Stablecoins

Tether mints $1 billion USDT: Is this a bull signal?

Market participants ignored Tether’s explanation, fueling a surge in Bitcoin’s price to $65,254, up from $60,200 on the day of the minting.

- Despite clarifications from Tether, the market sentiment was bullish following the $1 billion USDT minting.

- USDT market continues to grow with signs that it could drive BTC price higher.

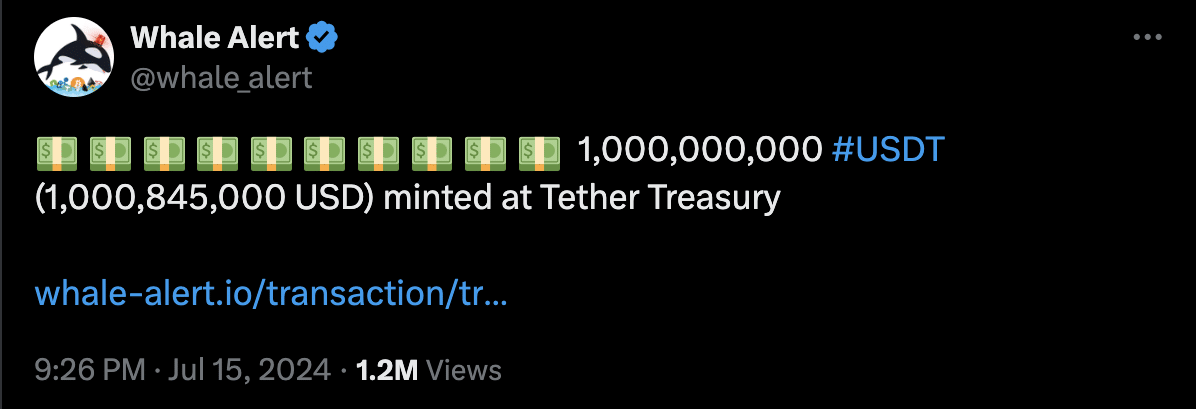

On the 15th of July, Whale Alert disclosed that stablecoin issuer Tether [USDT] minted $1 billion via its treasury. The development sent shockwaves around the crypto community, with many saying that it is a sign of a bull market.

No, the coins are not for the bulls

The reception was not surprising especially as the previous minting of USDT increased buying power. In most cases, prices of cryptos jump weeks after the development.

However, Tether’s CEO Paolo Ardoino was quick to quench the speculation. According to Ardoino, the stablecoins were not in circulation. Instead, the project minted the USDT to use as inventory for chain swaps.

Ardoino stated,

“PSA: 1B USDt inventory replenish on Tron Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.”

Unconcerned about the clarification, market participants’ comments showed that they were still bullish. Interestingly, the sentiment in the market seems to have spread to prices.

For example, the day the USDT minting took place, Bitcoin’s [BTC]

price was around $60,200. But at press time, things have changed for better as the coin was trading at $65,254 at press time.USDT’s market cap continues to put the bull market in the spotlight

In terms of the market cap, AMBCrypto noticed that it has been rising since the 9th of July. At that time, USDT’s market cap was $112.20 billion. But at press time, the value had increased to $112.92 billion as of this writing.

Market cap is a product of price and coins in circulation. However, USDT is always pegged to the dollar, meaning that apart from the minted USDT lately, more stablecoins flowed into circulation.

This was also evident from Justin Sun’s post on the 16th of July. According to Sun, who is the founder of the Tron [TRX] network, it has issued stablecoins worth $60 billion. In his words, Sun wrote that,

“The issuance of TRON USDT has exceeded $60 billion, which is a significant milestone. We have also become the first blockchain with a single stablecoin surpassing $60 billion!”

This milestone indicates that Tether’s stablecoin was the one with the most demand as others have been unable to reach this landmark. Therefore, in the coming days, it is possible to experience an increase in demand for USDT.

Realistic or not, here’s USDT’s market cap in BTC terms

If this is the case, the bull run might accelerate and we might start to see prices of cryptos move higher than they have in the last few weeks.

Should this be the case, the value of BTC could attempt retesting its all-time high. If that happens, altcoins might also follow in a similar direction.