SUSHI, UNISWAP and CRV: What rising DEX volume means for your portfolio

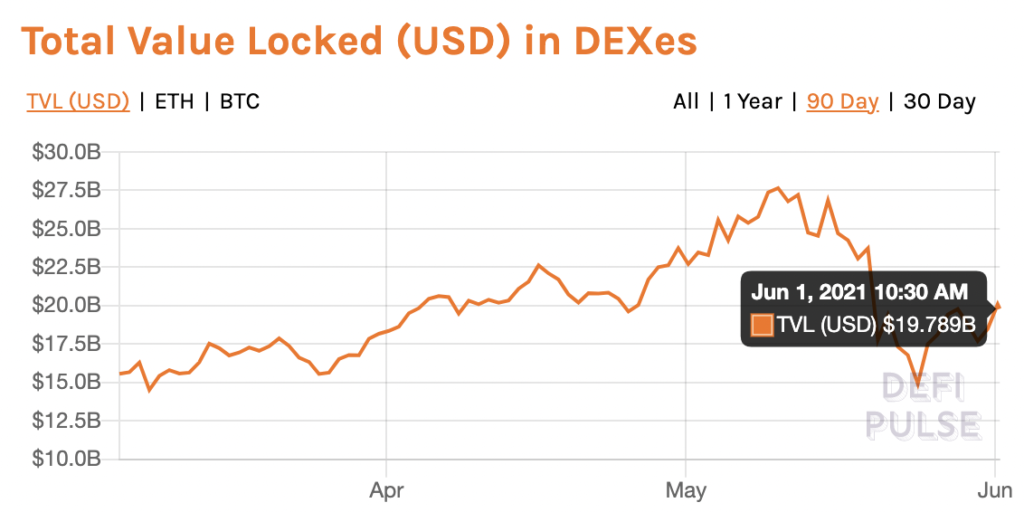

Decentralized Exchanges have hit $19.78 Billion in TVL after recovering from a drop to $14.9 Billion. This recovery comes following the drop on May 24, 2021. Among DEXes, Uniswap leads the way with $6.61 Billion in TVL. Among decentralized exchanges that registered the highest 1-day gain, 113.64% on Integral, 16.31% on LINKSWAP and 15.33% on PowerIndex were seen. The rising DEX volume is likely to have an impact on traders’ holdings of DeFi projects.

TVL of DEXes | Source: DeFiPulse

Based on activity in the past 30 days, traders adding more DeFi projects to their portfolio have had a positive ROI and double-digit ROI in the past 8 weeks. Especially since the beginning of 2021, DEXes and DeFi projects representing DEXes like SUSHI, UNI and CRV have seen a surge in ROI. Most of these DeFi projects are rallying and then so is the DEX Volume based on data from DeFiPulse.

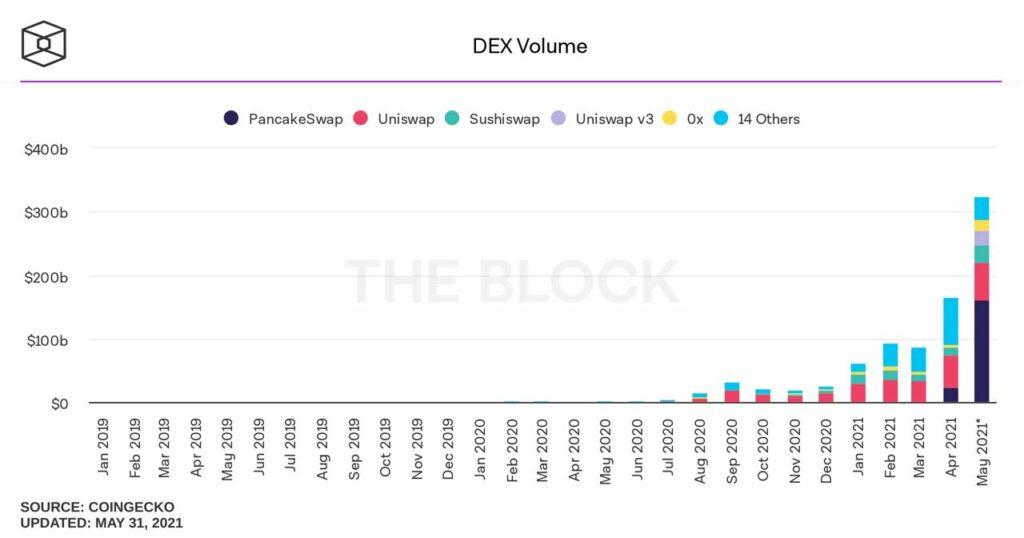

DEX Volume | Source: Twitter

Based on the above chart, the volume has increased exponentially in May 2021. Despite faster and cheaper transactions on L2 scaling solutions, the surge in stablecoin transactions and volume in the past weeks has contributed to the increasing volume on DEXes. DAI, USDT and USDC inflow to DEXes competes with the inflow to L2 scaling solutions. Besides, top DEXes use Ethereum as the base layer, and its slow speed and high transaction fees pose a challenge. The rise of stablecoins plays a key role in that as well.

The compounded APY and incentives are another key reason driving the growth. Besides, top DEXes use Ethereum as the base layer, and its slow speed and high transaction fees pose a challenge. The rise of stablecoins plays a key role in that as well. Additionally, following the drop in Ethereum’s price during the dip, the fee for swap on DEXes hit a low after a long time. Uniswap’s V3, within a month of its launch, has changed the landscape of DEXes. The changing DEX landscape is having an impact on the portfolio of HODLers and their composition. Rising DEX volume supports the bullish narrative of top DeFi projects in the long run based on the TVL and the stablecoin inflow metrics.