From $2 to $43 in 4 months, what can you expect from the latest ‘Ethereum competitor’

The crypto-market’s bullish resurgence over the past few months, a revival led by the likes of Bitcoin and Ethereum, has understandably rubbed off on the performances of other altcoins in the market. SOL is a case in point, with the altcoin surging by an astounding 3,200% since the start of the year.

Yes, 3,200%. Those are Dogecoin-like levels there. However, there’s a key difference here – Unlike DOGE, Solana seems to be promising a lot more in terms of development and utility.

At the time of writing, SOL was valued at $43.07. On the 1st of January 2021, the alt was trading at just under $2 on the charts. Thanks to its recent surges, the cryptocurrency is now ranked 15th on CoinMarketCap’s charts.

Source: SOL/USD on TradingView

How come SOL was able to hike so dramatically? Well, the performance of the Solana blockchain certainly has had a part to play in the same, but what has also contributed to the same is how its performance has fared compared to the likes of Ethereum.

Target – Ethereum

Solana is a layer-1 blockchain that promises faster transactions through its scalability infrastructure and fees that are much lower than competitors like Ethereum. Yes, competitor, because while Solana hasn’t advertised itself as one, it occupies perhaps the same space as the likes of Binance Smart Chain. Like Solana, BSC too promises something similar, centralization concerns notwithstanding.

According to the latest report by OKEx Insights, Solana is able to back its promises with its “novel” approach to “reaching consensus, which adds proof-of-history to an underlying proof-of-stake mechanism.” In fact, as the said report pointed out, Solana uses the above to cut down on cross-validator communication and its associated delays, thanks to which there is a 400 millisecond block time for four blocks on the Solana blockchain.

As previously mentioned, Solana hasn’t exactly referred to itself as a competitor of Ethereum, nor as an “Ethereum-killer” either. What it has done, however, is targeted the deficiencies of Ethereum, just like Binance Smart Chain has done.

As the aforementioned report pointed out, while Ethereum currently processes an average of 18 transactions per second, the same figure is as high as 1000 for Solana. Further, while the average transaction fees for Ethereum were just under $10, the same for Solana was as low as $0.0002. That’s an astronomical difference, one that highlights not just what these new “competitors” offer, but also how much work there is to be done for Ethereum on the scalability front.

Local developments

There have been other local developments too, each of which has contributed to Solana’s blockchain and the SOL token gaining momentum.

For instance, Solana has announced the launch of Star Atlas, a unique gaming metaverse that is expected to expand the NFT universe on the platform. Before that, its ecosystem also announced Solstarter, the first IDO platform for Solana. Finally, the project has also integrated Raydium, a feature that has been described as “An avenue for the evolution of DeFi,” while also offering light-speed swaps.

These are all developments that will only contribute to and fuel Solana’s reputation as the blockchain to go to, especially if major networks such as Ethereum continue to face congestion and scalability issues. Right now, the likelihood of Ethereum being superseded seems like an improbability. If the status quo remains over the next few months, however, such projections might change quickly.

STEPping onto the plate

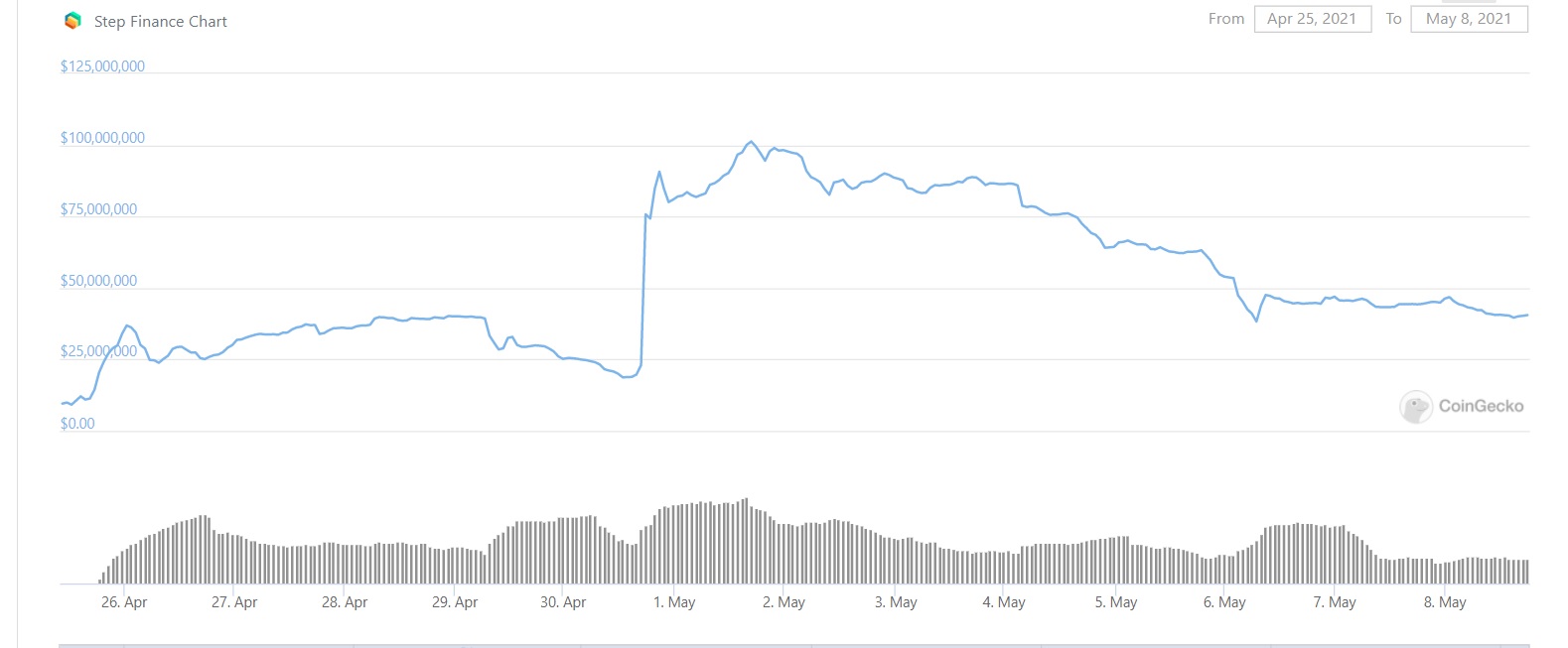

Projects and tokens built on it are seeing yields too, with Step Finance’s STEP being a prime example. A data aggregator for the Solana ecosystem, Step saw its market cap rise sharply to over $100M within 2 days of its launch, before corrections, inevitably, set in.

Source: CoinGecko

According to Step Finance’s George Harrap,

“We believe DeFi will be multichain and the most liquid and exciting blockchain out there is Solana.”

With the likes of FTX’s Sam Bankman-Fried also backing Solana, there is much to expect from Solana in the future. Ergo, in light of the same and the aforementioned developments, one can expect SOL to keep climbing on the charts until it seeks consolidation or until a market-wide event forces corrections on the charts.

SOL has already seen a 3200% hike in the last 4 months. With technical indicators still flashing bullish signals at press time, the likelihood of more upside on the charts remains higher than ever. If Solana cashes in on its promises and on-boards more projects and users, there will be only one direction to go for both the blockchain and the token.