Spot Solana ETF approval next? What GSOL’s rising price tells us

- GSOL surged towards it all-time high at press time.

- Increased anticipation around SOL ETFs drove GSOL’s prices.

Grayscale Solana Trust benefited from current market conditions as the crypto market recovered and institutional interest surged.

Over the past two months, heightened discourse over SOL ETFs has exposed the institutional interest around it, even as prices for Solana fell after the May rally.

GSOL trades near ATH

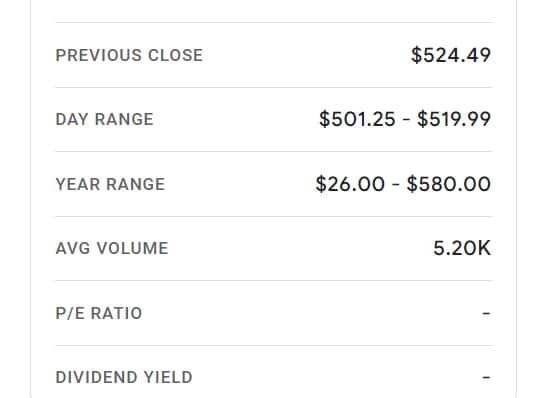

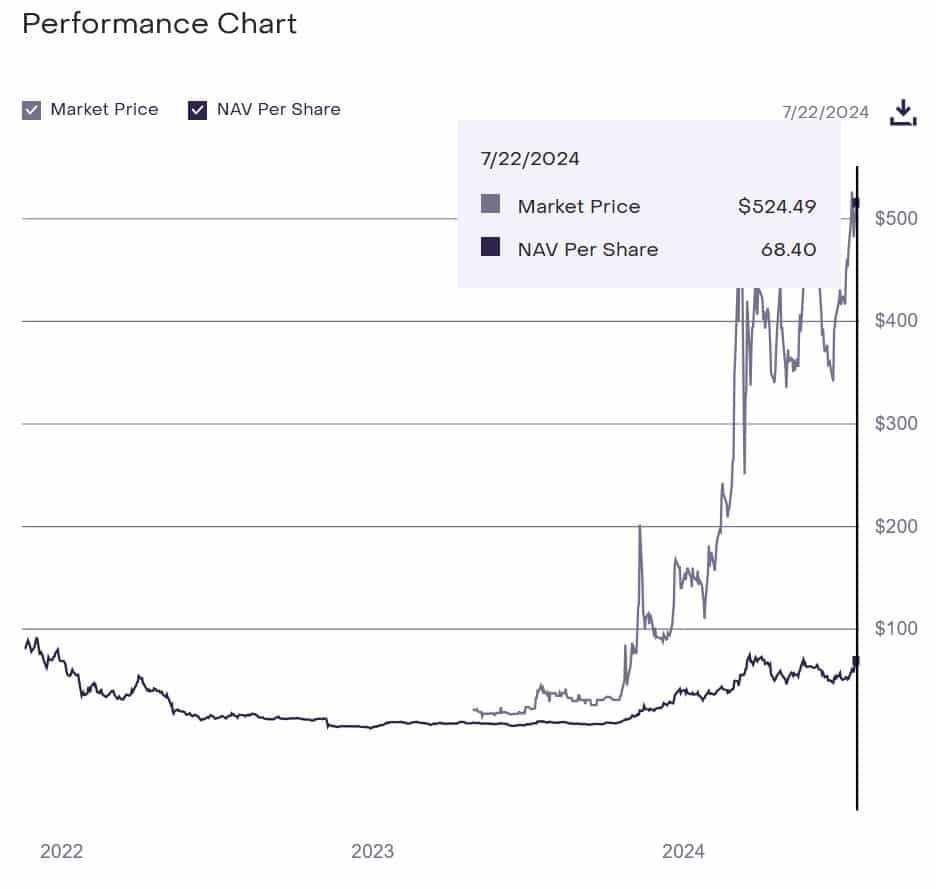

With the favorable market conditions around SOL, GSOL has benefited greatly. According to Google Finance, GSOL closed at $524 in the past two hours before press time, nearing an all-time high record.

Over the past 30 days, GSOL surged by 48.45% to $507 at press time, alongside a surge of 298.99% over the past six months.

Notably, the recent surge has left analysts speculating and optimistic about GSOL’s future potential. For instance, crypto analyst Nic noted that,

“The Grayscale GSOL trust is trading near all-time highs & at 7x the NAV. These institutional buyers are willing to gain $SOL exposure at an implied price of over $1,300.”

His analysis bet on continued institutional interest with SOL. With the increased investor inflow, these investors will be willing to pay higher premiums to gain SOL exposure.

Eyes on SOL ETFs

In the past two months, the crypto market has experienced increased social discourse over potential Solana Exchange-traded funds (ETFs).

Last month, hopes for SOL rose significantly following various firms’ applications for the funds. VanECK became the first asset management firm to file for Solana ETFs in the United States.

The application was followed by 21Shares submitting their proposal to the SEC. Equally, the Canadian firm filled for QSOL a Solana ETF to allow institutional investments.

These moves pushed GSOL shares to $408. Therefore, the anticipation for Solana ETFs drives GSOL’s recent surge and resilience as investors are optimistic, especially after Ethereum ETFs’ approval.

What Solana’s price charts indicate

SOL traded at $176.39 at press time, following an 8.21% on weekly charts. Its trading volume increased by 4.24% to $3b in the past 24 hours.

According to AMBCrypto’s analysis, the recent rise in SOL prices corresponded with GSOL’s sustained rise, also a sign of favorable market conditions for the SOL ecosystem.

Is your portfolio green? Check out the SOL Profit Calculator

Solana was experiencing a positive market sentiment at press time, as Chaikin Money Flow (CMF) indicated. SOL’s CMF is positive at 0.31, suggesting increased buying pressure.

The On Balance Volume (OBV) further proved. A rising OBV at $73.4M showed increasing buying pressure at the time of writing, and a possible price surge.