Stars Arena outpaces Friend.tech – Will Avalanche benefit?

- Stars Arena, a SocialFi dApp on Avalanche, surged ahead of Friend.tech in transaction volume.

- Avalanche excels in DeFi ventures into Real World Assets, while AVAX experienced significant growth.

The introduction of Friend.tech revitalized the dApp ecosystem and managed to garner great interest in SocialFi. The dApp dominated the market and drove massive activity to the Base protocol.

Is your portfolio green? Check out the AVAX Profit Calculator

But in the last 24 hours, a notable shift occurred. Stars Arena, a SocialFi dApp on Avalanche[AVAX], emerged as a dominant player, surpassing Friend.tech in terms of transaction volume.

Stars arena takes center stage

This dApp simplified user experiences by eliminating the need to fund with crypto upfront. Moreover, it empowered content creators with a 7% fee structure, making it attractive for those seeking a platform that’s user-friendly and profitable.

These factors ignited the growth of Stars Arena and contributed to its remarkable rise on the Avalanche network.

.@starsarenacom flipped https://t.co/iJ8upG0LUg in transactions over the past 24 hours. ? pic.twitter.com/vrfjCcbrD7

— Emperor Osmo? (@Flowslikeosmo) October 19, 2023

While Stars Arena flourished, it didn’t challenge the Base protocol’s overall activity. Despite its achievements, Stars Arena couldn’t match Base’s numbers.

At the time of writing, Avalanche had around 29,689 active users, whereas Base boasted approximately 113,000. In terms of transaction activity, data from Artemis showed that Base outperformed Avalanche, highlighting the enduring strength of the Base protocol.

In the decentralized finance (DeFi) sector, however, Avalanche held the upper hand. The protocol’s total value locked (TVL) amounted to a substantial $499 million.

Furthermore, in the realm of decentralized exchange (DEX) volumes, Avalanche led the way, surpassing the Base protocol. This DeFi superiority boded well for Avalanche, indicating its potential for growth and dominance in DeFi applications.

Avalanche’s venture into Real World Assets (RWA) is poised to be another catalyst for the protocol’s success. The technology and solutions developed by Avalanche aim to facilitate the integration of traditional financial assets into the crypto space.

In July, the Avalanche Foundation unveiled the “Avalanche Vista” program, earmarking up to $50 million for the purchase of tokenized assets minted on the Avalanche blockchain.

This move underscored Avalanche’s commitment to expanding its footprint in the crypto space and empowering real-world asset tokenization.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

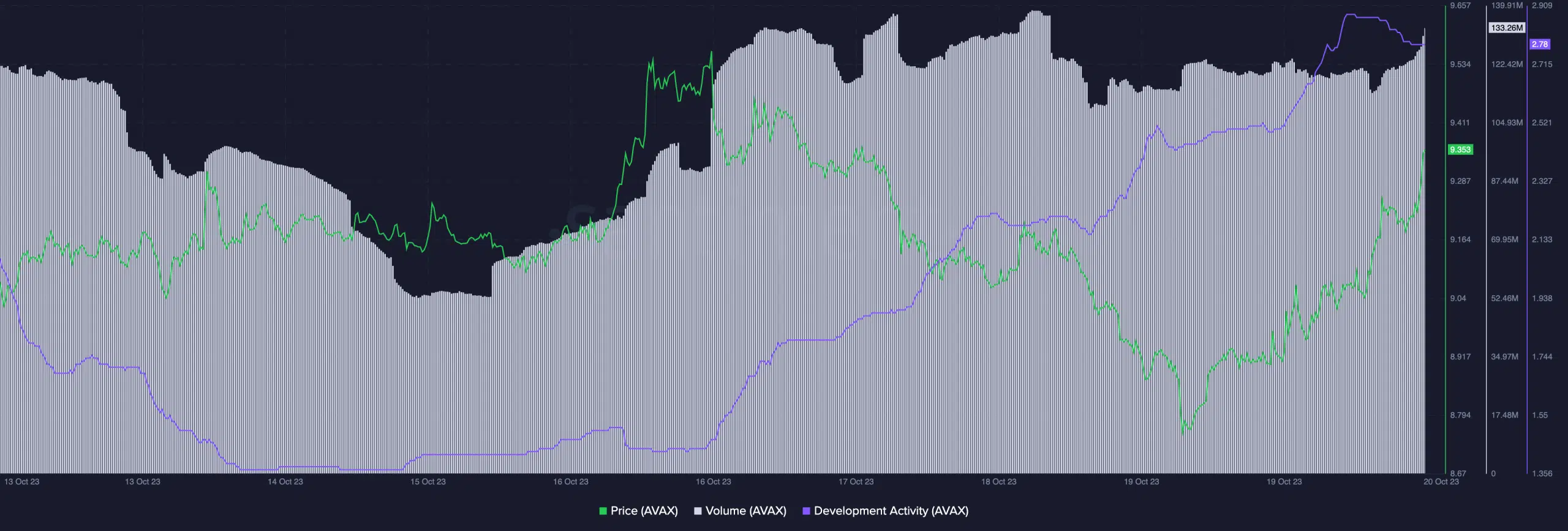

Beyond DeFi and dApps, the performance of AVAX, Avalanche’s native token, demonstrated significant growth. Its price surged notably over recent days, reaching $49.535.

The trading volume of AVAX also experienced a substantial uptick during this period, signaling heightened interest and activity around the token.