Still want to hold on to TRX? Here’s why this level is worth looking out for

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

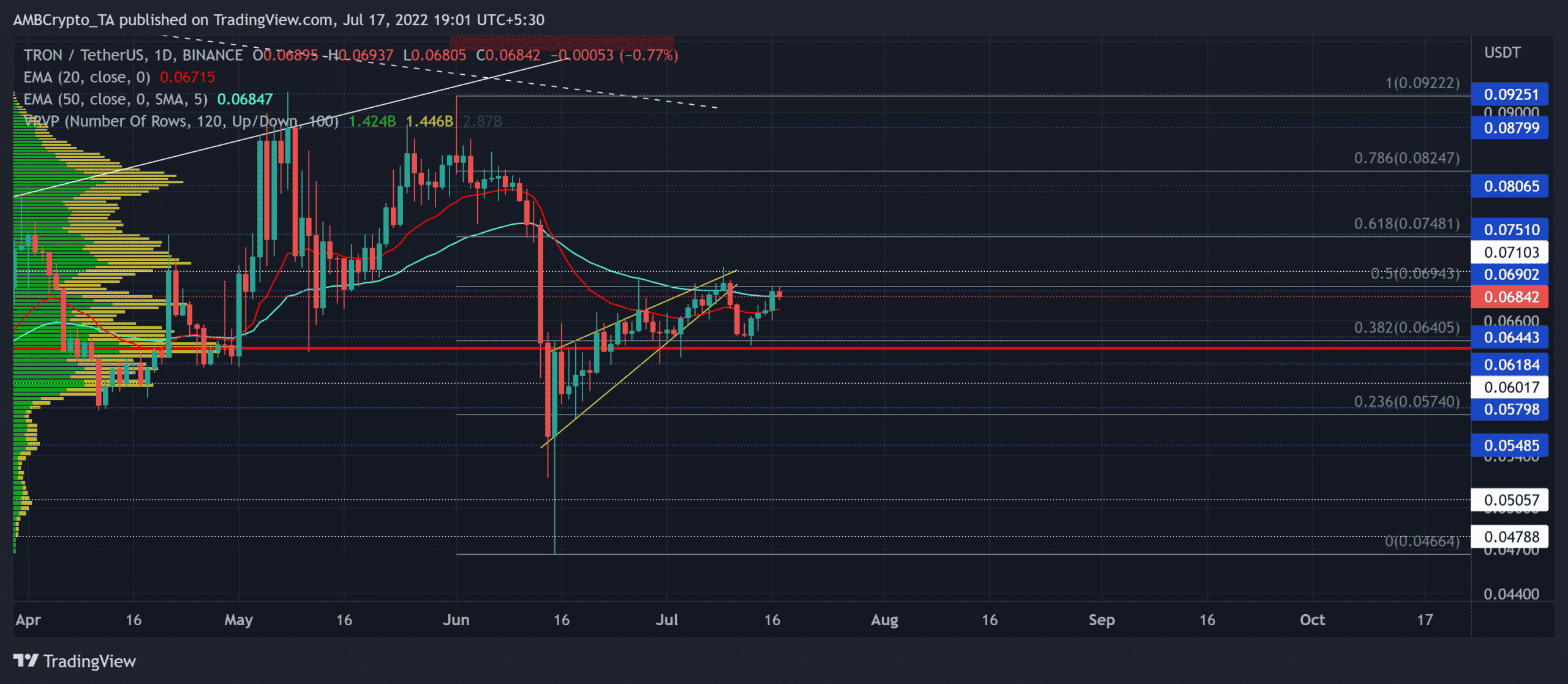

After registering double-digit gains in its rising wedge, Tron [TRX] saw an expected breakdown from its reversal pattern. The decline from the 50 EMA (cyan) helped sellers keep the buying pressure under check.

An inability to close beyond the 50% Fibonacci level could extend the sluggish phase in the coming days. At press time, TRX was trading at $0.06842, up by 2.85% in the last 24 hours.

TRX Daily Chart

TRX noted a rather short-lived recovery after dropping towards its yearly low on 15 June. The revival from its long-term support entailed a bearish rising wedge structure on the daily chart.

However, the buyers were yet to force a bullish crossover on the 20 EMA (red) and the 50 EMA (cyan). After an over 47% ROI from its June lows, the altcoin found itself floating above the Point of Control (POC, red).

A sustained decline from the 50 EMA could force the crypto to retest the POC zone. In this case, the potential targets would rest in the $0.063-$0.0614 range.

To escape the shackles of its long-term bearish tendencies, TRX bulls have to find a way to prevent the rejection of higher prices at the $0.069-level. Investors/traders must take note of the broader macro-economic sentiments affecting the placement of long bets. The alt would likely continue its squeeze near the EMAs before a volatile break.

Rationale

The Relative Strength Index (RSI) finally saw a close above the midline. A drop below the 50-mark would reaffirm the near-term drawback inclinations.

To top it up, the OBV saw lower peaks over the last week and bearishly diverged with the price action. Nonetheless, the ADX projected a substantially weak directional trend for the altcoin.

Conclusion

Given the reversal inclinations from the $0.069-level alongside the bearish divergence on the OBV, TRX could continue its near-term sluggish phase. The targets would remain the same as above. Any bearish invalidations would be constricted by the 61.8%-level.

Finally, investors/traders should consider Bitcoin’s movement and its impact on broader market perception to make a profitable move.