SUI’s 35% price jump amidst new ATH: What’s driving the rally?

Sui Network [SUI] has achieved a major milestone in its journey as the blockchain network closed its latest weekly candle at the highest price level since its mainnet launch.

This marks an exciting continuation of the recent bullish momentum, following a new ATH set just three days ago.

The surge in price reflected both increasing market confidence in SUI’s ecosystem and a broader uptick in the market sentiment surrounding Layer 1 blockchain projects.

Record-breaking momentum

SUI ended the week at $4.23, marking its highest-ever weekly close since the mainnet launch. The 7-day period saw a sharp upward trajectory, with SUI gaining over 35% in value.

The rally was driven by increased trading volume and sustained bullish sentiment across Layer 1 ecosystems.

A key breakout above $3.50 midweek acted as a catalyst, pushing the price to its new all-time high of $4.45 before a minor retracement.

The weekly close reflected strong market confidence, supported by accumulating higher lows on the daily chart. Technical indicators now suggest $4.50 as the next critical resistance zone for SUI.

SUI: Technical insights

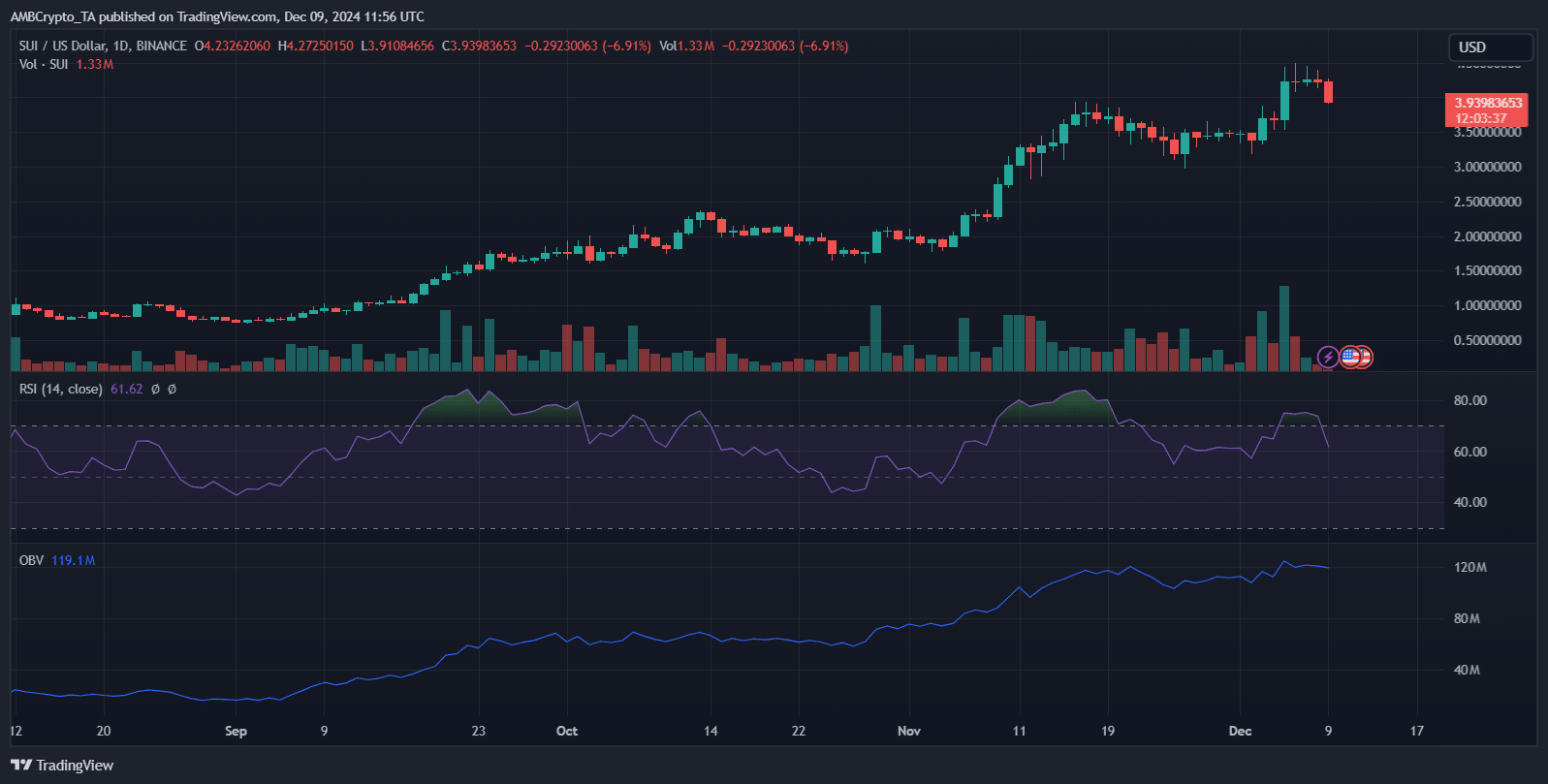

SUI’s RSI was at 61.67, indicating bullish momentum while staying below the overbought threshold of 70. This suggests room for further upside if buying pressure persists.

OBV shows a steady upward trend, reflecting accumulation and consistent interest among market participants.

Source: TradingView

However, the recent dip in price to $3.94 highlights potential profit-taking, which could test immediate support near $3.80. A breach below this level might signal a short-term correction.

Conversely, maintaining strong OBV levels would validate ongoing demand, positioning SUI to reclaim its recent highs at $4.45 and potentially challenge new resistance at $4.50.

Factors behind SUI’s price surge

SUI’s recent rally to $4.23 reflects a confluence of bullish developments.

Key drivers include increased developer activity on its Layer 1 blockchain, with several DeFi and gaming projects announcing integrations over the past week.

Additionally, its $20 million daily transaction volume spike on the 6th of December highlighted rising network usage.

Institutional interest has also surged, as evidenced by elevated staking activity and significant whale accumulation, particularly after SUI hit a new all-time high on the 3rd of December.

Read Sui’s [SUI] Price Prediction 2024-25