Surge in Ethereum [ETH] active deposits spawns hope of $2,000, more inside

- Ethereum witnessed an electrifying surge in active deposits, potentially pushing towards the $2,000 price range.

- PEPE token’s impact on Ethereum was highlighted as traders converted profits.

Ethereum [ETH] has recently found itself in an electrifying surge in active deposits. This surge, emanating from an unexpected origin, carried the potential to catapult Ethereum’s price into the highly sought-after realm of $2,000.

Read Ethereum’s [ETH] Price Prediction 2023-24

The PEPE effect on Ethereum

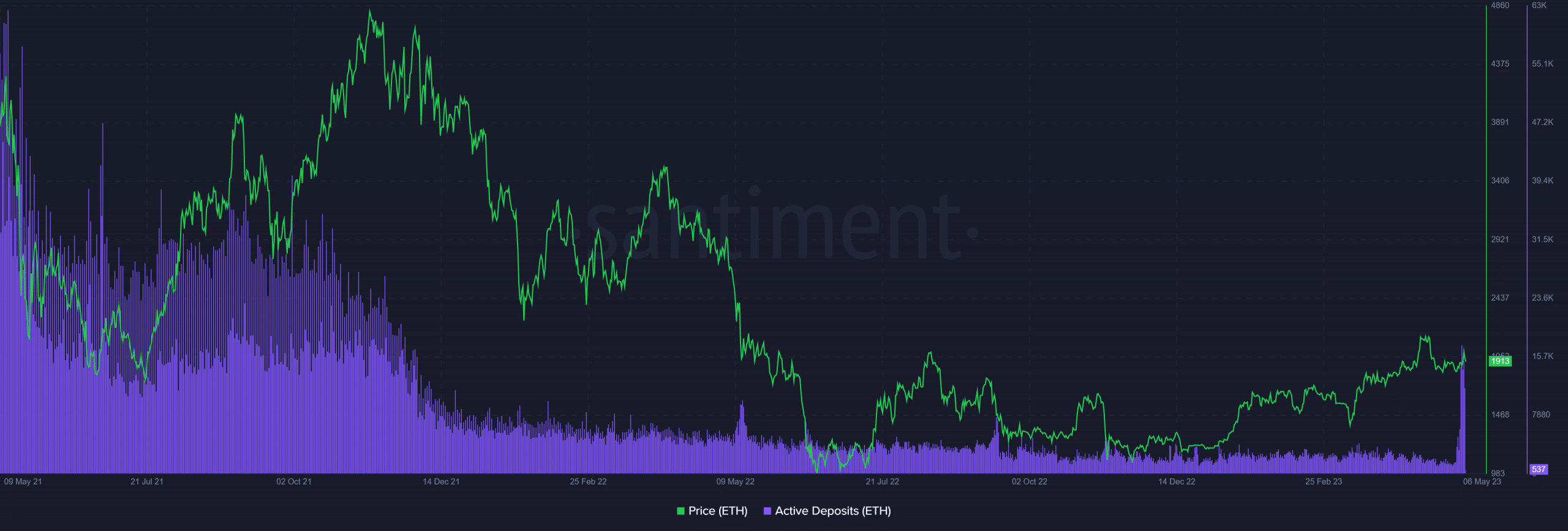

A fascinating development has emerged according to a recent Santiment chart. The chart unveiled a notable surge in active deposits within the network, unveiling a trend that commenced on 3 May. However, it reached its apex on 4 and 5 May, scaling heights that had not been witnessed since November 2021.

During these significant days, the number of active deposits surpassed a staggering 14,000, while the press time figure stood above 9,000.

The surge in active deposits seems to have found its roots in the advent of a new memecoin called PEPE. Santiment’s findings suggested that many crypto traders have converted their PEPE profits into ETH. Also, this has contributed to the sudden influx of deposits.

PEPE itself had embarked on an astonishing rally, generating significant interest in the crypto space. Notably, its recent listing and skyrocketing trading volumes, surpassing a staggering $2.7 billion, have placed it close to Bitcoin [BTC] and ETH.

Ethereum’s price trend

In the eventful trading session that concluded on 5 May, ETH experienced a noteworthy ascent. It recorded a 6.28% increase in value and concluded its trading activities at a respectable $1,996.96.

The momentum propelled its price to reach a notable milestone, breaching the $2,000 mark. However, as of this writing, ETH has encountered a slight setback, enduring a depreciation of over 4% and trading at approximately $1,912.

Despite this temporary dip, Ethereum remained firmly within the $1,900 price range, positioned favorably to reclaim the coveted $2,000 zone. Furthermore, the recent surge in price propelled ETH slightly above the neutral line on the Relative Strength Index (RSI).

With its RSI line positioned in a manner suggestive of a modest bull trend, ETH continued to see a positive price move.

More ETH exits exchanges

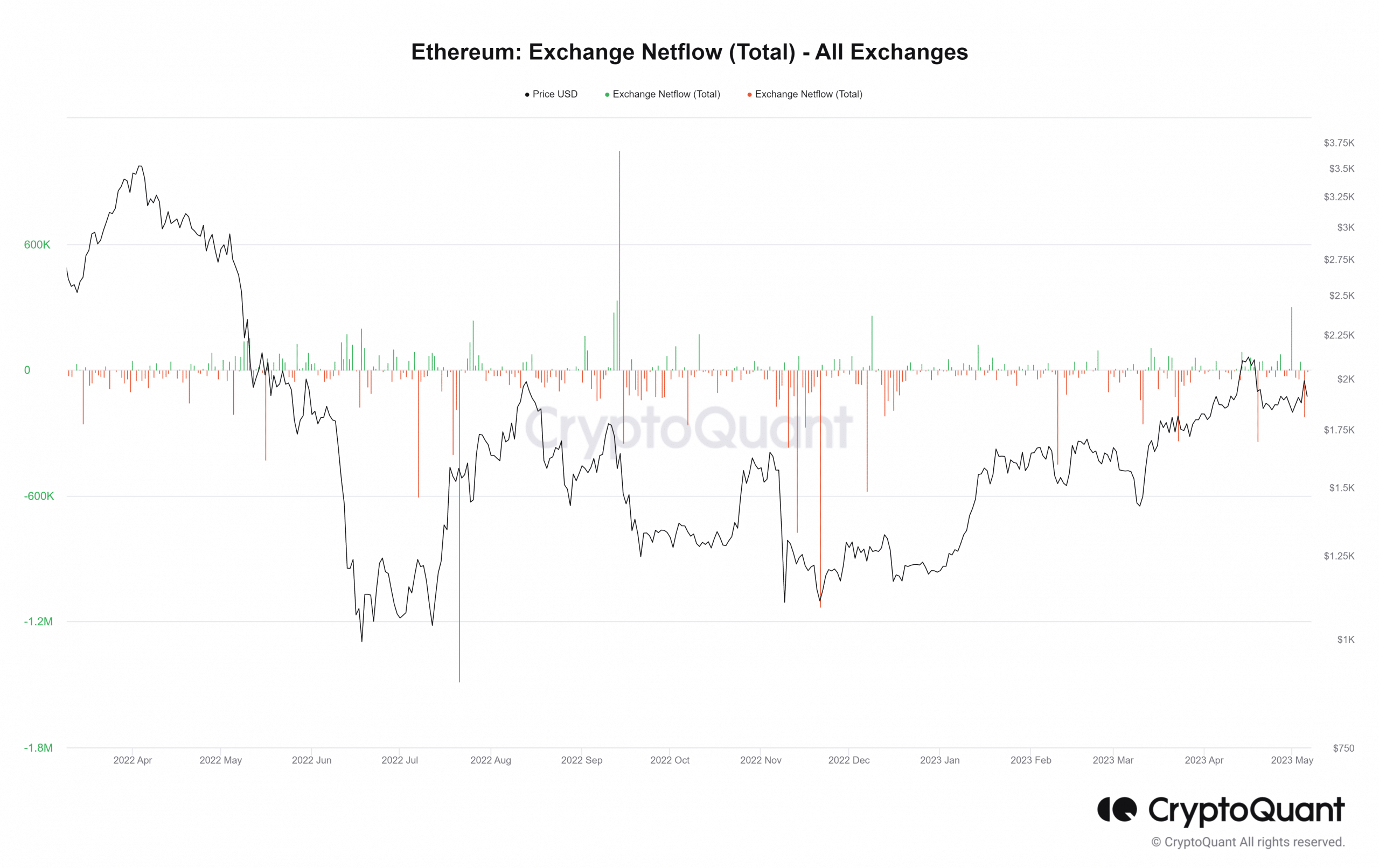

Crypto Quant’s Exchange NetFlow data insights revealed a clear trend in the Ethereum ecosystem. On 5 May, the data highlighted a significant outflow of ETH, suggesting a notable movement away from exchanges.

This trend persisted even as of the press time moment, with the dominant outflow exceeding 3,000 ETH.

Specifically, on 5 May, the Exchange NetFlow data indicated an impressive volume of over 320,000 ETH exiting exchanges. This substantial figure showed a substantial amount of Ethereum is being withdrawn from exchanges.

How much are 1,10,100 ETHs worth today?

Also, it suggested a decreased availability for trading purposes. This could impact market dynamics and influence the balance between supply and demand for Ethereum.

The duration of the surge in Ethereum’s active deposits and the potential volume of the PEPE token remains uncertain. However, given the current positive metrics, there exists a probability for Ethereum to reclaim and surpass the coveted $2,000 price zone.