levels.

This suggests that selling momentum could continue unless the broader market experiences a fresh capital influx. Hence, Solana remains vulnerable to another corrective move.

Key levels to watch for Solana’s next dip

Solana’s struggles across key metrics suggest that a local bottom may not be in yet.

What’s surprising is that this comes right after BlackRock’s massive $1.7 billion investment in Solana’s BUIDL initiative, showing that bullish news hasn’t sparked a strong recovery.

Adding to the concern, the SOL/BTC pair has hit a two-year low on the daily chart. The consistent formation of lower lows signals a shift in investor preference, suggesting that capital is flowing elsewhere.

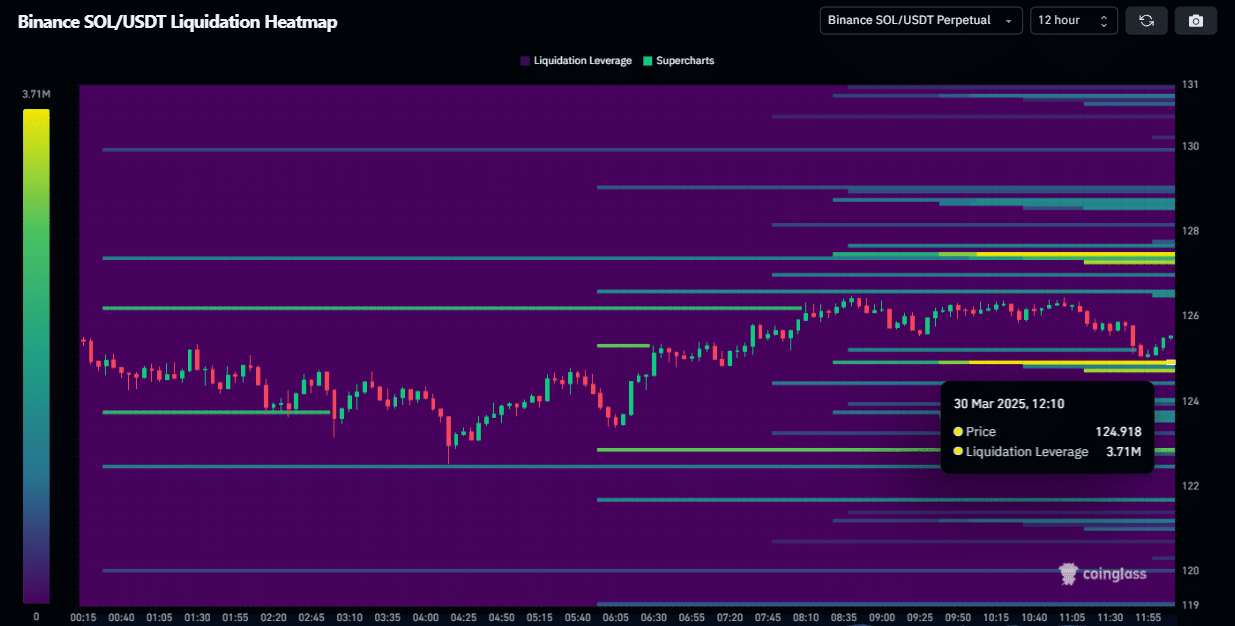

With bullish momentum lacking, the 3.71 million in leveraged positions on the 12-hour derivatives chart face an elevated risk of liquidation should SOL retest the $124.91 support level.

A 32.54% contraction in Solana’s trading volume to $2.05 billion further diminishes the probability of a strong bullish defense, reinforcing downside risks.

Additionally, risk-off sentiment remains elevated as markets brace for the high-stakes tariff decisions set for this week, adding macro uncertainty.

As Q2 unfolds under heightened volatility, a retracement toward the $110–$115 demand zone appears increasingly probable. Solana traders should thus exercise caution.