Analysis

Stellar Lumens price prediction – XLM bulls seek re-entry at…

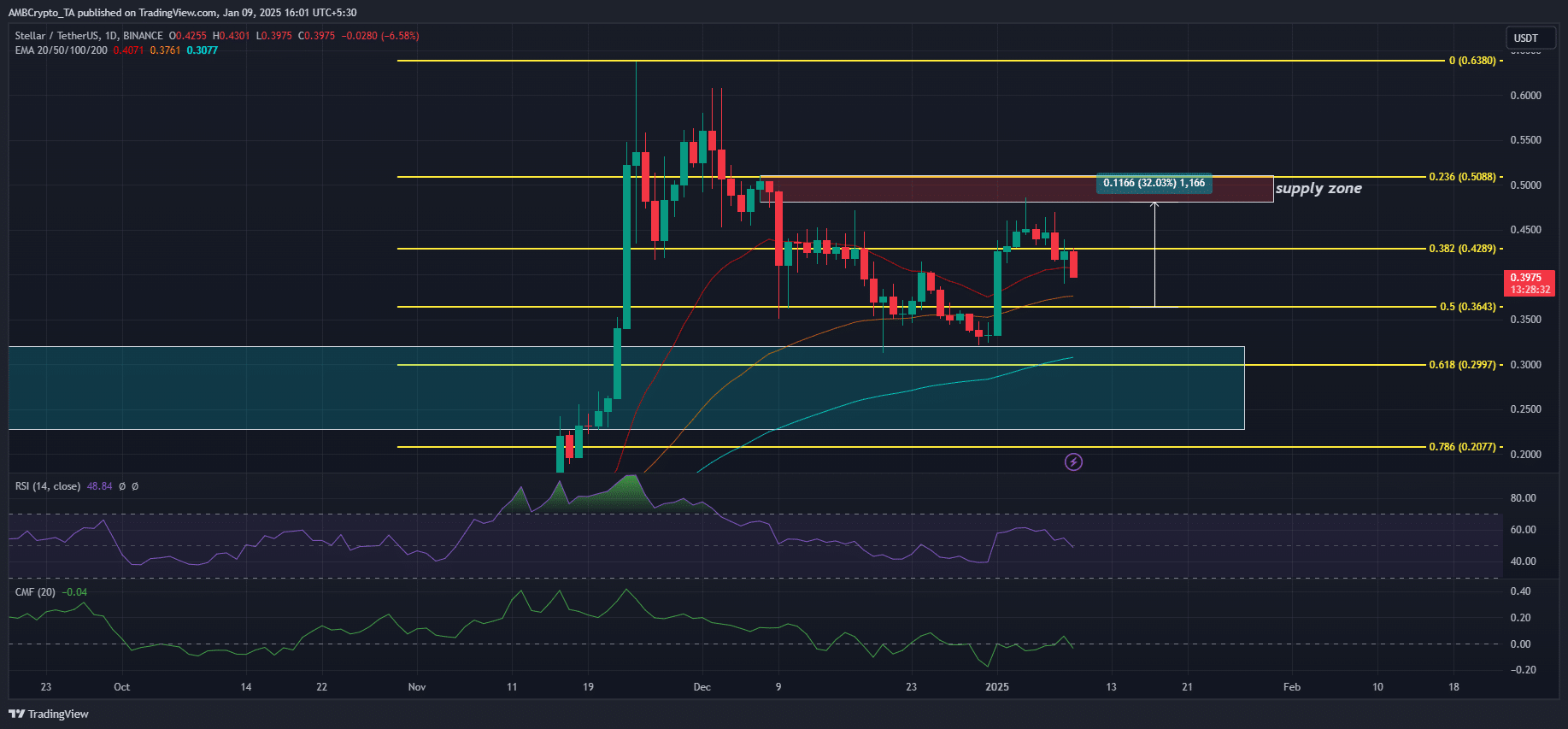

Liquidation heatmap showed that a strong recovery could push XLM towards $0.50.

- Stellar Lumens’ pullback was headed to key support levels at $0.3 and $0.36

- An upside liquidity sweep could influence a likely price rebound toward $0.50.

Stellar Lumens [XLM] pumped 45% in early January but erased some gains. The recent market sell-off could offer swing traders and investors another buying opportunity.

After soaring from $0.30 to nearly 50 cents, XLM’s ongoing pullback was headed toward key levels that could interest bulls again.

Stellar Lumens price prediction

First, the New Year’s upswing flipped the daily chart market structure bullish. This could be shifted if the retracement extended below the recent low at $0.32.

Until that bearish market structure shift happens, the current outlook was primed for bulls.

The recent pullback was about 18% and closed in on key levels of $0.36, and the December support stopped the holiday sell-off at $0.30.

The two levels could be market re-entry for bulls targeting overhead supply below $0.50 (red zone). A bullish idea would be invalidated if XLM extended its decline to below $0.30.

The $0.30 support was further reinforced by the weekly charts, which marked the cyan area as a breaker block that could trigger a price rebound if defended.

Upside liquidity could attract XLM price

From a liquidity sweep perspective, there were two upside liquidity levels worth tracking. The first was between $0.43 and $0.45, and the second was at $0.48.

In most cases, these high liquidity zones always act as magnets for price action.

If so, they could be the next key upside targets to be tapped by a likely XLM rebound. Interestingly, the upper liquidity zone aligned with the supply zone below $0.50 on the price charts.

In short, one could book partial profit at the first target and liquidate the rest when the price taps the $0.48-$0.50 target.

Read Stellar Lumens [XLM] Price Prediction 2025-2026

In conclusion, XLM’s market structure and liquidation heatmap suggested a great buying opportunity if the pullback extended to $0.30.

However, a sustained sell-off below $0.30 would embolden sellers and invalidate the bullish thesis.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion