Stellar flips 2023 price ceiling to support – What now?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XLM cracked the June 2022 – June 2023 price ceiling of $0.13.

- Short positions were discouraged across all timeframes as of the time of writing.

Stellar Lumens [XLM] isn’t risking July gains as it consolidates above the previous 2022/2023 price ceiling. In mid-July, the altcoin cleared a key roadblock of $0.13, which constrained further upside between June 2022 and June 2023.

Is your portfolio green? Check out the XLM Profit Calculator

Stellar oscillated above the breakout level ($0.13) and $0.17 since mid-July. Despite Bitcoin’s [BTC] weak price action over the same period, XLM has fiercely defended the mid-July breakout level.

The bulls defended $0.13

The Relative Strength Index reclaimed the 50-mark, reinforcing that buying pressure improved over the weekend. However, the Chaikin Money Flow struggled to cross the zero mark, underscoring the weak capital inflows in XLM markets.

However, the range-low and weekly breaker block of $0.114 – $0.123 (cyan) has been defended, underscoring the area as a solid bullish zone. So, if BTC doesn’t record further losses, the bullish zone can be a discounted buying level, targeting overhead resistances.

To the north, resistance levels are found at the range-high of $0.1725, $0.2, and the weekly bearish order block of $0.22 – $0.24 (red).

A breach below the bullish zone will show an extreme weakening of the XLM market structure. To the south, the immediate support is $0.099.

Short positions discouraged

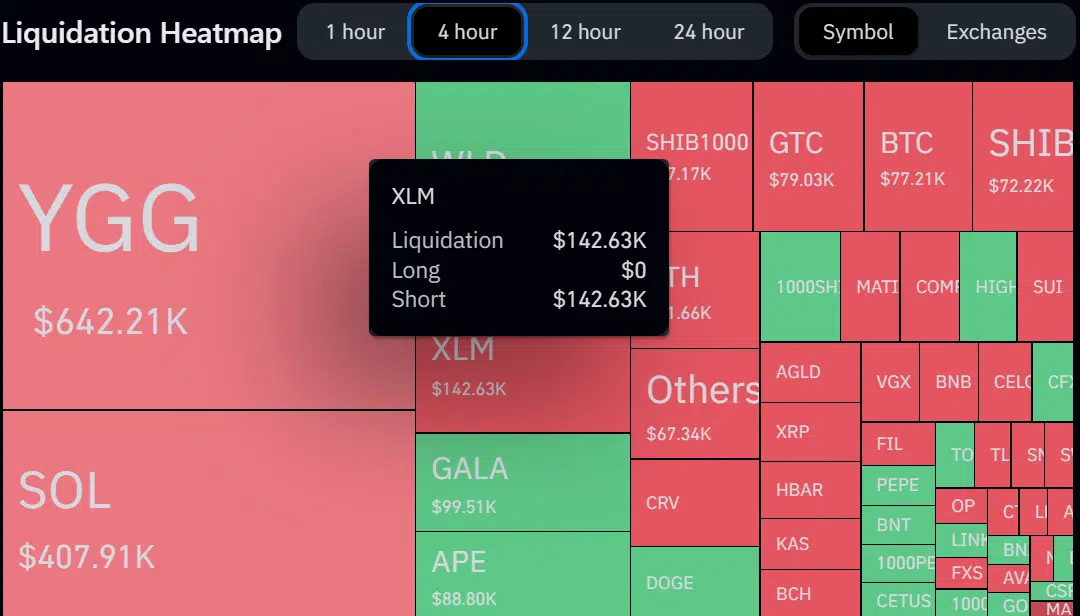

According to Coinglass, XLM recorded massive liquidation of short positions. A whopping >$140k worth of short positions were liquidated in the 4-hour timeframe. Interestingly, long positions saw zero liquidations over the same period – a short-term bullish bias.

How much are 1,10,100 XLMs worth today?

XLM’s Open Interest rates also surged by >1.5%, according to Coinglass. Although it denotes a spike in demand over the futures market, the dip in volume could delay a strong rebound.

So, the bullish zone $0.11 – $0.13 was a key interest price area for bulls, especially if BTC doesn’t record more losses in the next few hours/days.