Stellar [XLM] plunged, consolidates near $0.0950 – Are sellers subdued?

![Stellar [XLM] plunged, consolidates near $0.0950 - Are sellers subdued?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x900-3.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

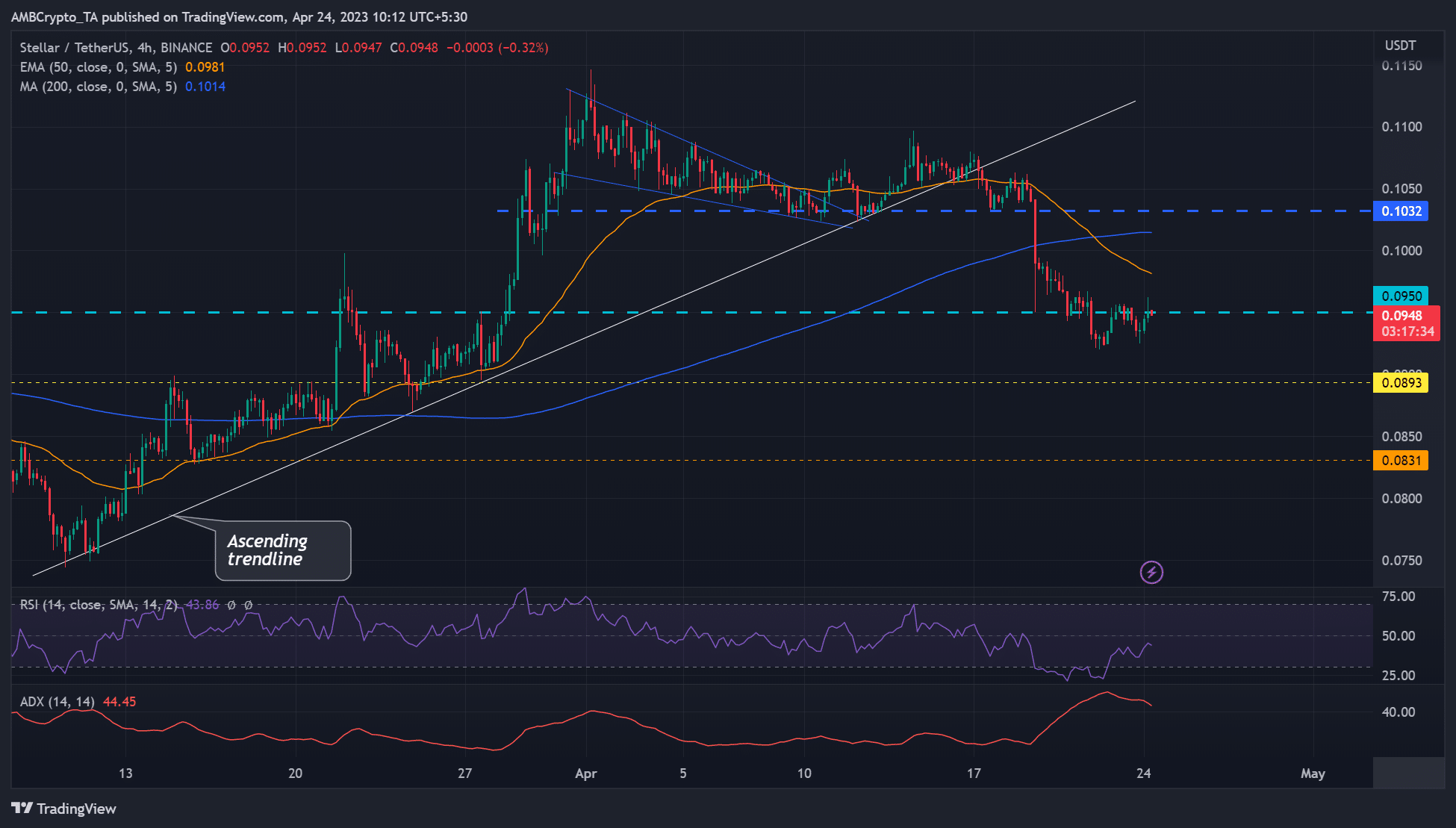

- There was a mild bullish momentum on the 4-hour chart.

- Open interest rates declined as funding rates wavered.

Stellar [XLM] has sustained a price dump since early April. The asset depreciated from its pre-FTX level of $0.115 but consolidated near $0.0950.

Notably, the $0.0950 price tag is a Q1 2023 high, which could be flipped into support, especially if Bitcoin [BTC] reclaims the $28k price range and surges forward.

Read Stellar [XLM] Price Prediction 2023-24

On the development front, Stellar Network only announced one key integration in April – a cross-border payment integration in the Philippines. The partnership, announced on 11 April, involved a micro-service company offering faster cross-border remittance.

Will the Q1 2023 highs prevent the drop?

XLM’s early April price action chalked a bullish falling wedge pattern. A bullish breakout set XLM to hit $0.1100 before dropping lower following the BTC correction. Notably, the breach of 200-MA dynamic support exposed XLM to more aggressive selling but has since steadied near $0.0950.

Meanwhile, the RSI retreated from the oversold zone – indicating mild bullish sentiment. But RSI faced could face rejection at the 50-mark level if a past trend repeats. On the other hand, ADX (Average Directional Index) declined – suggesting a likely consolidation or retracement.

As such, XLM could oscillate between $0.0950 – $0.0893 in the next few hours/days or breach below the range and drop to $0.0831 if BTC falls to the $26k price zone. Investors can target the upper and lower range for gains but must watch out for the hurdle at $0.0925.

Alternatively, a close above $0.0950 could tip bulls to aim $0.10 price level. However, near-term bulls could only gain leverage if they push XLM above 50-EMA ($0.0981) and 200-MA ($0.1014).

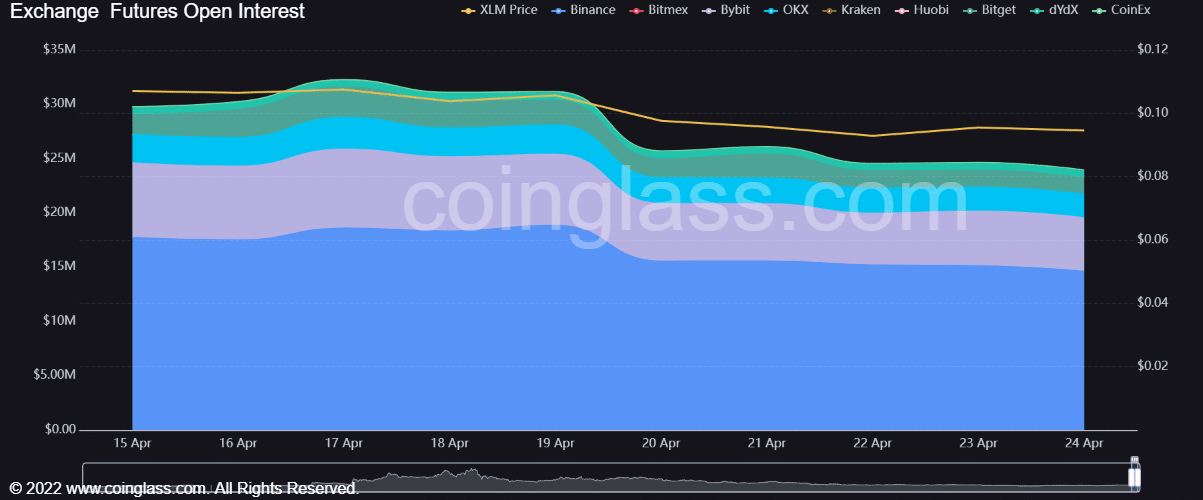

Open interest rates declined

Is your portfolio green? Check XLM Profit Calculator

XLM’s open interest rates have declined significantly from above $30M to below $25M – a considerable outflow that denotes a bearish sentiment in the futures market.

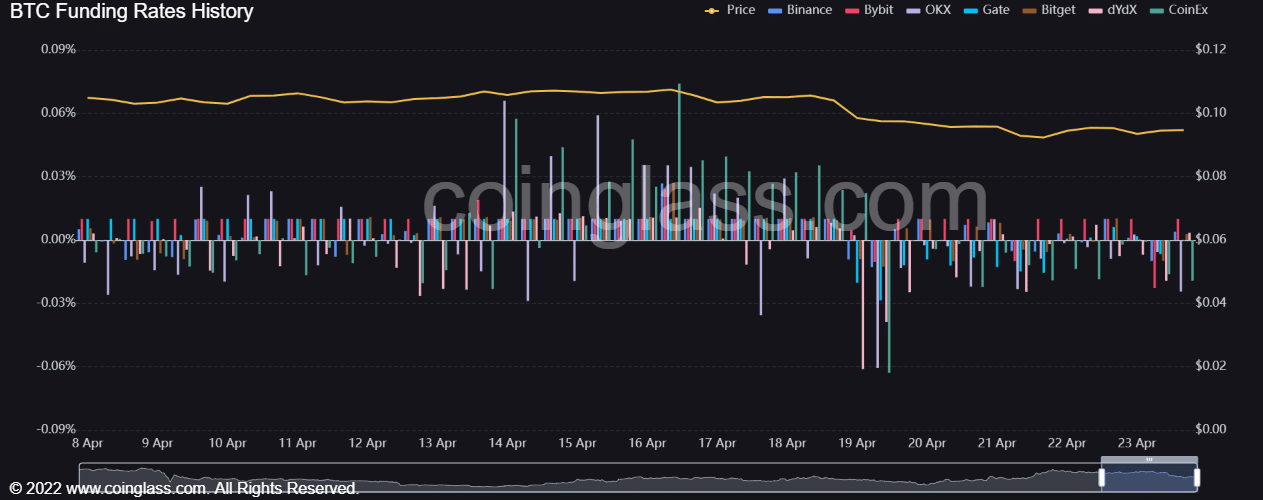

Similarly, the funding rates were only positive between 14 and 18 April. From 19 April, funding rates fluctuated and remained eerily negative at press time – the wavering demand could offer sellers more leverage.