SUSHI holders may have cut exposure long before SEC summon- Here’s how

- Long-term holders of the token have significantly shredded their holdings.

- The SUSHI protocol has seen a decline in growth, thereby putting the network’s health at risk.

Although associated with the DeFi movement, SushiSwap’s [SUSHI] recent escapades have reeked of adversity with the U.S. SEC knocking on its doors.

However, the troubles of the project did not begin with the regulatory Subpoena it received lately. Instead, holders of the token have been considering and acting upon their exit strategy since the last year.

How much are 1,10,100 SUSHIs worth today?

Dormancy comes alive

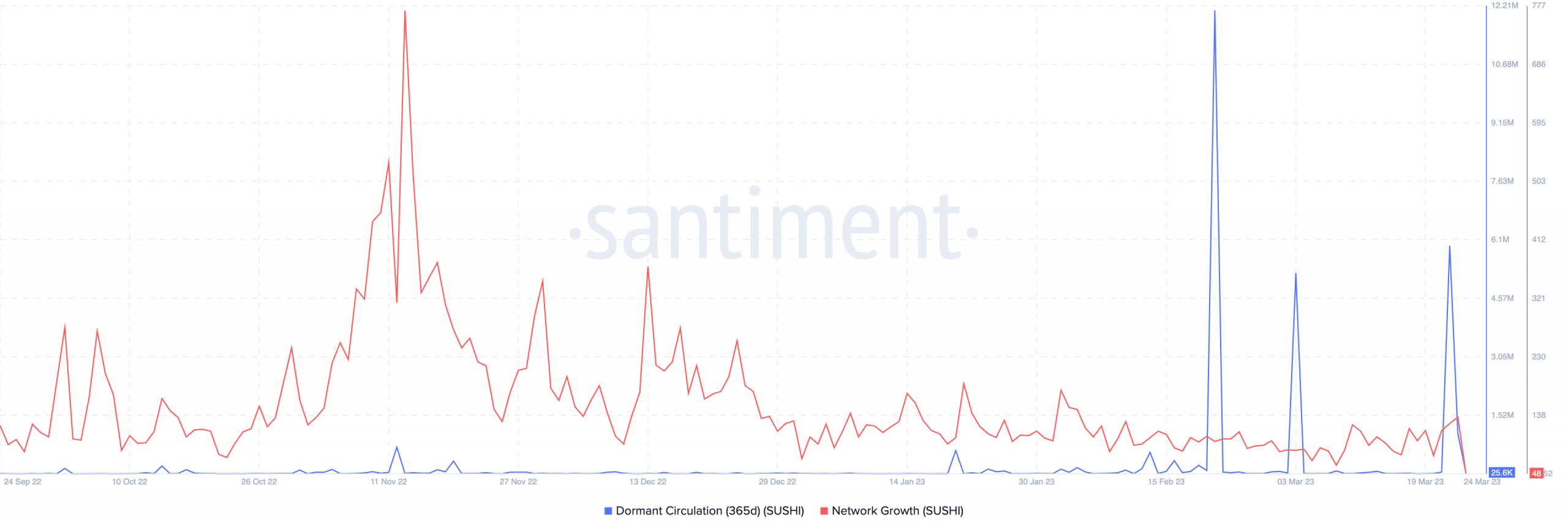

According to Santiment, the SUSHI 365-day dormant circulation had experienced several spikes amid the unfavorable market conditions of 2022 and since 2023 began. The metric describes the number of tokens that haven’t moved in one year being transferred on a particular day.

Notably, the dormant circulation increase has been more visible, in large numbers since 20 February. A similar occurrence happened on 3 March, and most recently— on 22 March. This series of increases implies that long-term holders may have lost faith in a SUSHI revival. Hence, the resolve to exit their positions.

Moreso, the protocols’ network growth had also been in shambles, laying flat at 48. The network growth illustrates the rate of user adoption in terms of new entries. So, since it was down bad, it implied that new addresses have invariably struggled to exist on SushiSwap as shown above.

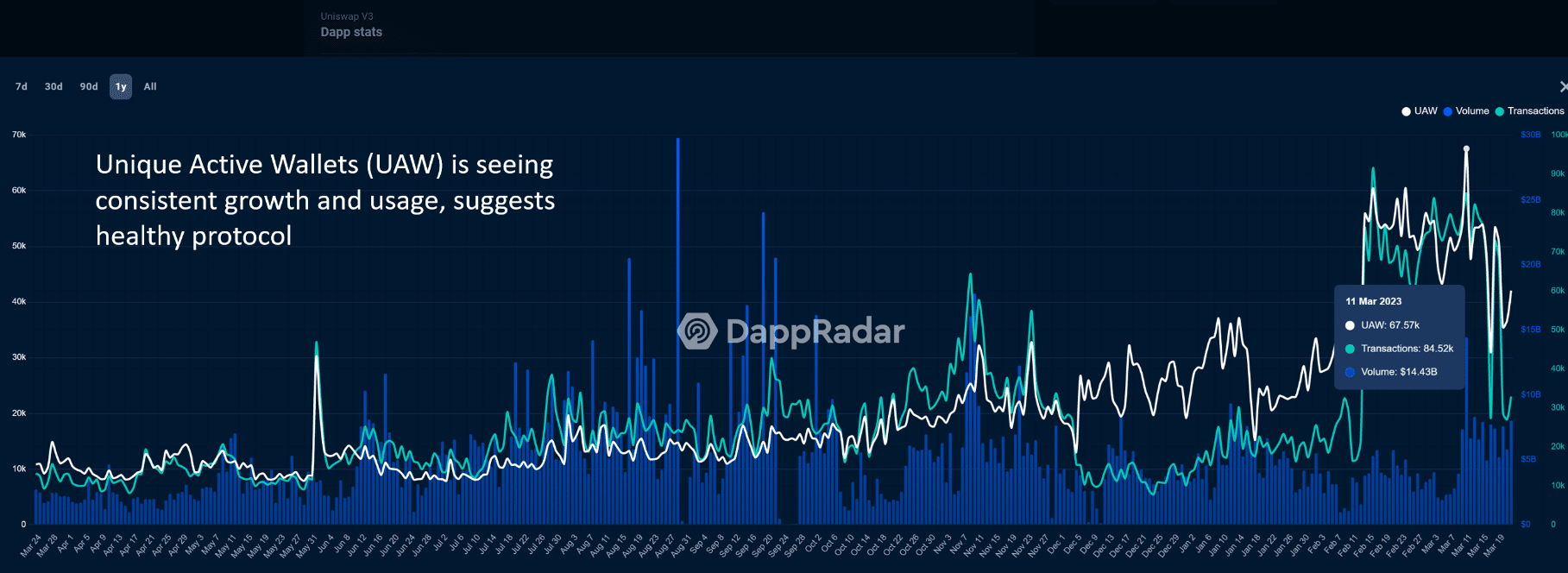

It was, indeed, a piece of good news that the community may have displayed dedication to supporting its legal cause. Besides, it was found that the Unique Active Wallets (UAW) registered consistent growth and usage. Well, the metric describes protocol usage and measures the level of interaction with decentralized applications (dApp) smart contracts on the network.

According to DappRadar, the UAW impacted the SUSHI growth at different intervals over the last 365 days. But these occasions were very few. And overall, growth has been minimal in this regard, bringing questions about the sustainability of the protocols’ health.

Is support back to distrust?

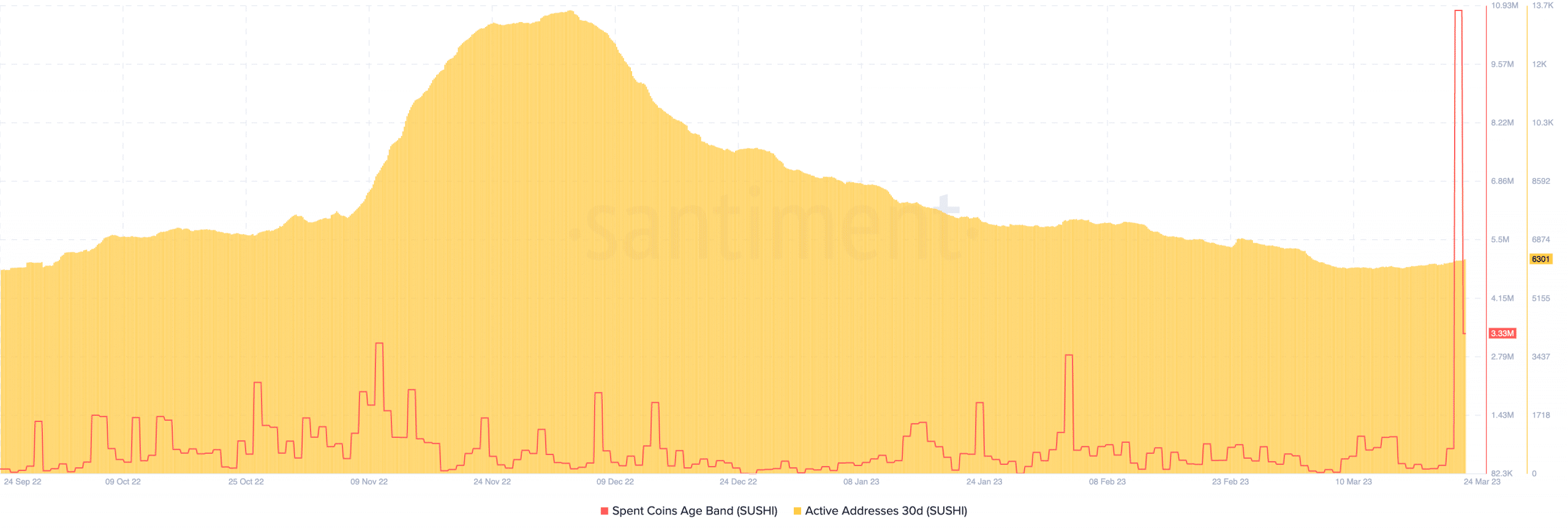

Furthermore, Santiment data showed that the SUSHI spent coins age bands moved significantly on 23 March. The movement was one that could not be ignored, reaching as high as 10.8 million.

Read SushiSwap’s [SUSHI] Price Prediction 2023-2024

A simplification of the metric trend points towards stationary coins movement in the seven to ten-year range, or in some cases, the whole lifespan of the project. So, the sudden increase implies that holders who have held SUSHI for the aforementioned period are opting to sell.

Meanwhile, the case for short-term participants has not been impressive either. At press time, active addresses over the last 30 days have been decreasing. With the number at 6301, it means that daily unique transactions on the SUSHI were not up to par.

To conclude, SUSHI also lost one of its major investors. Goldentree, the asset management firm showed support for the project in 2022 after CEO Jared Grey was accused of fraudulent activities. But, according to Lookonchain, the wallet owned by the firm transferred $2.68 million worth of SUSHI to Binance as it unstaked some of the tokens.

1/ Goldentree unstaked all 5,954,024 $SUSHI and transferred 2.5M $SUSHI ($ 2.68M) to #Binance via Cumberland 2 hrs ago.

And currently holds 3.44M $SUSHI($3.67M). pic.twitter.com/Z0PJ5lZRmJ

— Lookonchain (@lookonchain) March 23, 2023