SushiSwap investors going long can expect this in the coming week

- Several metrics including MVRV Ratio and exchange reserves indicated a further price decline

- The market indicators were also not favoring SUSHI, which was concerning for the investors

SushiSwap [SUSHI] made it to the news again as it was in the list of top Polygon projects in terms of Altranking, which investors can consider a major bullish signal.

Read SushiSwap’s [SUSHI] Price Prediction 2023-24

Top @0xPolygon Projects by Altrank

? $TEL @telcoin_team

? $BIFI @beefyfinance

? $QUICK @QuickswapDEX$SUSHI @SushiSwap$OM @MANTRAOMniverse$KASTA @kasta_app$INSUR @InsurAce_io$AXN @axion_network

$POLYDOGE @PolyDoge$IGG @IG_Galaxy@LunarCrush#POLYGON $MATIC pic.twitter.com/4gV9PtGa1R— Polygon Daily ? (@PolygonDaily) November 7, 2022

Not only on Polygon, but SUSHI topped the list of the most influential projects on the Avalanche network too. This looked quite promising for the future trajectory of the token.

Most Influential Project on Avalanche$SUSHI @SushiSwap$DYP @dypfinance$FITFI @StepApp_$BIFI @beefyfinance$FXS @fraxfinance$CRA @PlayCrabada$JOE @traderjoe_xyz$TIME @wonderland_fi$XAVA @AvalaunchApp$PNG @pangolindex#AVAX $AVAX pic.twitter.com/8cdvvBua2t

— AVAX Daily ? (@AVAXDaily) November 7, 2022

However, none of these actually reflected on SUSHI’s chart, as it was mostly painted red. CoinMarketCap’s data revealed a different story, as SUSHI was down by 20% and 16% in the last 24 hours and the past week, respectively.

At the time of writing, SUSHI was trading at $1.29, with a market capitalization of more than $163 million. A look at SUSHI’s on-chain metrics revealed the possibility of a further downtrend, which might give investors nightmares.

Trouble is around the corner

CryptoQuant’s data revealed that SushiSwap’s exchange reserves were increasing, which is a bearish signal as it indicates higher selling pressure.

In fact, SUSHI’s MVRV Ratio was also considerably lower, further increasing the chances of a price decline. Moreover, while SUSHI’s price witnessed a downfall, the volume kept increasing, legitimizing the downtrend.

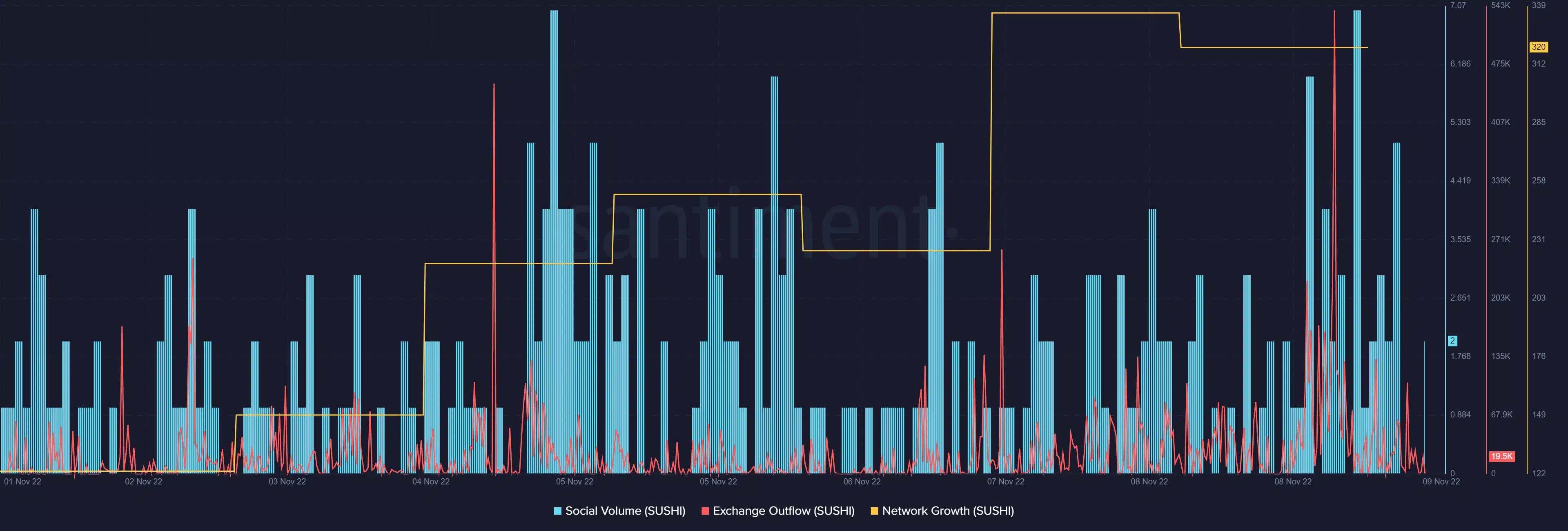

Nonetheless, a few of the metrics provided some relief as they indicated that things might get better. For instance, despite the price decline, SUSHI’s network growth went northward.

Not only that, but SUSHI’s exchange outflow also registered a sharp spike on 9 November, which is a bullish signal. The token’s social volume was consistently high over the last week. Thus, indicating the popularity of the token in the crypto community.

Interestingly, according to GitHub’s recent data, SushiSwap was on the list of the most active cryptos in the last 12 months. This development looked quite promising as it reflected the efforts of the developers.

THE MOST ACTIVE CRYPTOS BASED ON THE #GITHUB DATA FOR 12 MONTHS$ICP $MINA $SOL $XCH $SUSHI $BTC $FEI $GRS $MASK $PART pic.twitter.com/23Y3vT3WjR

— PHOENIX ?? (@pnxgrp) November 6, 2022

Looking forward

That being said, SushiSwap’s daily chart gave a bearish notion regarding the currency market, as most of the market indicators favored a price decline.

For instance, the Relative Strength Index (RSI) chose to go southward and was resting way below the neutral mark, which is a concerning factor for holders who are planning to go long.

The MACD’s reading displayed a bearish crossover, further increasing the chances of a price plummet. Though the 20-day Exponential Moving Average (EMA) was above the 55-day EMA, the gap between them was decreasing, at press time, which is yet another bearish signal.