SushiSwap soars 20%, but is market manipulation involved?

- SushiSwap’s trading volumes jumped by a whopping 569% in 24 hours.

- On-chain activity fueled suspicion of market manipulation.

Native token of decentralized exchange (DEX) SushiSwap [SUSHI] stunned the crypto market with gains of more than 20% in the last 24 hours, according to CoinMarketCap. At press time, the token exchanged hands at $0.7865, the highest in nearly five months.

Realistic or not, here’s SUSHI’s market cap in BTC’s terms

Signs of something fishy?

As prices skyrocketed, traders scrambled to get their hands on the token. Frantic buying and selling ensued as trading volumes jumped by a whopping 569% in the 24-hour period.

While market participants cheered the development, such dramatic rises in prices tend to cause suspicion. Popular on-chain activity tracker Lookonchain expressed a similar sentiment, flagging concerns of market manipulation.

The analytics firm stated that a new entrant to the market bought a ton of SUSHI tokens, more than 900,000, from decentralized exchanges.

Shortly after, they started transferring USD Coin [USDC] to decentralized derivatives exchange dYdX [DYDX] using multiple new wallets. Lookonchain suggested that the objective of the wallet could be to artificially inflate the price of SUSHI and go long.

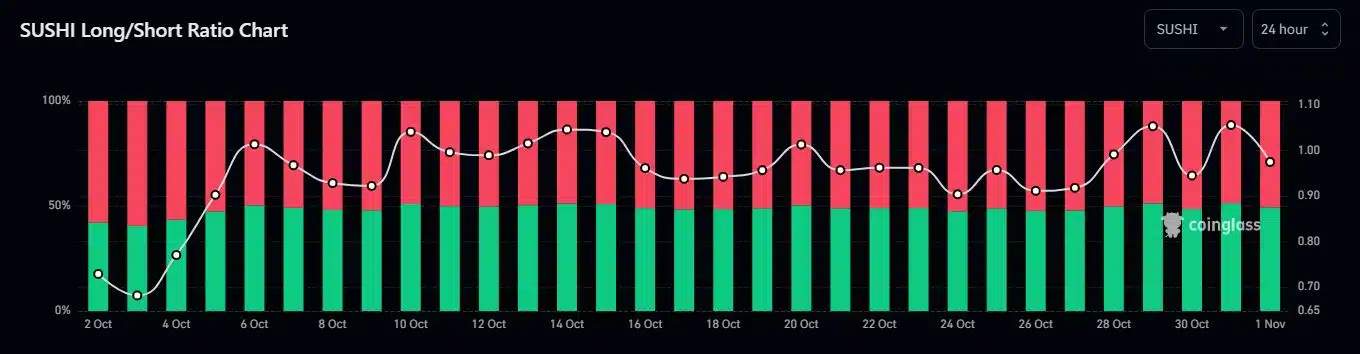

Indeed, the number of long accounts exceeded the short accounts on 31 October, reflecting dominance of bullish leveraged traders.

Should SUSHI traders watch out?

Typically, influential players employ this technique of creating a buying frenzy that will “pump” up the price of a stock. Once the prices are sufficiently pumped, these holders start dumping their assets at a profit.

This sends the price of the asset tumbling, and new investors are stuck with a low-value asset.

While there was no concrete evidence to fit the above scenario in SUSHI’s context, investors should exercise caution and DYOR. It was normal for profit-hungry traders to get carried away by these events, especially in a bear market.

How much are 1,10,100 SUSHIs worth today?

However, a sharp price correction could undo all their gains.

Meanwhile, SushiSwap’s DEX volume surged significantly in the last 24 hours, data from DeFiLlama revealed. Trades worth more than $11 million were executed on the platform, representing an increase of nearly 33% from the previous day.