Solana’s MarginFi sees $80M withdrawals in a day – What now?

- MarginFi, a popular lending platform on Solana, witnessed a massive number of withdrawals.

- Despite the rise in negative sentiment, the overall state of Solana remained fine.

Solana [SOL] was one of the few networks that gained massive popularity over the last few months. However, one space where Solana was observed to be facing challenges was the lending sector.

Just by a Margin

MarginFi, a lending platform on the Solana blockchain, experienced a record-breaking day of withdrawals. In a single day, lenders pulled out a staggering $80 million, signaling a potential loss of confidence.

The mass withdrawal contributed to a decline in MarginFi’s Total Value Locked (TVL), a key metric reflecting the total value of crypto assets deposited in the platform.

This could be due to recent leadership changes at MarginFi. Edgar Pavlovsky, the CEO of the company behind the crypto borrow-and-lend platform MarginFi, resigned on 10th April as internal conflicts within the prominent Solana DeFi project became public.

In a resignation notice posted on X, formerly Twitter, Pavlovsky stated that he doesn’t agree with the way things have been done internally or externally. MarginFi’s official account referred to the departure of its co-founder as a result of internal operational disagreements.

Despite this, MarginFi reassured users that all products remain fully operational and unaffected by the departure, emphasizing the decentralized nature of DeFi protocols where core contributors can leave, and the protocol continues to operate.

MarginFi’s troubles follow weeks of issues with its withdrawal function and the introduction of a points program preceding a surge in growth-driven incentivization loyalty schemes across the Solana DeFi ecosystem.

How is Solana doing?

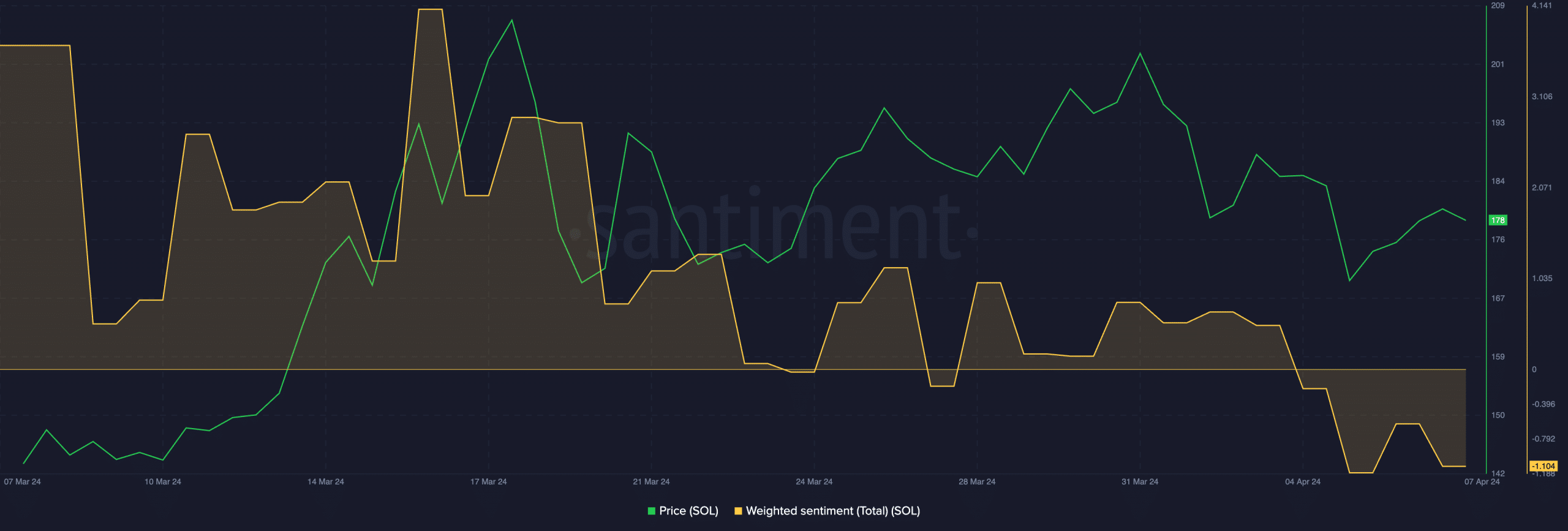

These factors could heavily impact sentiment around the Solana ecosystem. At press time, the weighted sentiment around Solana had fallen significantly. This indicated that the number of negative comments around Solana outnumbered the positive ones over the last few days.

Despite these factors, the total value(TVL) collected by Solana remained consistent and did not witness too much of a decline.

Realistic or not, here’s SOL’s market cap in BTC’s terms

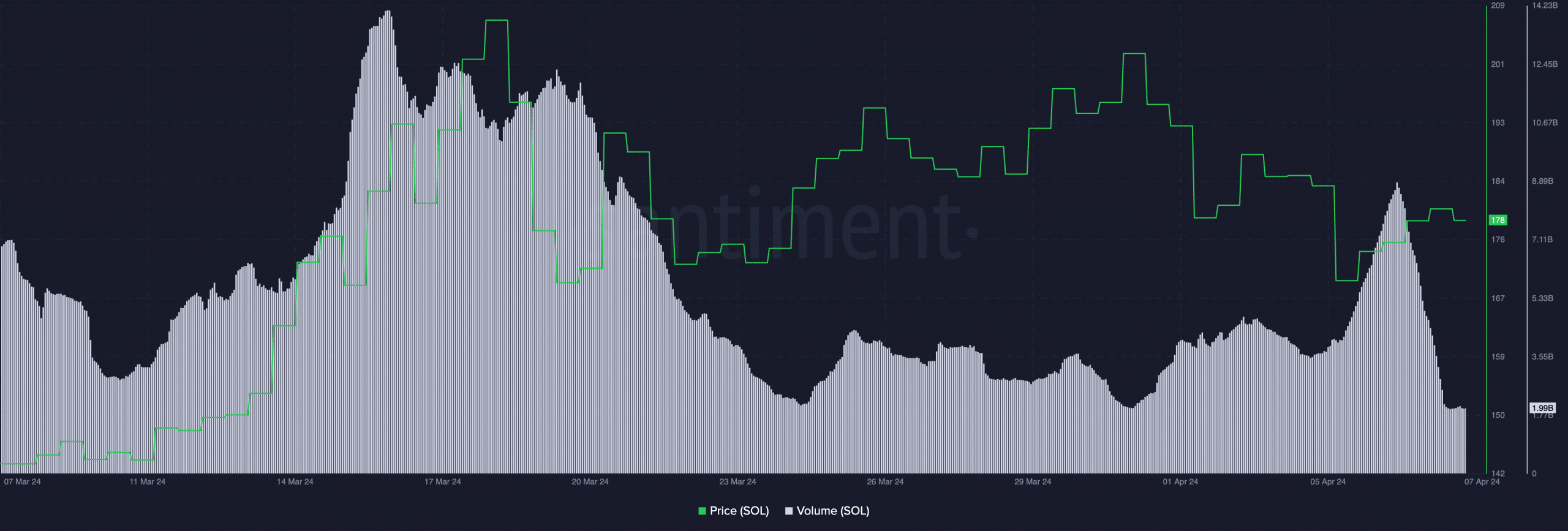

Along with its TVL, the price of SOL also remained unaffected. In the past 24 hours, the price of SOL grew by 1.56%. At press time, SOL was trading at $172.24.

Coupled with the uptick in price, the volume at which SOL was trading at had also grown by 21.70% during this period.