STEPN users take a step back from running after airdrop misery

- User activity on STEPN has dropped significantly.

- GMT’s price continues to decline as investors reduce accumulation.

As part of its New Horizon initiative, popular play-to-earn gaming platform STEPN conducted an airdrop for its Genesis holders in February. However, as interest in the blockchain-based game wanes, key growth metrics continue to decline. This, despite the token airdrop, according to data from DappRadar.

We're delighted to announce the #STEPN New Horizon Initiative, giving back to the community ?

Genesis Sneaker Airdrop ?

Common ➡️ 4,000 $GMT

Uncommon ➡️ 8,000 $GMT

Rare ➡️ 16,000 $GMT

Epic ➡️ 32,000 $GMT⚠️ Read on for important information ⤵️ [1/3] pic.twitter.com/yBzMLZq7Ou

— STEPN | Public Beta Phase V (@Stepnofficial) February 17, 2023

Is your portfolio green? Check out the STEPN Profit Calculator

Walking has replaced running on STEPN

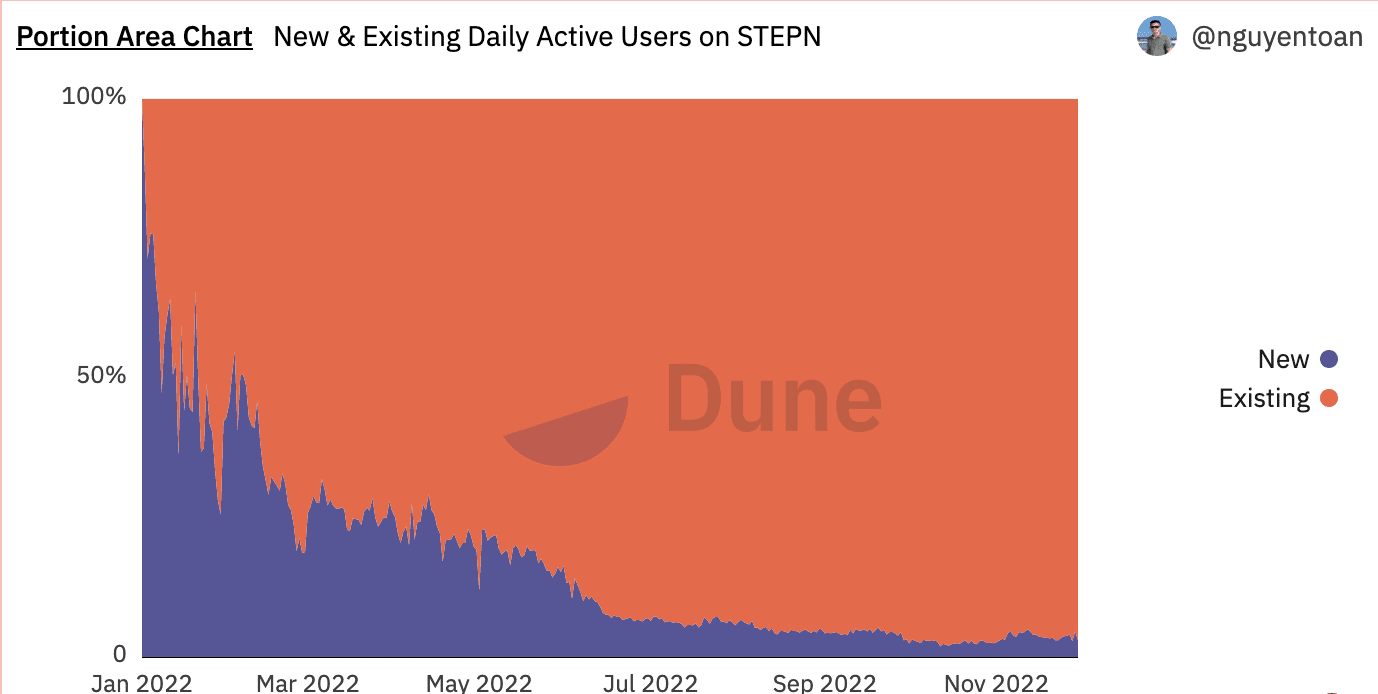

A key indicator of an unhealthy protocol is a consistent decline in its user activity. This has been the case for STEPN since the end of the play-to-earn boom in December 2021. In fact, data from Dune Analytics has revealed a consistent decline in the new demand for STEPN sneakers since January 2022.

Additionally, the count of new entrants onboarded onto the gaming ecosystem has declined significantly since.

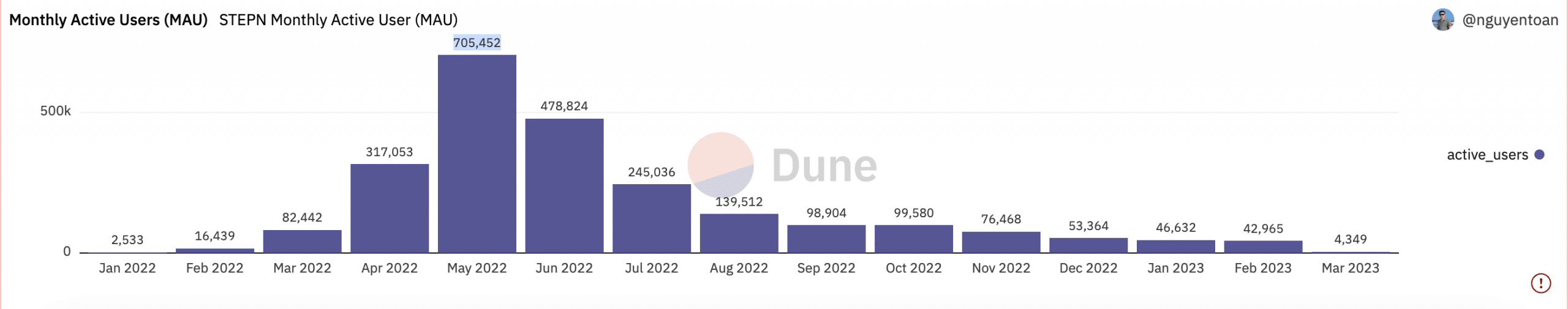

February’s token airdrop was conducted to drive up network activity from existing users, but this has failed to materialize. According to DappRadar, over the past month, the number of unique active wallets on STEPN dropped by 33%.

In fact, STEPN closed February with a monthly active user count of 42,965 – Its lowest since March 2022, data from Dune Analytics revealed. Since the number of STEPN’s monthly active users peaked at 705,452 in May 2022, it has dropped by almost 95%.

STEPN’s GMT has a difficult road ahead

While the rest of the market traded sideways over the past month, STEPN’s GMT trended south. In the last 30 days, the native token of the STEPN ecosystem shed 35% of its value on the charts.

Realistic or not, here’s GMT’s market cap in BTC terms

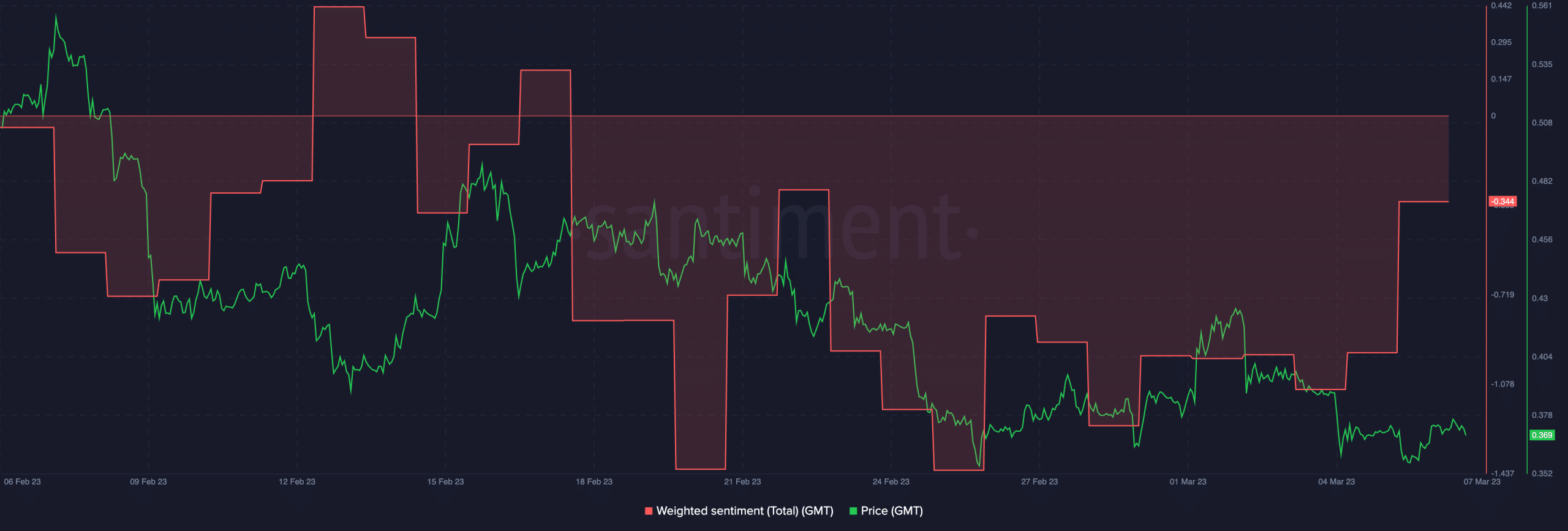

With the token’s price was southbound over the past month, it has since been followed by negative sentiments. This, especially as investors distribute their GMT holdings to hedge against further losses.

At press time, GMT’s weighted sentiment was – 0.344.

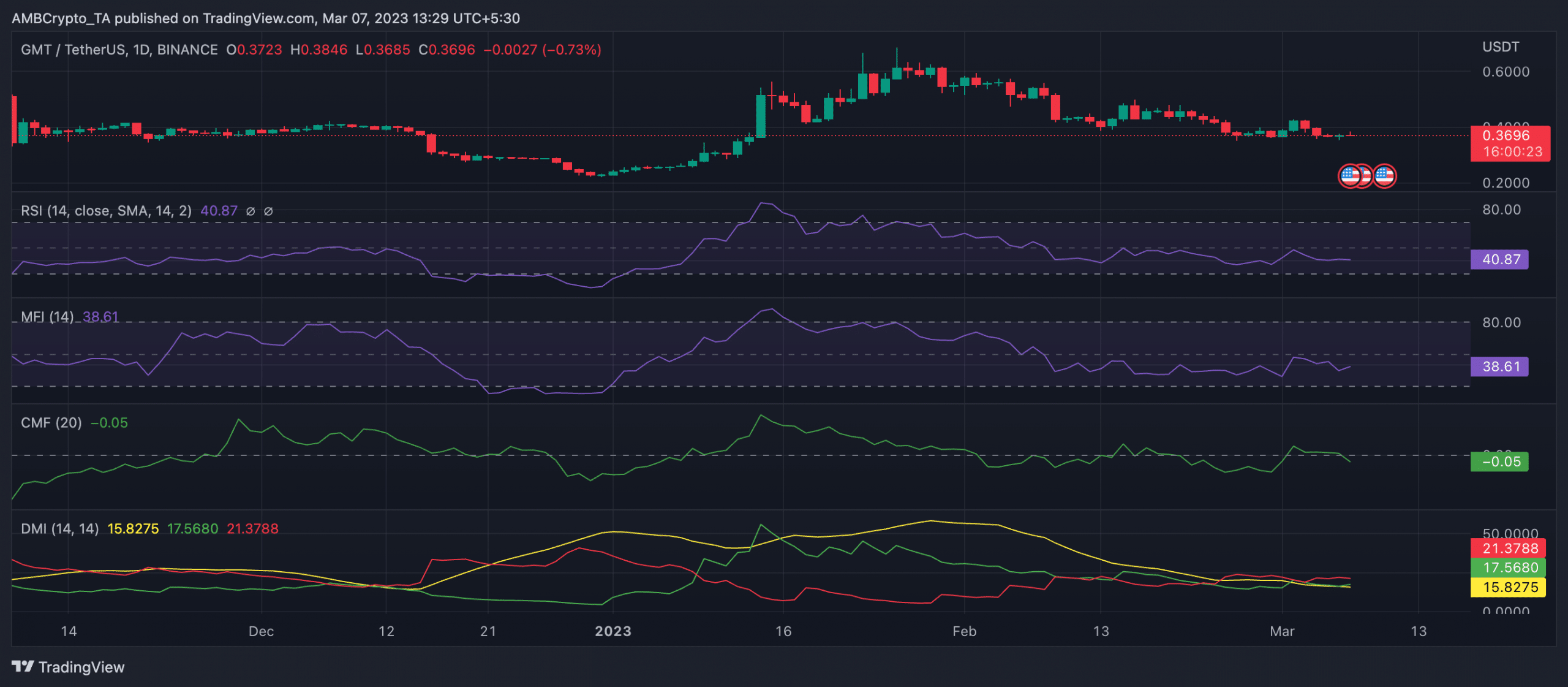

On the daily chart, buying momentum seemed to have fallen significantly. Key momentum indicators lay below their respective neutral lines, indicating greater coin distribution.

This put the sellers in control of the GMT market, at press time, as the negative directional indicator (red) lay solidly above the positive directional indicator (green).

A suffering DEX?

STEPN launched its decentralized exchange (DEX) DOOAR in June 2022. The DEX allows users of the gaming platform to provide liquidity to its native tokens – GST/USDC or GMT/USDC pairs.

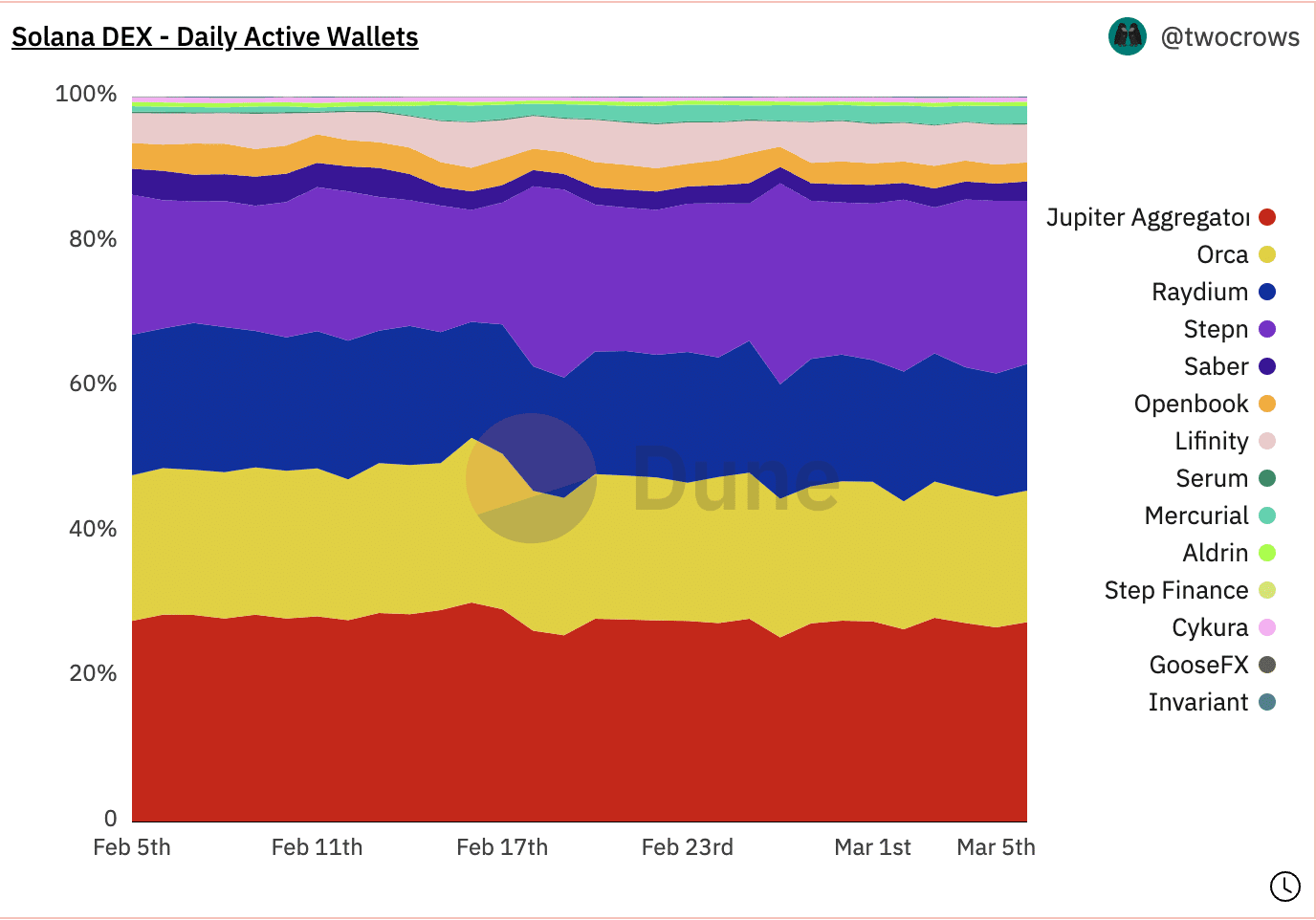

The consistent decline in the value of these tokens over the past year has resulted in a steep decline in the DEX’s dominance. When DOOAR was first launched, its use skyrocketed, leading it to hold a 33% share of all the daily active wallets across all the DEXs housed within the Solana network.

This percentage, however, has fallen since. At press time, STEPN’s DOOAR held a 22% share of all the daily active wallets on the DEXs on Solana.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)