Strong HODLers are buying the Bitcoin, altcoin dip; what’s the impact?

Bitcoin, at press time, was trading above $56,000 on the price charts, but based on its on-chain analysis, the sentiment among retail traders on exchanges is still a little bearish.

Source: Coinstats

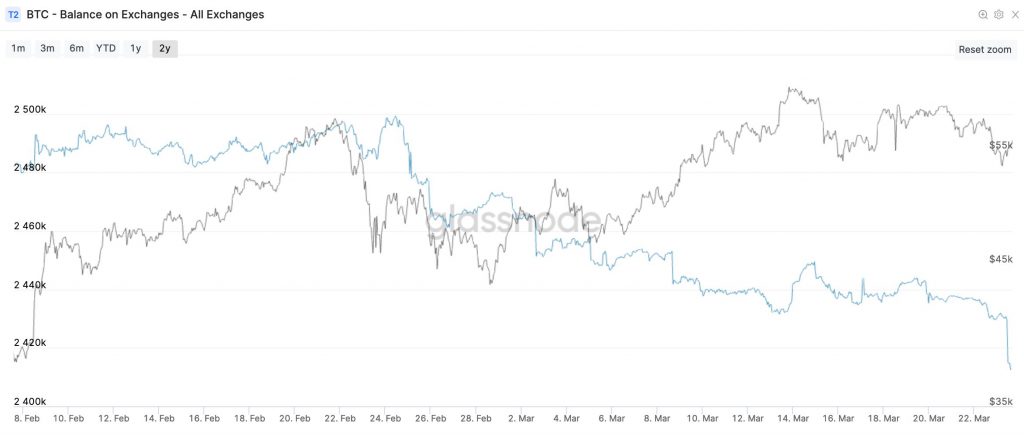

However, Willy Woo is reading it as bullish in the future. In fact, according to the popular crypto-analyst, selling Bitcoin right now is a crazy proposition since strong long-term HODLers are buying the dip. Consider the following chart, one which shows Bitcoin being scooped off exchanges like Coinbase, and underlines the scale of withdrawals. The said chart seemed to suggest that an institutional buyer may have been involved here.

Bitcoin balance on exchanges || Source: Twitter

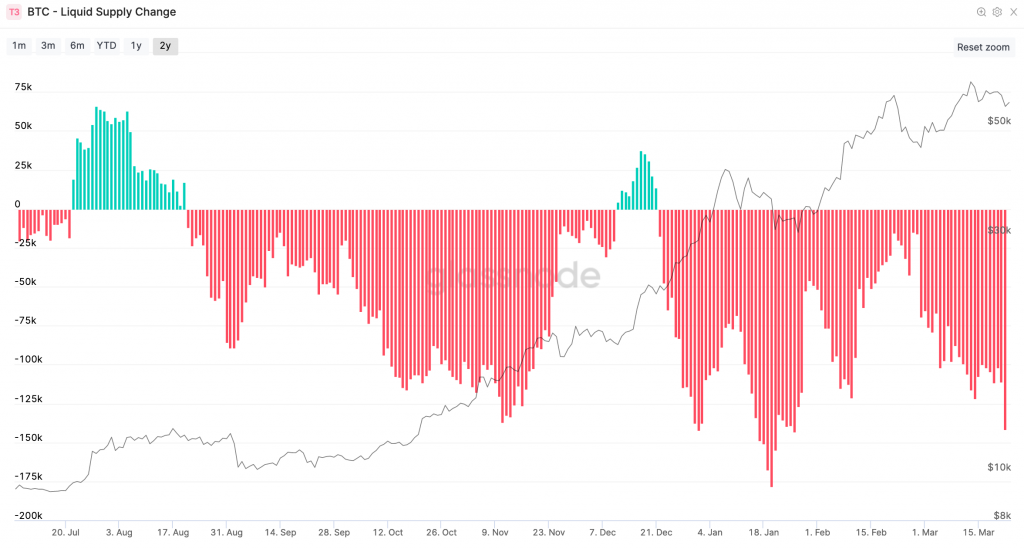

In fact, another chart shared by Woo indicated that it is clear that Bitcoins are moving to stronger hands that have a minimal history of selling in previous market cycles through the bull runs.

Bitcoin: Liquid Supply Changes || Source: Twitter

Expanding this narrative to altcoins, the supply on exchanges is shrinking, just as it is for Bitcoin. Exchange inflow volume has dropped for top altcoins and DeFi tokens like SUSHI, AAVE, LINK, YFI, DAI. A shortage narrative is building up for most, if not all of these tokens. Does that mean they are changing hands too? Well, there isn’t much evidence to track the outflows from exchanges for these tokens, however, the supply surely is dropping.

The dropping inflows to exchanges and the increase in trade volume could signal a shift in trader sentiment when it comes to DeFi tokens. For instance, AAVE’s price dropped by over 7% in 24 hours and the trade volume shot up by over 64% over the same period. There has been a rapid increase in trade volume against exchange inflows and the price drop, and this could be indicative of the dropping supply and changing hands.

Similarly, SUSHI, nearly 27% away from its ATH of $23.38, was trading on exchanges with gains of 38% in trade volume in the 24 hours before press time. UNI topped this list, with a 91% increase in trade volume over the said period, despite the price dropping by 8.77%. With the DeFi token 11% away from its ATH, inflows to exchanges have dropped.

The shortage in supply for UNI could be UNI changing hands, with the alt building on a similar narrative as what Willy Woo shared for Bitcoin. The impact on retail trader’s portfolio is more significant when it comes to altcoins and DeFi tokens than Bitcoin, since the returns are higher and the ROI is for a shorter timeframe relative to Bitcoin.

As strong HODLers take over Bitcoin, it is likely that a similar narrative is partially playing out for DeFi tokens and other altcoins. This would have a net positive impact and support an alt rally later this week.