Starknet takes baby steps to emerge as a robust Ethereum scaling solution

- Assets worth more than $65 million have been deposited on Starknet.

- Starknet still suffered with poor transaction throughput.

Launched in 2021, Ethereum’s [ETH] layer-2 solution (L2) Starknet has grabbed a lot of eyeballs in the first half of 2023. Though still in its infancy, the zero-knowledge rollup (zk-rollup) witnessed significant activity.

Read Ethereum’s [ETH] Price Prediction 2023-24

Deposits on the rise

According to blockchain analytics firm Nansen, more than 500,000 wallets have bridged over to Starknet, depositing assets worth more than $65 million. As evident from the graph below, ETH was the most bridged asset, equating to nearly 75% of the total value bridged (TVB).

Users port their assets to take advantage of the speed and cost-effectiveness of a L2 technology. The StarkGate bridge is used to port assets in the case of Starknet. Each supported token is associated with an L1 and L2 bridge contract that communicates via Starknet’s messaging mechanism.

Starkware, the firm which developed Starknet, has set limitations involving the deposit amount and total value locked in the L1 bridge contract. An increase in deposit caps in mid-March resulted in the sharp jump in deposits. As of this writing, ETH had the maximum cap of 80,000 among all assets.

Nansen also emphasized the age breakdown of depositing wallets, shedding light on some intriguing aspects of Starknet’s demand. As revealed below, nearly 75% of these wallets were created in the last one year, with a significant 41% being in the age-band of 3-12 months. This indicated that Starknet’s demand was driven by newer market participants.

Still early days

When compared with other L2 solutions, Starknet was still in its nascent stage. According to a Dune dashboard, deposits on Starknet were still considerably less as compared to established players like Arbitrum [ARB] and Optimism [OP] and even trailed the recently launched zk-rollup zkSync Era.

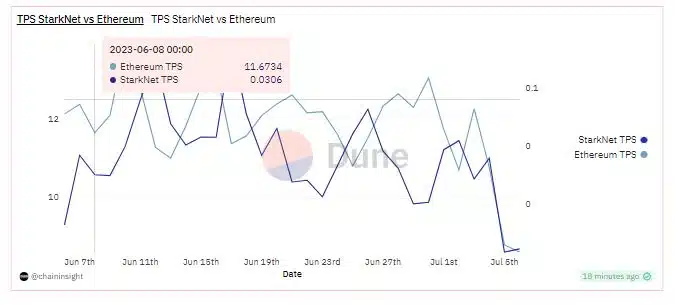

One reason behind the poor growth rate could be the low transactions processed per second (TPS). Data from Dune highlighted that while Ethereum mainnet handled 11 TPS on average, the number of transactions on Starknet was less than one, a significant low for a rollup.

However, Starknet was looking to address this issue through the upcoming version 0.12.0. The upgrade is expected to reduce block execution time, thus significantly improving throughput and latency.